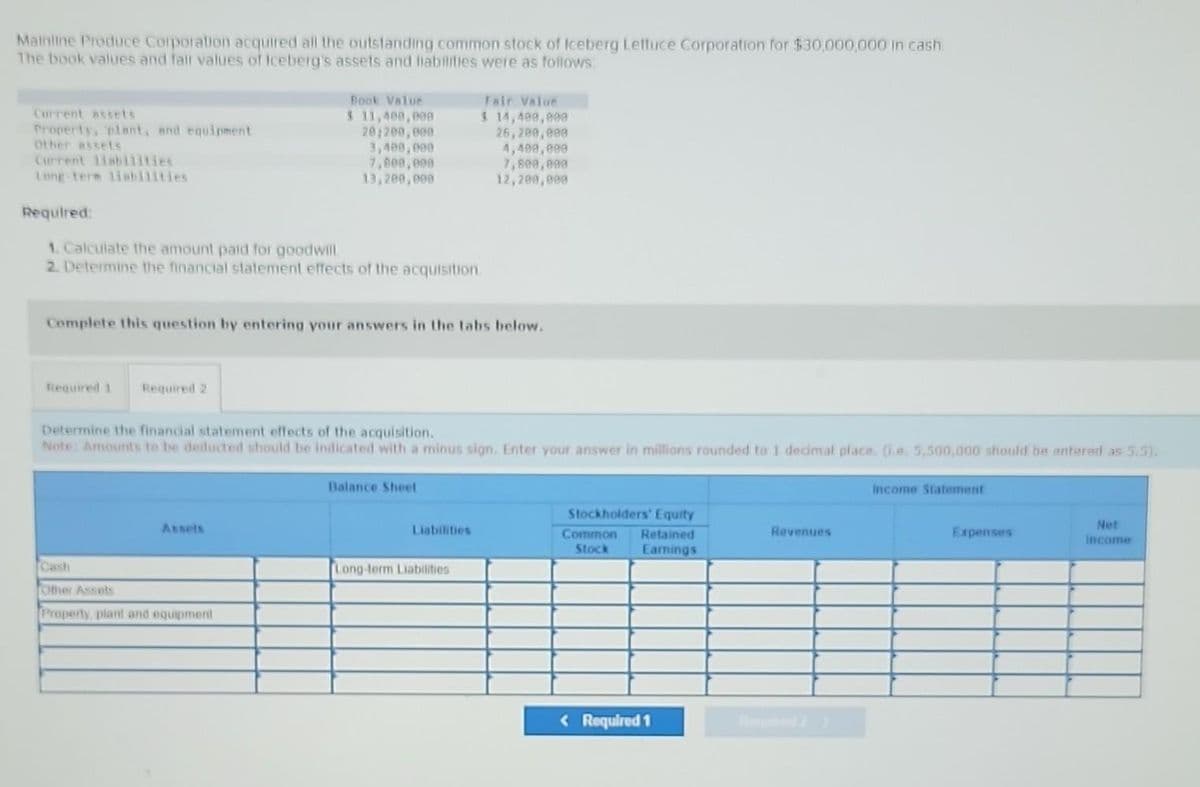

Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash The book values and fall values of Iceberg's assets and liabilities were as follows: Current assets Property, plant, and equipment other assets Current liabilities Long-term liabilities Required: 1. Calculate the amount paid for goodwill 2. Determine the financial statement effects of the acquisition Required 1 Complete this question by entering your answers in the tabs below. Required 2 Book Value $ 11,400,000 20:200,000 3,400,000 7,000,000 13,200,000 Assels Determine the financial statement effects of the acquisition. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answer in millions rounded to 1 decimal place. (.e. 5,500,000 should be entered as 5.5). Other Assets Property, plant and equipment Balance Sheet Fair Value $ 14,400,000 26,200,000 4,400,000 7,800,000 12,200,000 Liabilities Long-term Liabilities Stockholders' Equity Common Retained Stock Earnings Revenues Income Statement Expenses Net income

Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash The book values and fall values of Iceberg's assets and liabilities were as follows: Current assets Property, plant, and equipment other assets Current liabilities Long-term liabilities Required: 1. Calculate the amount paid for goodwill 2. Determine the financial statement effects of the acquisition Required 1 Complete this question by entering your answers in the tabs below. Required 2 Book Value $ 11,400,000 20:200,000 3,400,000 7,000,000 13,200,000 Assels Determine the financial statement effects of the acquisition. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answer in millions rounded to 1 decimal place. (.e. 5,500,000 should be entered as 5.5). Other Assets Property, plant and equipment Balance Sheet Fair Value $ 14,400,000 26,200,000 4,400,000 7,800,000 12,200,000 Liabilities Long-term Liabilities Stockholders' Equity Common Retained Stock Earnings Revenues Income Statement Expenses Net income

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

vd

Subject-Accounting

Transcribed Image Text:Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash.

The book values and fall values of Iceberg's assets and liabilities were as follows:

Current assets

Property, plant, and equipment

Other assets

Current liabilities

Long-term liabilities

Required:

1. Calculate the amount paid for goodwill

2. Determine the financial statement effects of the acquisition.

Required 1 Required 2

Book Value

$ 11,400,000

20,200,000

3,400,000

7,800,000

13,200,000

Complete this question by entering your answers in the tabs below.

Assets

Determine the financial statement effects of the acquisition.

Note: Amounts to be deducted should be indicated with a minus sign. Enter your answer in millions rounded to I decimal place. (.e. 5,500,000 should be entered as 5.5).

Cash

Other Assets

Property, plant and equipment

Fair Value

$ 14,490,000

26,200,000

4,400,000

7,800,000

12,200,000

Balance Sheet

Liabilities

Long-term Liabilities

Stockholders' Equity

Common Retained

Stock Earnings

< Required 1

Revenues

Income Statement

Expenses

Net

Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning