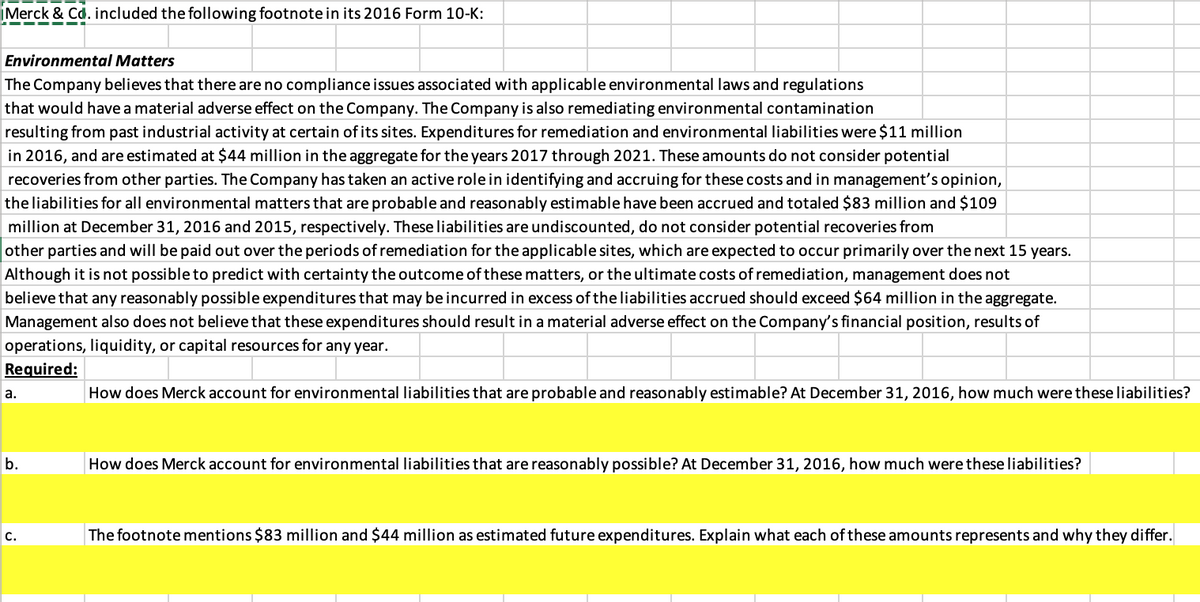

Merck & Cd. included the following footnote in its 2016 Form 10-K: --- Environmental Matters The Company believes that there are no compliance issues associated with applicable environmental laws and regulations that would have a material adverse effect on the Company. The Company is also remediating environmental contamination resulting from past industrial activity at certain of its sites. Expenditures for remediation and environmental liabilities were $11 million in 2016, and are estimated at $44 million in the aggregate for the years 2017 through 2021. These amounts do not consider potential recoveries from other parties. The Company has taken an active role in identifying and accruing for these costs and in management's opinion, the liabilities for all environmental matters that are probable and reasonably estimable have been accrued and totaled $83 million and $109 million at December 31, 2016 and 2015, respectively. These liabilities are undiscounted, do not consider potential recoveries from other parties and will be paid out over the periods of remediation for the applicable sites, which are expected to occur primarily over the next 15 years. Although it is not possible to predict with certainty the outcome of these matters, or the ultimate costs of remediation, management does not believe that any reasonably possible expenditures that may be incurred in excess of the liabilities accrued should exceed $64 million in the aggregate. Management also does not believe that these expenditures should result in a material adverse effect on the Company's financial position, results of operations, liquidity, or capital resources for any year. Required: а. How does Merck account for environmental liabilities that are probable and reasonably estimable? At December 31, 2016, how much were these liabilities? b. How does Merck account for environmental liabilities that are reasonably possible? At December 31, 2016, how much were these liabilities? The footnote mentions $83 million and $44 million as estimated future expenditures. Explain what each of these amounts represents and why they differ. с.

Merck & Cd. included the following footnote in its 2016 Form 10-K: --- Environmental Matters The Company believes that there are no compliance issues associated with applicable environmental laws and regulations that would have a material adverse effect on the Company. The Company is also remediating environmental contamination resulting from past industrial activity at certain of its sites. Expenditures for remediation and environmental liabilities were $11 million in 2016, and are estimated at $44 million in the aggregate for the years 2017 through 2021. These amounts do not consider potential recoveries from other parties. The Company has taken an active role in identifying and accruing for these costs and in management's opinion, the liabilities for all environmental matters that are probable and reasonably estimable have been accrued and totaled $83 million and $109 million at December 31, 2016 and 2015, respectively. These liabilities are undiscounted, do not consider potential recoveries from other parties and will be paid out over the periods of remediation for the applicable sites, which are expected to occur primarily over the next 15 years. Although it is not possible to predict with certainty the outcome of these matters, or the ultimate costs of remediation, management does not believe that any reasonably possible expenditures that may be incurred in excess of the liabilities accrued should exceed $64 million in the aggregate. Management also does not believe that these expenditures should result in a material adverse effect on the Company's financial position, results of operations, liquidity, or capital resources for any year. Required: а. How does Merck account for environmental liabilities that are probable and reasonably estimable? At December 31, 2016, how much were these liabilities? b. How does Merck account for environmental liabilities that are reasonably possible? At December 31, 2016, how much were these liabilities? The footnote mentions $83 million and $44 million as estimated future expenditures. Explain what each of these amounts represents and why they differ. с.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 20PC

Related questions

Question

Answer a,b,c.if answered within 45mins,it would be appreciable!!!

Transcribed Image Text:iMerck & Cd. included the following footnote in its 2016 Form 10-K:

Environmental Matters

The Company believes that there are no compliance issues associated with applicable environmental laws and regulations

that would have a material adverse effect on the Company. The Company is also remediating environmental contamination

resulting from past industrial activity at certain of its sites. Expenditures for remediation and environmental liabilities were $11 million

in 2016, and are estimated at $44 million in the aggregate for the years 2017 through 2021. These amounts do not consider potential

recoveries from other parties. The Company has taken an active rolein identifying and accruing for these costs and in management's opinion,

the liabilities for all environmental matters that are probable and reasonably estimable have been accrued and totaled $83 million and $109

million at December 31, 2016 and 2015, respectively. These liabilities are undiscounted, do not consider potential recoveries from

other parties and will be paid out over the periods of remediation for the applicable sites, which are expected to occur primarily over the next 15 years.

Although it is not possible to predict with certainty the outcome of these matters, or the ultimate costs of remediation, management does not

believe that any reasonably possible expenditures that may be incurred in excess of the liabilities accrued should exceed $64 million in the aggregate.

Management also does not believe that these expenditures should result in a material adverse effect on the Company's financial position, results of

operations, liquidity, or capital resources for any year.

Required:

а.

How does Merck account for environmental liabilities that are probable and reasonably estimable? At December 31, 2016, how much were these liabilities?

b.

How does Merck account for environmental liabilities that are reasonably possible? At December 31, 2016, how much were these liabilities?

с.

The footnote mentions $83 million and $44 million as estimated future expenditures. Explain what each of these amounts represents and why they differ.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning