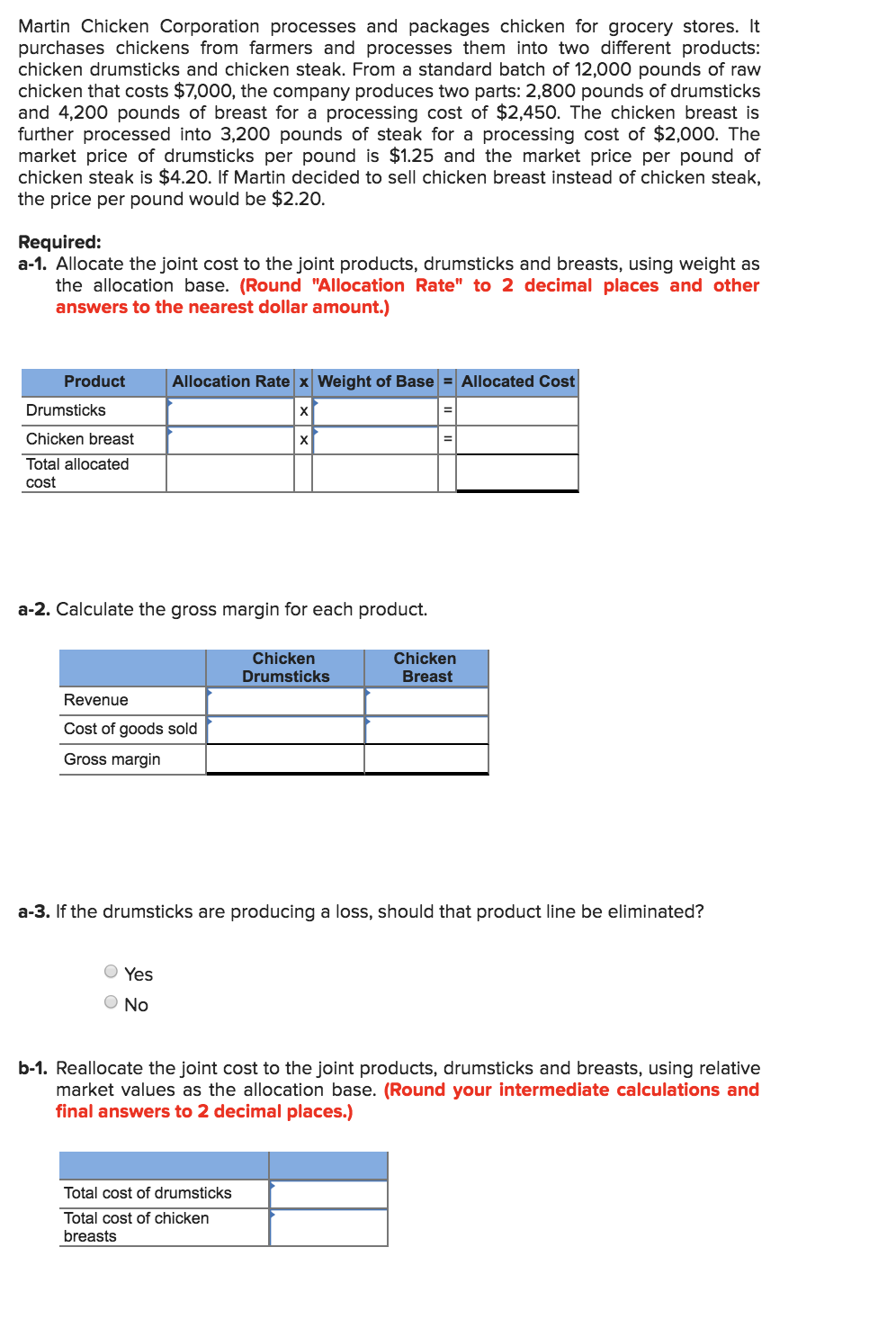

Martin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,000. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20. Required: a-1. Allocate the joint cost to the joint products, drumsticks and breasts, using weight as the allocation base. (Round "Allocation Rate" to 2 decimal places and other answers to the nearest dollar amount.) Product Allocation Rate x Weight of Base Allocated Cost Drumsticks х Chicken breast х Total allocated cost a-2. Calculate the gross margin for each product. Chicken Chicken Drumsticks Breast Revenue Cost of goods sold Gross margin a-3. If the drumsticks are producing a loss, should that product line be eliminated? Yes No b-1. Reallocate the joint cost to the joint products, drumsticks and breasts, using relative market values as the allocation base. (Round your intermediate calculations and final answers to 2 decimal places.) Total cost of drumsticks Total cost of chicken breasts

Martin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,000. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20. Required: a-1. Allocate the joint cost to the joint products, drumsticks and breasts, using weight as the allocation base. (Round "Allocation Rate" to 2 decimal places and other answers to the nearest dollar amount.) Product Allocation Rate x Weight of Base Allocated Cost Drumsticks х Chicken breast х Total allocated cost a-2. Calculate the gross margin for each product. Chicken Chicken Drumsticks Breast Revenue Cost of goods sold Gross margin a-3. If the drumsticks are producing a loss, should that product line be eliminated? Yes No b-1. Reallocate the joint cost to the joint products, drumsticks and breasts, using relative market values as the allocation base. (Round your intermediate calculations and final answers to 2 decimal places.) Total cost of drumsticks Total cost of chicken breasts

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 11P: Otto Inc. specializes in chicken farming. Chickens are raised, packaged, and sold mostly to grocery...

Related questions

Question

Transcribed Image Text:Martin Chicken Corporation processes and packages chicken for grocery stores. It

purchases chickens from farmers and processes them into two different products:

chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw

chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks

and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is

further processed into 3,200 pounds of steak for a processing cost of $2,000. The

market price of drumsticks per pound is $1.25 and the market price per pound of

chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak,

the price per pound would be $2.20.

Required:

a-1. Allocate the joint cost to the joint products, drumsticks and breasts, using weight as

the allocation base. (Round "Allocation Rate" to 2 decimal places and other

answers to the nearest dollar amount.)

Product

Allocation Rate x Weight of Base Allocated Cost

Drumsticks

х

Chicken breast

х

Total allocated

cost

a-2. Calculate the gross margin for each product.

Chicken

Chicken

Drumsticks

Breast

Revenue

Cost of goods sold

Gross margin

a-3. If the drumsticks are producing a loss, should that product line be eliminated?

Yes

No

b-1. Reallocate the joint cost to the joint products, drumsticks and breasts, using relative

market values as the allocation base. (Round your intermediate calculations and

final answers to 2 decimal places.)

Total cost of drumsticks

Total cost of chicken

breasts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College