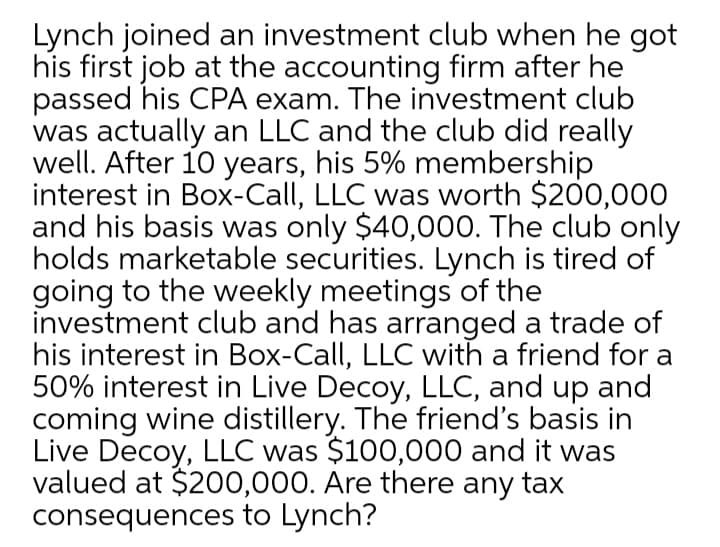

Lynch joined an investment club when he got his first job at the accounting firm after he passed his CPA exam. The investment club was actually an LLC and the club did really well. After 10 years, his 5% membership interest in Box-Call, LLC was worth $200,000 and his basis was only $40,000. The club only holds marketable securities. Lynch is tired of going to the weekly meetings of the investment club and has arranged a trade of his interest in Box-Call, LLC with a friend for a 50% interest in Live Decoy, LLC, and up and coming wine distillery. The friend's basis in Live Decoy, LLC was $100,000 and it was valued at $200,000. Are there any tax consequences to Lynch?

Lynch joined an investment club when he got his first job at the accounting firm after he passed his CPA exam. The investment club was actually an LLC and the club did really well. After 10 years, his 5% membership interest in Box-Call, LLC was worth $200,000 and his basis was only $40,000. The club only holds marketable securities. Lynch is tired of going to the weekly meetings of the investment club and has arranged a trade of his interest in Box-Call, LLC with a friend for a 50% interest in Live Decoy, LLC, and up and coming wine distillery. The friend's basis in Live Decoy, LLC was $100,000 and it was valued at $200,000. Are there any tax consequences to Lynch?

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:Lynch joined an investment club when he got

his first job at the accounting firm after he

passed his CPA exam. The investment club

was actually an LLC and the club did really

well. After 10 years, his 5% membership

interest in Box-Call, LLC was worth $200,000

and his basis was only $40,000. The club only

holds marketable securities. Lynch is tired of

going to the weekly meetings of the

investment club and has arranged a trade of

his interest in Box-Call, LLC with a friend for a

50% interest in Live Decoy, LLC, and up and

coming wine distillery. The friend's basis in

Live Decoy, LLC was $100,000 and it was

valued at $200,000. Are there any tax

consequences to Lynch?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you