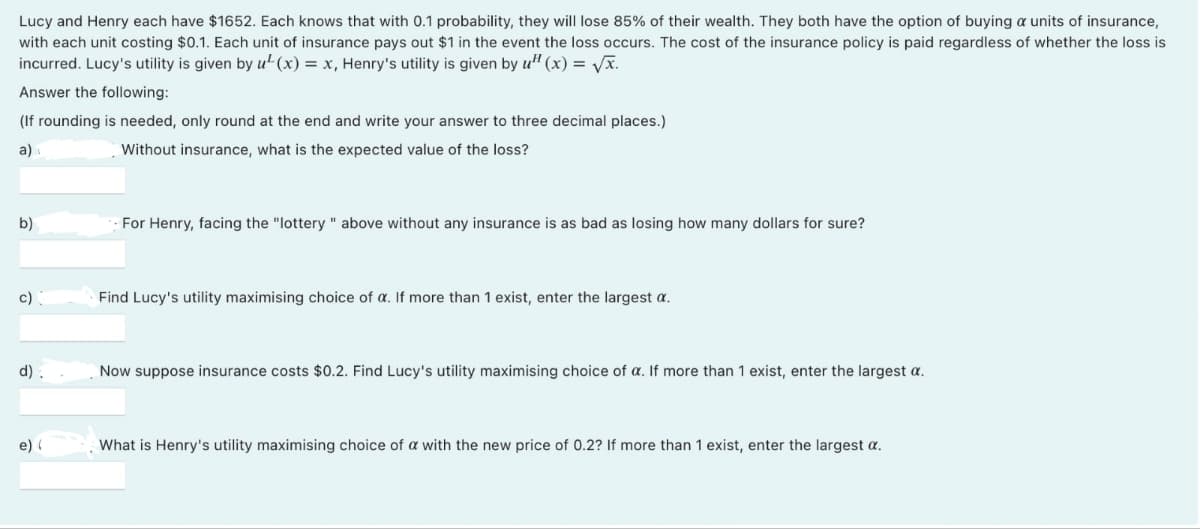

Lucy and Henry each have $1652. Each knows that with 0.1 probability, they will lose 85% of their wealth. They both have the option of buying a units of insurance, with each unit costing $0.1. Each unit of insurance pays out $1 in the event the loss occurs. The cost of the insurance policy is paid regardless of whether the loss is incurred. Lucy's utility is given by u²(x) = x, Henry's utility is given by u¹(x) = √√x. Answer the following: (If rounding is needed, only round at the end and write your answer to three decimal places.) a) Without insurance, what is the expected value of the loss? b) c) For Henry, facing the "lottery " above without any insurance is as bad as losing how many dollars for sure? Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a.

Lucy and Henry each have $1652. Each knows that with 0.1 probability, they will lose 85% of their wealth. They both have the option of buying a units of insurance, with each unit costing $0.1. Each unit of insurance pays out $1 in the event the loss occurs. The cost of the insurance policy is paid regardless of whether the loss is incurred. Lucy's utility is given by u²(x) = x, Henry's utility is given by u¹(x) = √√x. Answer the following: (If rounding is needed, only round at the end and write your answer to three decimal places.) a) Without insurance, what is the expected value of the loss? b) c) For Henry, facing the "lottery " above without any insurance is as bad as losing how many dollars for sure? Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a.

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.3P

Related questions

Question

Transcribed Image Text:Lucy and Henry each have $1652. Each knows that with 0.1 probability, they will lose 85% of their wealth. They both have the option of buying a units of insurance,

with each unit costing $0.1. Each unit of insurance pays out $1 in the event the loss occurs. The cost of the insurance policy is paid regardless of whether the loss is

incurred. Lucy's utility is given by u²(x) = x, Henry's utility is given by u¹(x) = √√x.

Answer the following:

(If rounding is needed, only round at the end and write your answer to three decimal places.)

a)

Without insurance, what is the expected value of the loss?

b)

c)

d).

e) (

For Henry, facing the "lottery " above without any insurance is as bad as losing how many dollars for sure?

Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a.

Now suppose insurance costs $0.2. Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a.

What is Henry's utility maximising choice of a with the new price of 0.2? If more than 1 exist, enter the largest a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you