Make-or-Buy Decision Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $61 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 39% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $29 Direct labor 20 Factory overhead (39% of direct labor) 7.8 Total cost per unit $56.8 If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 15% of the direct labor costs.

1. Make-or-Buy Decision

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $61 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 39% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows:

| Direct materials | $29 |

| Direct labor | 20 |

| Factory overhead (39% of direct labor) | 7.8 |

| Total cost per unit | $56.8 |

If Companion Computer Company manufactures the carrying cases, fixed

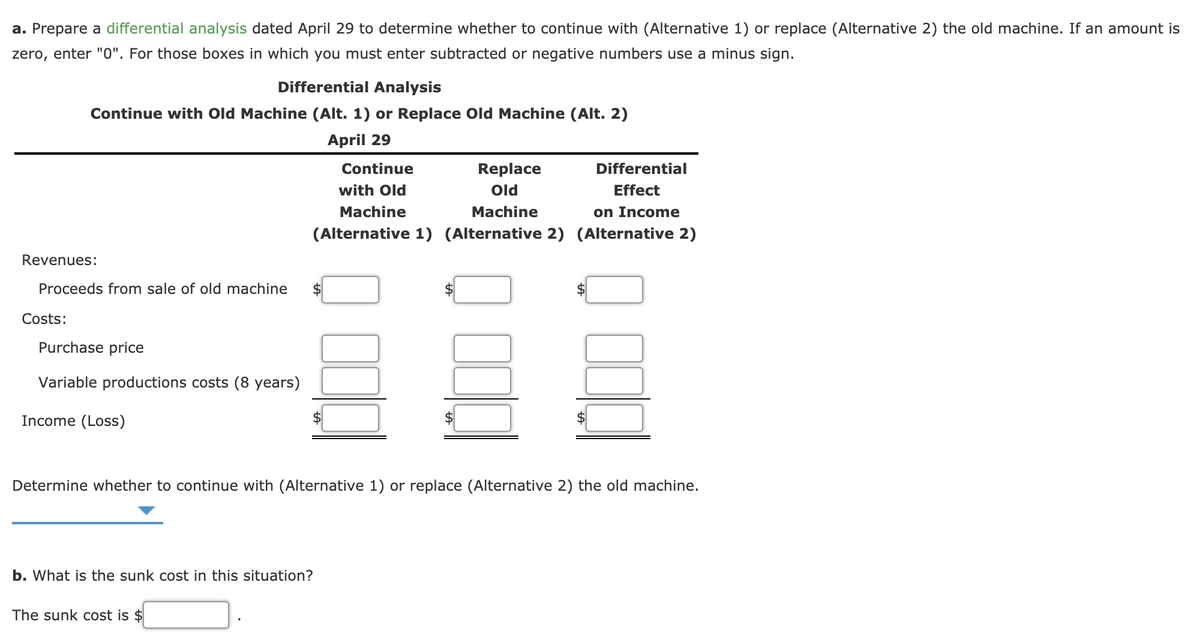

2. Machine Replacement Decision

A company is considering replacing an old piece of machinery, which cost $599,500 and has $349,400 of

The decision of make or buy is defined as the act of using the cost- benefit in order to make the strategic decision among manufacturing the product in house or to buy the product from the external supplier. This situation arises when the producing company face problems with present suppliers and diminishing capacity.

NOTE: Answering the first question as there multiple questions, please submit a new question.

1.

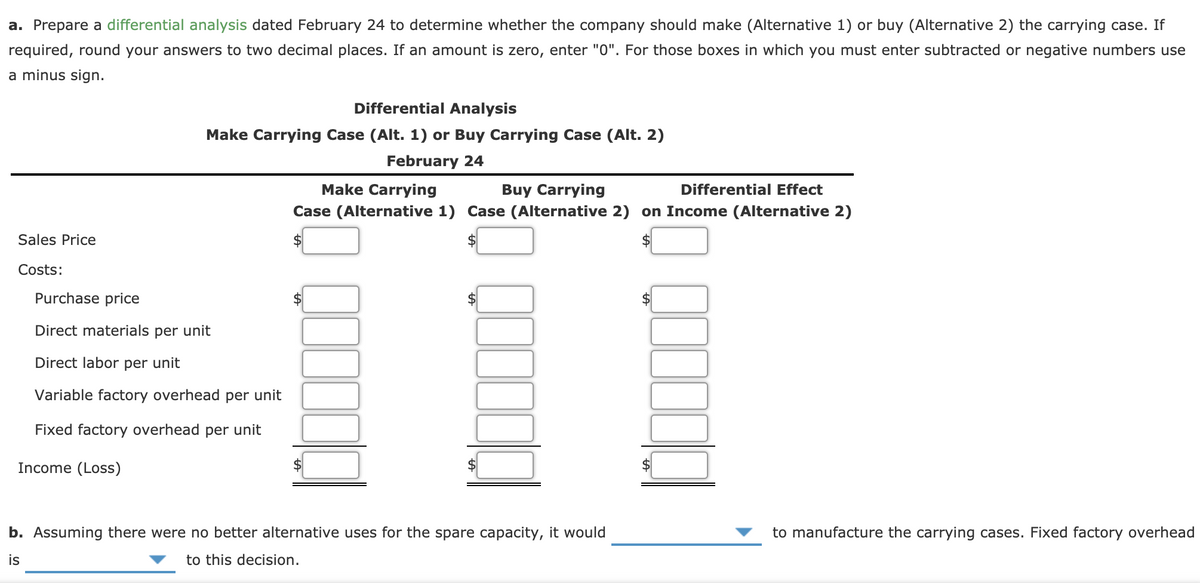

a. The differential analysis is shown as:

| Differential analysis |

| Make Carrying case (Alt. 1) Or Buy Carrying case (Alt. 2) |

| February 24 |

| Make Carrying Case (Alt. 1) | Buy Carrying Case (Alt. 2) | Differential Effect on Income (Alt. 2) | |

| Sales | |||

| Costs: | |||

| Purchase Price | $61 | -$61 | |

| Direct material per unit | $29 | - | $29 |

| Direct Labor per unit | $20 | - | $20 |

| Variable factory overhead per unit | $3 | - | $3 |

| Fixed factory overhead per unit | $4.8 | $4.8 | - |

| Income (Loss) | $56.8 | $65.8 | -$9 |

Working Note:

1. Computing variable factory overhead as:

2. Computing fixed factory overhead per unit as:

Step by step

Solved in 3 steps