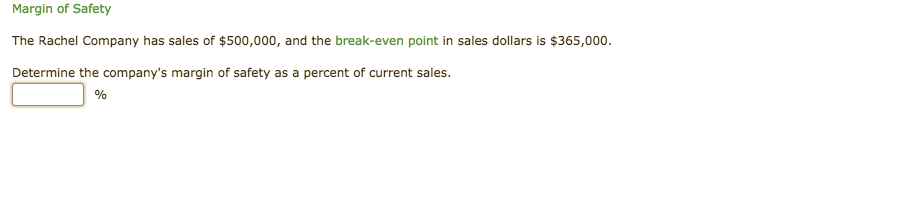

Margin of Safety The Rachel Company has sales of $500,000, and the break-even point in sales dollars is $365,000. Determine the company's margin of safety as a percent of current sales.

Q: Margin of Safety a. If Canace Company, with a break-even point at $223,200 of sales, has actual…

A: The margin of safety sales are excess of actual sales over break even sales.

Q: Margin of Safety a. If Canace Company, with a break-even point at $631,800 of sales, has actual…

A: a. 1. Calculation of Margin of safety in dollars: Therefore, the margin of safety is $148,200. 2.…

Q: Margin of Safety a. If Canace Company, with a break-even point at $605,900 of sales, has actual…

A: Margin of Safety= Total sales- Break even sales Margin of safety ratio= MOS Sales/Total Sales*100…

Q: Margin of Safety a. If Canace Company, with a break-even point at $401,800 of sales, has actual…

A: The Margin of Safety - The margin of safety is the difference between break-even sales and Actual…

Q: Margin of Safety The Rachel Company has sales of $290,000, and the break-even point in sales dollars…

A: Formula used: Margin of safety = [ Current sales - Break even sales ) / Current sales ] x 100 In…

Q: If a business had sales of $4,000,000 and a margin of safety of 25%, the break-even point in sales…

A: Margin of safety = Actual sales - Break even point Sales Actual sales = $4,000,000 Margin of safety…

Q: Margin of Safety The Spector Company has sales of $440,000, and the break-even point in sales…

A: Fixed costs: These costs are constant and don’t change with the units produced. However, the cost…

Q: Margin of Safety a. If Canace Company, with a break-even point at $464,000 of sales, has actual…

A: Margin of safety refers computation of how much output or sales level can fall before a business…

Q: The break-even point for sales of Luckyme is P200,000 with a contribution margin of 40%. Assuming…

A: Break even sales = P 200,000 Contribution margin = 40% Profit = P 100,000

Q: Margin of Safety a. If Canace Company, with a break-even point at $386,900 of sales, has actual…

A: Margin of Safety represents the value of sales over and above the break-even point.Margin of Safety…

Q: Determine the company's margin of safety percentage. Round answer to the nearest whole number.

A: Margin of safety is that portion of sales which is over and above the break even point of the…

Q: Following is the last year data of X company: Selling price Variable expenses S80 per unit $40 per…

A: Advertising expenses may be defined as that type of indirect expenses which occurs during the…

Q: Margin of Safety Yellow Sticker Company’s variable expenses are 40% of sales. The company has…

A: The margin of safety is a tool of cost volume profit analysis. It can be calculated by deducting…

Q: Dean Company has sales of $157,000, and the break-even point in sales dollars is $111,470. Determine…

A: Formula: Margin of safety in Dollars = Current sales - Break even sales Deduction of Break even…

Q: Jonick Company has sales of $460,000, and the break-even point in sales dollars is $372,600.…

A: Sales $4,60,000 Break-even point in sales dollars $3,72,600 Margin of Safety $ (Sales in dollar…

Q: Graphite Corporation Sale Price per unit is $174 Variable cost is 40% of sales Net Income is…

A:

Q: A firm has a margin of safety percentage of 25.1% based on its actual sales. The break-even point is…

A: Break-even analysis is a technique used widely by the production management. It helps to determine…

Q: Jonick Company has sales of $740,000, and the break-even point in sales dollars is $547,600.…

A: The margin of safety is calculated as difference between current sales and break even sales.

Q: XYZ Company's single product has a selling price of $25 per unit. Last year the company reported…

A: Old selling price =$25Contribution Margin Ratio =40%Contribution per unit =$25 ×40%=$10Variable cost…

Q: a. Compute the contribution margin ratio and the dollar sales volume required to break even. b.…

A: Contribution margin ratio The contribution margin ratio is the difference between a company's sales…

Q: Margin of Safety a. If Canace Company, with a break-even point at $463,600 of sales, has actual…

A: a. 1. Calculate the margin of safety (in Dollars).

Q: a. If Canace Company, with a break-even point at $384,000 of sales, has actual sales of $480,000,…

A: Margin of safety: Difference between total sales and break even sales is called margin of safety.…

Q: Quick Inc. has sales of $36,400,000, and the break-even point in sales dollars is $24,024,000.…

A: Margin of safety = Total sales - Break even sales = $36,400,000 - $24,024,000 = $12,376,000

Q: Margin of Safety a. If Canace Company, with a break-even point at $386,900 of sales, has actual…

A: a. 1. Calculate the margin of safety (in Dollars).

Q: Dragon, Inc. has actual sales of $310,000 and a margin of safety of $136,400. What is Dragon's…

A: Break-even point in sales = Actual sales - margin of safety

Q: Majid Corporation sells a product for $240 per unit. The product's current sales are 41,300 units…

A: Margin of safety = Current sales - Break even sales

Q: Compute (a) the margin of safety in dollars and (b) the margin of safety ratio with the given…

A: Margin of safety can termed as an difference between the sales of an product and break-even sales.

Q: Music Corporation recorded sales of $2,235,245 for the most recent year. The company's breakeven…

A: Formula: sales (in dollars) would be needed to increase the company's MOS% : = ( Actual sales -…

Q: Graphite Corporation Sale Price per unit is $174 Variable cost is 40% of sales Net Income is…

A: Given the information: Sales (500*$174) $ 87,000 Less: Variable Cost (40%) $ 34,800…

Q: If a business had sales of $3,894,000 and a margin of safety of 20%, the break-even point in sales…

A: Introduction: Break even point: The point where there is no profit nor loss to the company for the…

Q: Statement of Comprehensive Income for Brooklyn Company for the current year is Sales P750,000…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: . Calculate the break-even sales when a business has sales of $824,000 and a margin of safety of…

A: Introduction: The dollar amounts of income at which a firm generates no profit are referred to as…

Q: Margin of Safety The Ira Company has sales of $840,000, and the break-even point in sales dollars…

A: In the break even analysis, the term margin of safety indicates the amount of sales that are above…

Q: a. If Canace Company, with a break-even point at $281,400 of sales, has actual sales of $420,000,…

A: a. Margin of safety = Sales - break-even point = $420,000 - $281,400 = $138,600 Margin of safety as…

Q: XYZ Company's single product has a selling price of $15 per unit. The fixed expenses were $110,000.…

A: Profit per unit is the selling price minus variable cost per unit as reduced by fixed expenses

Q: With the following information, calculate the break-even point in sales dollars for a retail store:…

A: The variable costs are computed by multiplying the percentage of the cost of sales and sales revenue…

Q: Last year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: A company's forecasted sales are $300,000 and its sales at break-even are $180,000. Calculate the…

A: Margin of safety is the sales value which exceeds the break even sales. We can calculate Margin of…

Q: Dean Company has sales of $76,000, and the break-even point in sales dollars is $47,120. Determine…

A: The margin of safety is calculated as sales above break even sales.

Q: ABC Corporation total breakeven point is 100,000 units. Its selling price is 100 and contribution…

A: Contribution margin is the sales revenue which is over and above variable costs of the business.

Q: Margin of Safety The Rachel Company has sales of $550,000, and the break-even point in sales dollars…

A:

Q: company produces and sells product with the following characteristics: Per Unit ng price ble…

A: Net income = contribution - fixed cost

Q: If a business had sales of $3,894,000 and a margin of safety of 20%, the break-even point in sales…

A: Formula: Break even point in sales dollars = Sales value x ( 100 - Margin of safety )

Q: Help Awtis Corporation has a margin of safety percentage of 25% based on its actual sales. The…

A: Actual sales = Break even sales / (1 - margin of safety %) = $390,000 / (1 - 0.25) = $520,000

Q: Daniel sells a single product at P20 per unit. The firm's most recent income statement revealed…

A: The question is based on the concept of Cost Accounting.

Q: Quick Inc. has sales of $36,400,000, and the break-even point in sales dollars is $24,024,000.…

A: Margin of safety is calculated as excess of current sales over break even sales.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?Klamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?Maple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.

- Schylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000If a company has fixed costs of $6.000 per month and their product that sells for $200 has a contribution margin ratio of 30%, how many units must they sell in order to break even? A. 100 B. 180 C. 200 D. 2,000Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.

- Marlin Motors sells a single product with a selling price of $400 with variable costs per unit of $160. The companys monthly fixed expenses are $36,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of November when they will sell 130 units. How many units will Marlin need to sell in order to realize a target profit of $48,000? What dollar sales will Marlin need to generate in order to realize a target profit of $48.000? Construct a contribution margin income statement for the month of February that reflects $200,000 in sales revenue for Marlin Motors.Kerr Manufacturing sells a single product with a selling price of $600 with variable costs per unit of $360. The companys monthly fixed expenses are $72,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of January when they will sell 500 units. How many units will Kerr need to sell in order to realize a target profit of $120,000? What dollar sales will Kerr need to generate in order to realize a target profit of $120,000? Construct a contribution margin income statement for the month of June that reflects $600,000 in sales revenue for Kerr Manufacturing.Macom Manufacturing has total contribution margin of $61,250 and net income of $24,500 for the month of June. Marcus expects sales volume to increase by 10% in July. What are the degree of operating leverage and the expected percent change in income for Macom Manufacturing? 0.4 and 10% 2.5 and 10% 2.5 and 25% 5.0 and 50%