Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 2.4P

Related questions

Question

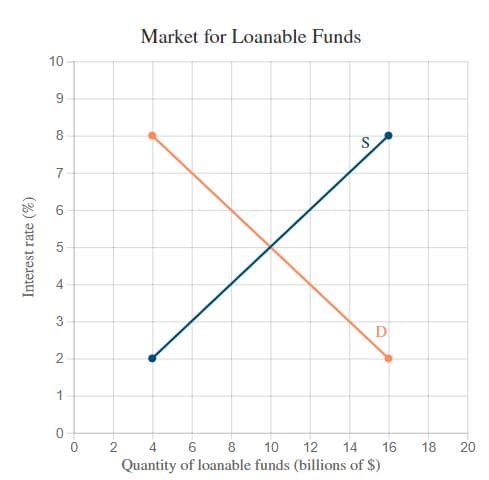

The accompanying graph represents the market for loanable funds in the hypothetical country of Bunko. Assume the market is initially in equilibrium and inflation expectations are 2%.

a. Adjust the graph to demonstrate the effects of inflation expectations increasing from 2% to 4%.

Market for Loanable FundsInterest rate (%)Quantity of loanable funds (billions of $)02468101214161820012345678910DS

b. What is the real interest rate after the change in inflation expectations?

3%

2%

5%

7%

c. Which effect below characterizes the relationship between inflation expectations and nominal interest rates?

The Leontief Paradox

The Inflation effect

The Fisher effect

The Pigou effect

Transcribed Image Text:Market for Loanable Funds

10

S

7

3

D

2

1

C

4.

C

2

6

10

12

14

16

18

20

Quantity of loanable funds (billions of $)

Interest

rate (%)

LO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you