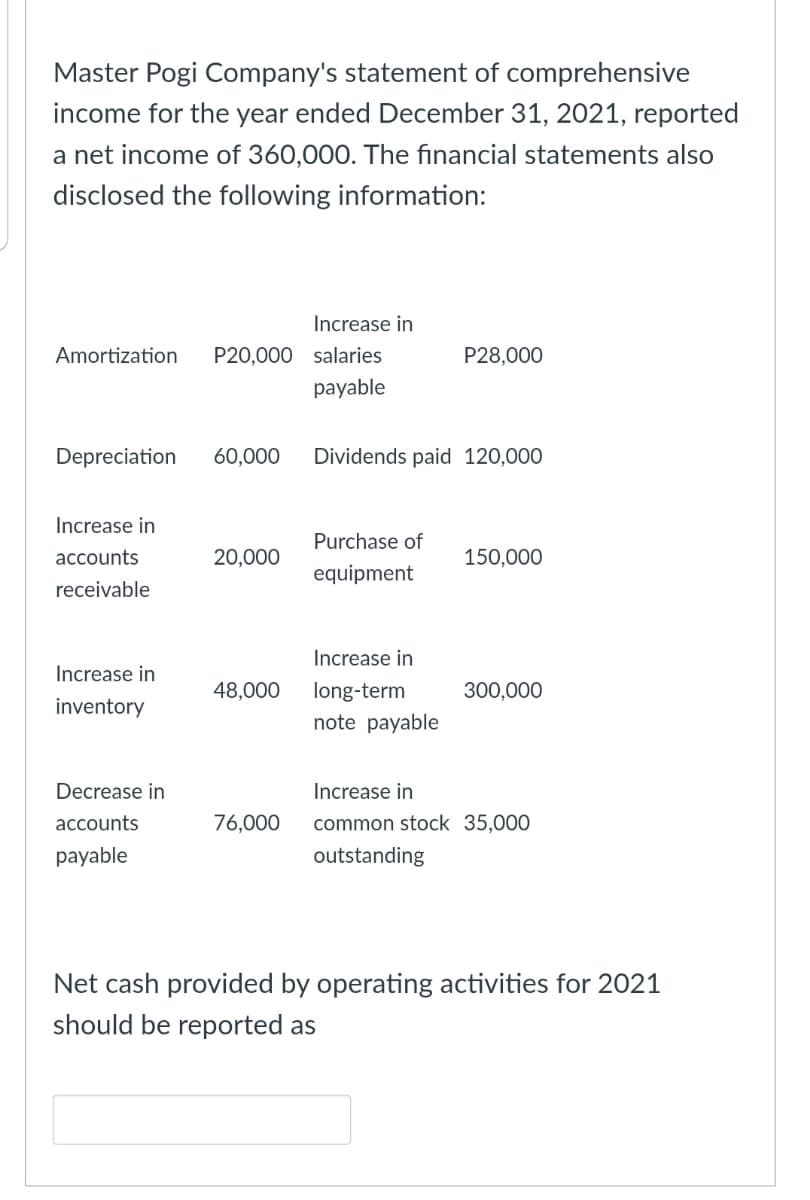

Master Pogi Company's statement of comprehensive income for the year ended December 31, 2021, reported a net income of 360,000. The financial statements also disclosed the following information: Increase in Amortization P20,000 salaries P28,000 payable Depreciation 60,000 Dividends paid 120,000 Increase in Purchase of accounts 20,000 150,000 equipment receivable Increase in Increase in 48,000 long-term 300,000 inventory note payable Decrease in Increase in accounts 76,000 common stock 35,000 payable outstanding Net cash provided by operating activities for 2021 should be reported as

Master Pogi Company's statement of comprehensive income for the year ended December 31, 2021, reported a net income of 360,000. The financial statements also disclosed the following information: Increase in Amortization P20,000 salaries P28,000 payable Depreciation 60,000 Dividends paid 120,000 Increase in Purchase of accounts 20,000 150,000 equipment receivable Increase in Increase in 48,000 long-term 300,000 inventory note payable Decrease in Increase in accounts 76,000 common stock 35,000 payable outstanding Net cash provided by operating activities for 2021 should be reported as

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 98.3C

Related questions

Question

Transcribed Image Text:Master Pogi Company's statement of comprehensive

income for the year ended December 31, 2021, reported

a net income of 360,000. The financial statements also

disclosed the following information:

Increase in

Amortization

P20,000 salaries

P28,000

payable

Depreciation

60,000

Dividends paid 120,000

Increase in

Purchase of

accounts

20,000

150,000

equipment

receivable

Increase in

Increase in

48,000

long-term

300,000

inventory

note payable

Decrease in

Increase in

accounts

76,000

common stock 35,000

payable

outstanding

Net cash provided by operating activities for 2021

should be reported as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning