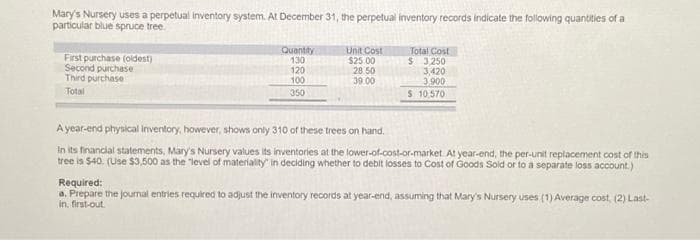

Mary's Nursery uses a perpetual inventory system. At December 31, the perpetual inventory records indicate the following quantities of a particular blue spruce tree. First purchase (oldest) Second purchase Third purchase Total Quantity 130 120 100 350 Unit Cost $25.00 28.50 39.00 Total Cost $ 3,250 3,420 3.900 $ 10,570 A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mary's Nursery values its inventories at the lower-of-cost-or-market At year-end, the per-unit replacement cost of this tree is $40. (Use $3,500 as the level of materiality" in deciding whether to debit losses to Cost of Goods Soid or to a separate loss account.) Required: a. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last- in, first-out

Mary's Nursery uses a perpetual inventory system. At December 31, the perpetual inventory records indicate the following quantities of a particular blue spruce tree. First purchase (oldest) Second purchase Third purchase Total Quantity 130 120 100 350 Unit Cost $25.00 28.50 39.00 Total Cost $ 3,250 3,420 3.900 $ 10,570 A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mary's Nursery values its inventories at the lower-of-cost-or-market At year-end, the per-unit replacement cost of this tree is $40. (Use $3,500 as the level of materiality" in deciding whether to debit losses to Cost of Goods Soid or to a separate loss account.) Required: a. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last- in, first-out

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 1MP

Related questions

Question

Subject - account

Please help me.

Thankyou.

Transcribed Image Text:Mary's Nursery uses a perpetual inventory system. At December 31, the perpetual inventory records indicate the following quantities of a

particular blue spruce tree.

First purchase (oldest)

Second purchase

Third purchase

Total

Quantity

130

120

100

350

Unit Cost

$25.00

28.50

39.00

Total Cost

$3,250

3,420

3,900

$ 10,570

A year-end physical inventory, however, shows only 310 of these trees on hand.

In its financial statements, Mary's Nursery values its inventories at the lower-of-cost-or-market. At year-end, the per-unit replacement cost of this

tree is $40. (Use $3,500 as the level of materiality in deciding whether to debit losses to Cost of Goods Sold or to a separate loss account.)

Required:

a. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last-

in, first-out.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning