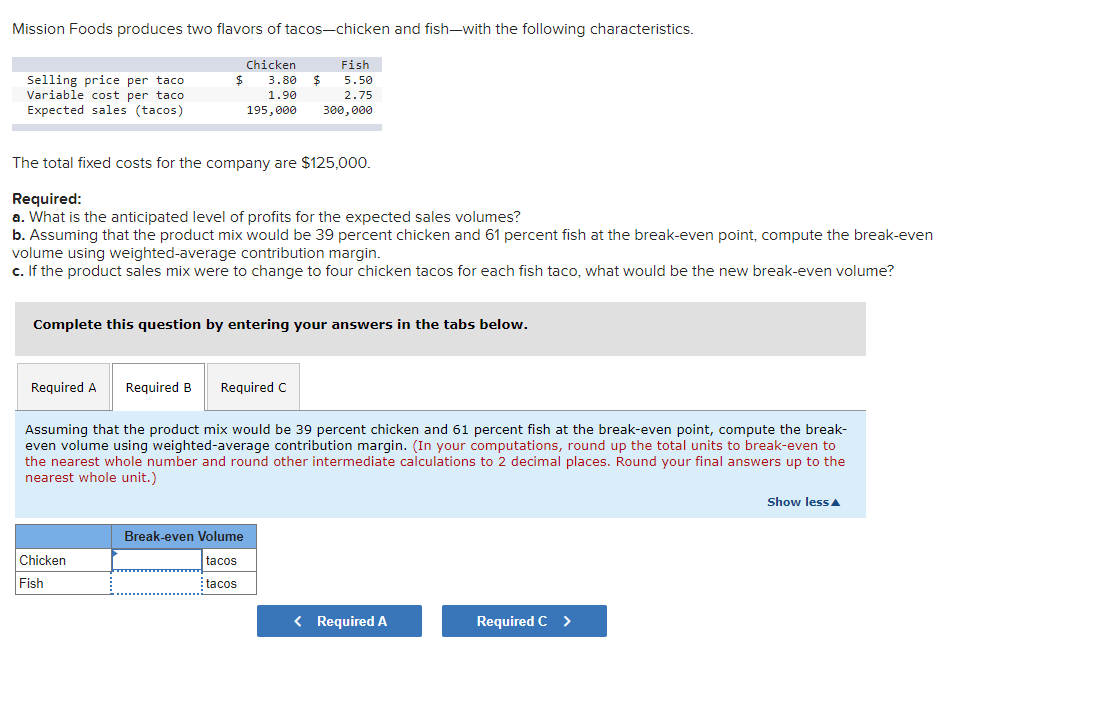

Mission Foods produces two flavors of tacos-chicken and fish-with the following characteristics. Chicken Fish $ 3.80 $ 5.50 Selling price per taco Variable cost per taco Expected sales (tacos) 1.90 2.75 195,000 300,000 The total fixed costs for the company are $125,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 39 percent chicken and 61 percent fish at the break-even point, compute the break-even volume using weighted-average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume?

Mission Foods produces two flavors of tacos-chicken and fish-with the following characteristics. Chicken Fish $ 3.80 $ 5.50 Selling price per taco Variable cost per taco Expected sales (tacos) 1.90 2.75 195,000 300,000 The total fixed costs for the company are $125,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 39 percent chicken and 61 percent fish at the break-even point, compute the break-even volume using weighted-average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 36P: Faldo Company produces a single product. The projected income statement for the coming year, based...

Related questions

Question

Mission foods produces two flavors of tacos-chicken and fish- with the following characteristics.

a) $1,070,500

B) need help

Transcribed Image Text:Mission Foods produces two flavors of tacos-chicken and fish-with the following characteristics.

Chicken

Fish

Selling price per taco

Variable cost per taco

Expected sales (tacos)

3.80

5.50

1.90

2.75

195,000

300, 000

The total fixed costs for the company are $125,000.

Required:

a. What is the anticipated level of profits for the expected sales volumes?

b. Assuming that the product mix would be 39 percent chicken and 61 percent fish at the break-even point, compute the break-even

volume using weighted-average contribution margin.

c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Assuming that the product mix would be 39 percent chicken and 61 percent fish at the break-even point, compute the break-

even volume using weighted-average contribution margin. (In your computations, round up the total units to break-even to

the nearest whole number and round other intermediate calculations to 2 decimal places. Round your final answers

nearest whole unit.)

to the

Show less

Break-even Volume

Chicken

tacos

Fish

tacos

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College