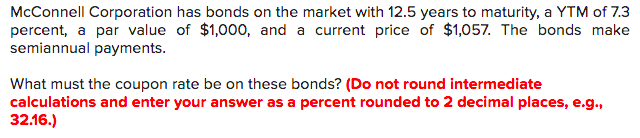

McConnell Corporation has bonds on the market with 12.5 years to maturity, a YTM of 7.3 percent, a par value of $1,000, and a current price of $1,057. The bonds make semiannual payments. What must the coupon rate be on these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

McConnell Corporation has bonds on the market with 12.5 years to maturity, a YTM of 7.3 percent, a par value of $1,000, and a current price of $1,057. The bonds make semiannual payments. What must the coupon rate be on these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:McConnell Corporation has bonds on the market with 12.5 years to maturity, a YTM of 7.3

percent, a par value of $1,000, and a current price of $1,057. The bonds make

semiannual payments.

What must the coupon rate be on these bonds? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning