Lockout Company revealed the following inventory transactions: Jan. 1 Beginning balance, 16,000 units @ P140 5 Purchased 4,000 units @ P150 10 Issued 15,000 units to production 15 Purchased 20,000 units @ P160 16 Returned 1,000 units to supplier from January 15 purchase 25 Issued 8,000 units to production 26 Production returned 4,000 units to storeroom from the January 25 issue 31 Purchased 30,000 units @ P150 What is the cost of the inventory on January 31 using FIFO method?

Lockout Company revealed the following inventory transactions: Jan. 1 Beginning balance, 16,000 units @ P140 5 Purchased 4,000 units @ P150 10 Issued 15,000 units to production 15 Purchased 20,000 units @ P160 16 Returned 1,000 units to supplier from January 15 purchase 25 Issued 8,000 units to production 26 Production returned 4,000 units to storeroom from the January 25 issue 31 Purchased 30,000 units @ P150 What is the cost of the inventory on January 31 using FIFO method?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.3BE: Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as...

Related questions

Topic Video

Question

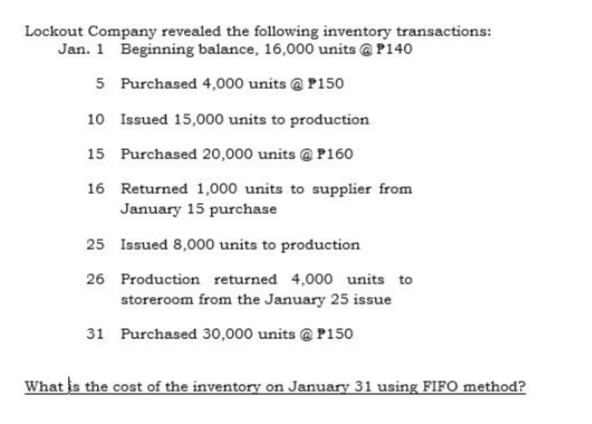

Transcribed Image Text:Lockout Company revealed the following inventory transactions:

Jan. 1 Beginning balance, 16,000 units @ P140

5 Purchased 4,000 units @ P150

10 Issued 15,000 units to production

15 Purchased 20,000 units @ P160

16 Returned 1,000 units to supplier from

January 15 purchase

25 Issued 8,000 units to production

26 Production returned 4,000 units to

storeroom from the January 25 issue

31 Purchased 30,000 units @ P150

What is the cost of the inventory on January 31 using FIFO method?

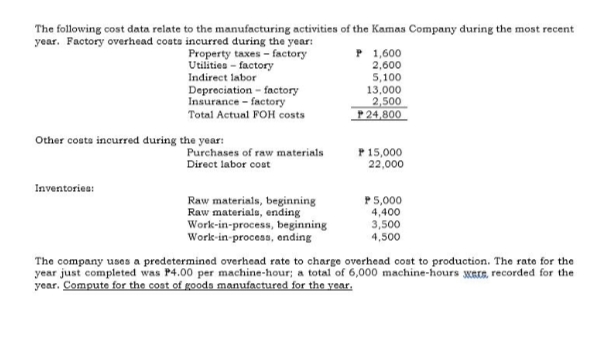

Transcribed Image Text:The following cost data relate to the manufacturing activities of the Kamas Company during the most recent

year. Factory overhead coata incurred during the year:

Property taxes - factory

Utilities - factory

P 1,600

2,600

5,100

13,000

2,500

P24,800

Indirect labor

Depreciation - factory

Insurance - factory

Total Actual FOH costs

Other coata incurred during the year:

Purchases of raw materials

Direct labor cost

P 15,000

22,000

Inventoriea:

Raw materials, beginning

Raw materials, ending

Work-in-process, beginning

Work-in-process, ending

P5,000

4,400

3,500

4,500

The company uses a predetermined overhead rate to charge overhead cost to production. The rate for the

year just completed was P4.00 per machine-hour; a total of 6,000 machine-hours wers, recorded for the

year. Compute for the cost of goods manufactured for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning