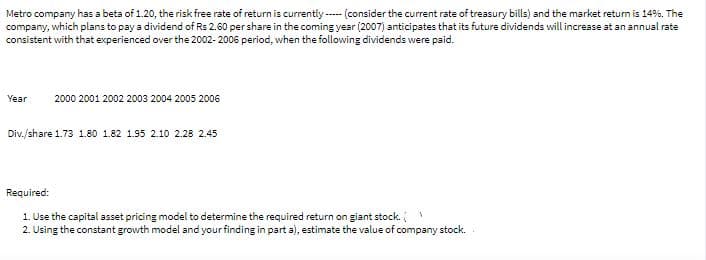

Metro company has a beta of 1.20, the risk free rate of return is currently ---- (consider the current rate of treasury bills) and the market return is 14%. The company, which plans to pay a dividend of Rs 2.60 per share in the coming year (2007) anticipates that its future dividends will increase at an annual rate consistent with that experienced over the 2002- 2006 period, when the following dividends were paid. Year 2000 2001 2002 2003 2004 2005 2006 Div./share 1.73 1.80 1.82 1.95 2.10 2.28 2.45 Required: 1. Use the capital asset pricing model to determine the required return on giant stock. 2. Using the constant growth model and your finding in part a), estimate the value of company stock.

Metro company has a beta of 1.20, the risk free rate of return is currently ---- (consider the current rate of treasury bills) and the market return is 14%. The company, which plans to pay a dividend of Rs 2.60 per share in the coming year (2007) anticipates that its future dividends will increase at an annual rate consistent with that experienced over the 2002- 2006 period, when the following dividends were paid. Year 2000 2001 2002 2003 2004 2005 2006 Div./share 1.73 1.80 1.82 1.95 2.10 2.28 2.45 Required: 1. Use the capital asset pricing model to determine the required return on giant stock. 2. Using the constant growth model and your finding in part a), estimate the value of company stock.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 18MC

Related questions

Question

Transcribed Image Text:Metro company has a beta of 1.20, the risk free rate of return is currently ---- (consider the current rate of treasury bills) and the market return is 14%. The

company, which plans to pay a dividend of Rs 2.60 per share in the coming year (2007) anticipates that its future dividends will increase at an annual rate

consistent with that experienced over the 2002- 2006 period, when the following dividends were paid.

Year

2000 2001 2002 2003 2004 2005 2006

Div./share 1.73 1.80 1.82 1.95 2.10 2.28 2.45

Required:

1. Use the capital asset pricing model to determine the required return on giant stock.

2. Using the constant growth model and your finding in part a), estimate the value of company stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning