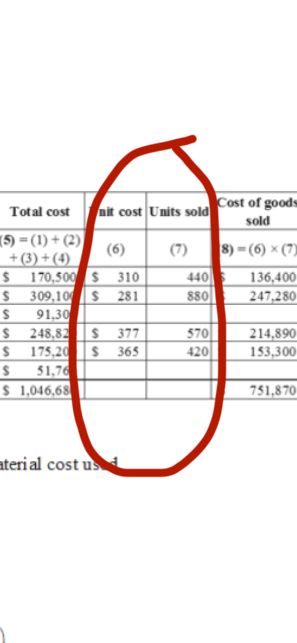

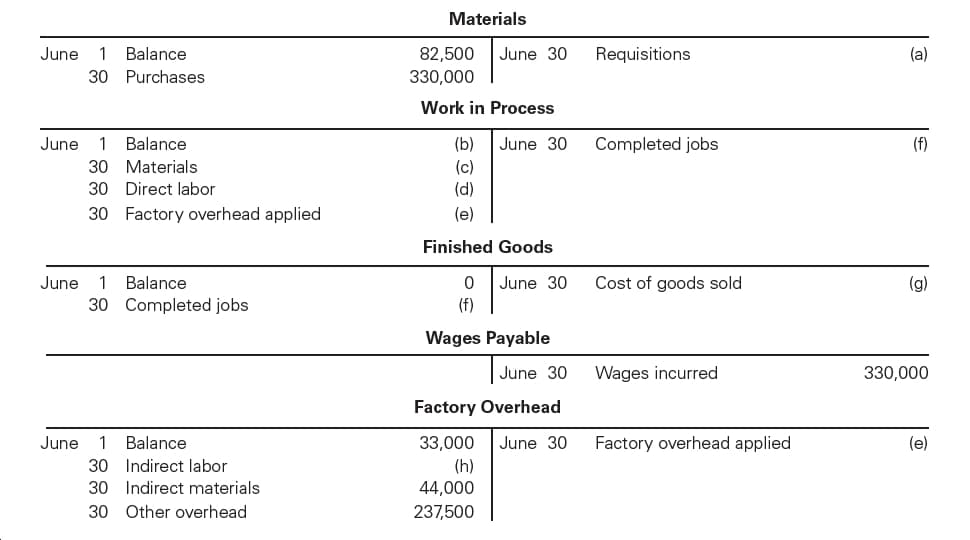

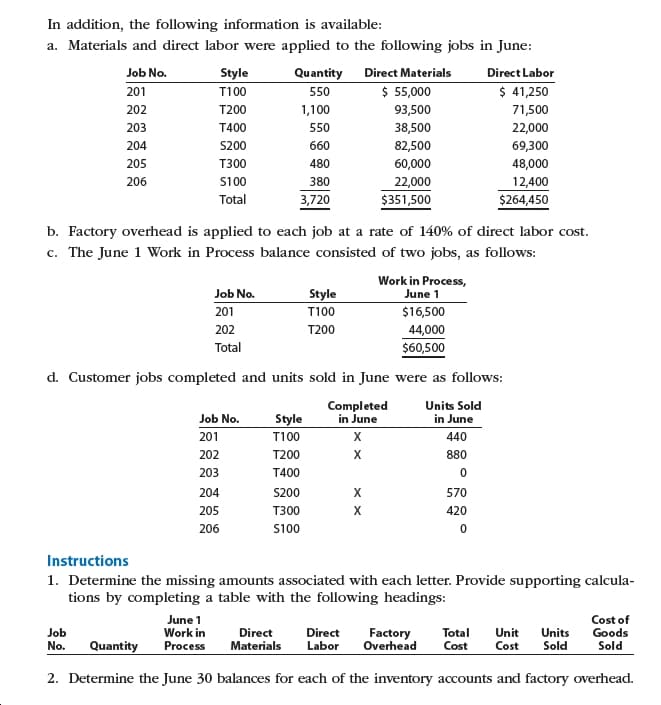

Materials June Balance 82,500 June 30 Requisitions (a) 30 Purchases 330,000 Work in Process Completed jobs June Balance (b) June 30 (f) 30 Materials (c) (d) 30 Direct labor 30 Factory overhead applied (e) Finished Goods June 30 (f) Cost of goods sold June Balance (g) 30 Completed jobs Wages Payable Wages incurred 330,000 June 30 Factory Overhead June 30 June Balance 33,000 Factory overhead applied (e) 30 Indirect labor (h) 44,000 30 Indirect materials 30 Other overhead 237,500 In addition, the following information is available: a. Materials and direct labor were applied to the following jobs in June: Job No. Style Quantity Direct Materials Direct Labor $ 55,000 $ 41,250 T100 201 550 202 T200 1,100 93,500 71,500 T400 203 550 38,500 22,000 S200 69,300 204 660 82,500 205 T300 480 60,000 48,000 22,000 $351,500 206 S100 380 12,400 Total 3,720 $264,450 b. Factory overhead is applied to each job at a rate of 140% of direct labor ost. c. The June 1 Work in Process balance consisted of two jobs, as follows: Work in Process, June 1 Job No. Style 201 T100 $16,500 202 T200 44,000 Total $60,500 d. Customer jobs completed and units sold in June were as follows: Units Sold in June Completed in June Job No. Style 201 T100 440 202 T200 880 203 T400 204 S200 570 205 T300 420 206 S100 Instructions 1. Determine the missing amounts associated with each letter. Provide supporting calcula- tions by completing a table with the following headings: June 1 Work in Process Cost of Goods Sold Job No. Direct Direct Factory Overhead Total Cost Unit Cost Units Sold Materials Labor Quantity 2. Determine the June 30 balances for each of the inventory accounts and factory overhead.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Fire Rock Company manufactures designer paddle boards in a wide variety of sizes and styles. The following incomplete ledger accounts refer to transactions that are summarized for June:

See Attachment

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

How did you find these?