The ABC company is considering constructing a plant to manufacture a proposed new product. The land costs P15,000,000, the building costs P30,000,000, the equipment costs P12,500,000, and P5,000,000 working capital is required. At the end of 12 years, the land can be sold for P25,000,000, the building for P12,000,000, the equipment for P250,000 and all of the working capital recovered. The annual disbursements for labor, materials, and all other expenses are estimated to cost P23,750,000. If the company requires a minimum return of 25%, what should be the minimum annual sales for 12 years to justify the investment? Find: Minimum annual sales for 12 years to justify the investment

The ABC company is considering constructing a plant to manufacture a proposed new product. The land costs P15,000,000, the building costs P30,000,000, the equipment costs P12,500,000, and P5,000,000 working capital is required. At the end of 12 years, the land can be sold for P25,000,000, the building for P12,000,000, the equipment for P250,000 and all of the working capital recovered. The annual disbursements for labor,

materials, and all other expenses are estimated to cost P23,750,000. If the company requires a minimum return of 25%, what should be the minimum annual sales for 12 years to justify the investment?

Find: Minimum annual sales for 12 years to justify the investment

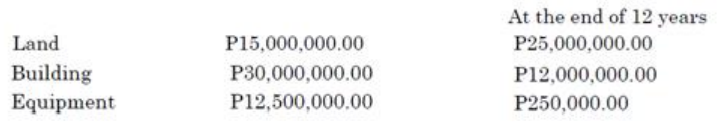

Given:

(see attached photo)

Trending now

This is a popular solution!

Step by step

Solved in 4 steps