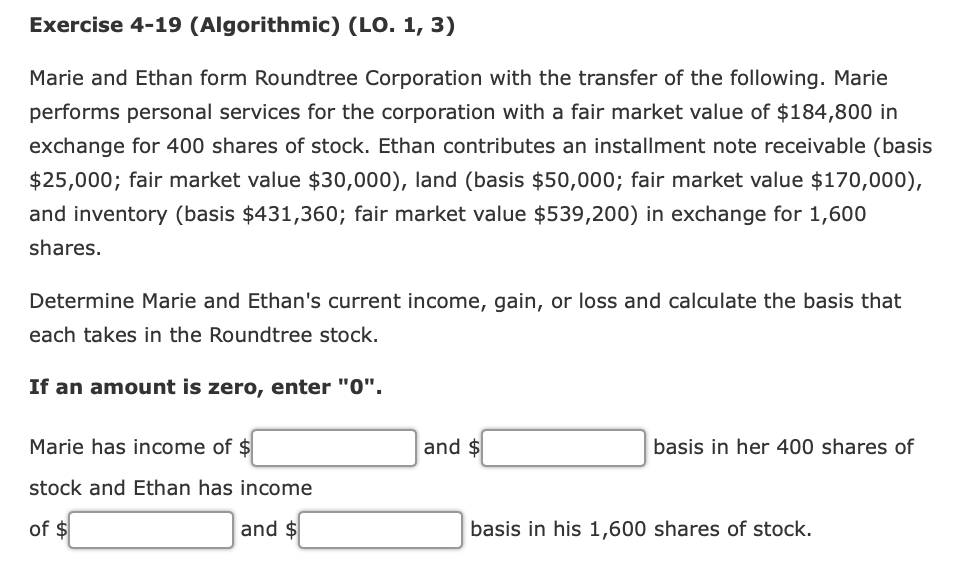

Marie and Ethan form Roundtree Corporation with the transfer of the following. Marie performs personal services for the corporation with a fair market value of $184,800 in exchange for 400 shares of stock. Ethan contributes an installment note receivable (basis $25,000; fair market value $30,000), land (basis $50,000; fair market value $170,000), and inventory (basis $431,360; fair market value $539,200) in exchange for 1,600 shares. Determine Marie and Ethan's current income, gain, or loss and calculate the basis that each takes in the Roundtree stock. If an amount is zero, enter "0". Marie has income of $ and $ basis in her 400 shares of stock and Ethan has income of $ and $ basis in his 1,600 shares of stock.

Marie and Ethan form Roundtree Corporation with the transfer of the following. Marie performs personal services for the corporation with a fair market value of $184,800 in exchange for 400 shares of stock. Ethan contributes an installment note receivable (basis $25,000; fair market value $30,000), land (basis $50,000; fair market value $170,000), and inventory (basis $431,360; fair market value $539,200) in exchange for 1,600 shares. Determine Marie and Ethan's current income, gain, or loss and calculate the basis that each takes in the Roundtree stock. If an amount is zero, enter "0". Marie has income of $ and $ basis in her 400 shares of stock and Ethan has income of $ and $ basis in his 1,600 shares of stock.

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 19CE

Related questions

Question

Hi can someone help me with this please?

Transcribed Image Text:Exercise 4-19 (Algorithmic) (LO. 1, 3)

Marie and Ethan form Roundtree Corporation with the transfer of the following. Marie

performs personal services for the corporation with a fair market value of $184,800 in

exchange for 400 shares of stock. Ethan contributes an installment note receivable (basis

$25,000; fair market value $30,000), land (basis $50,000; fair market value $170,000),

and inventory (basis $431,360; fair market value $539,200) in exchange for 1,600

shares.

Determine Marie and Ethan's current income, gain, or loss and calculate the basis that

each takes in the Roundtree stock.

If an amount is zero, enter "0".

Marie has income of $

and $

basis in her 400 shares of

stock and Ethan has income

of $

and $

basis in his 1,600 shares of stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you