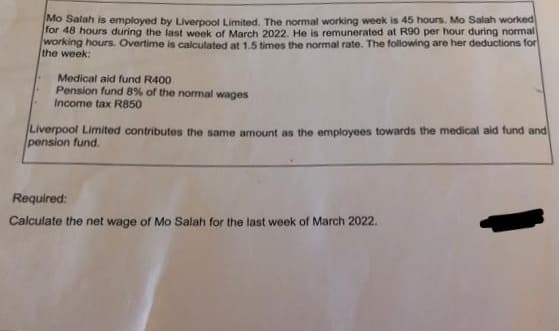

Mo Salah is employed by Liverpool Limited. The normal working week is 45 hours. Mo Salah worked for 48 hours during the last week of March 2022. He is remunerated at R90 per hour during normal working hours. Overtime is calculated at 1.5 times the normal rate. The following are her deductions for the week: Medical aid fund R400 Pension fund 8% of the normal wages Income tax R850 Liverpool Limited contributes the same amount as the employees towards the medical aid fund and pension fund. equired: alculate the net wage of Mo Salah for the last week of March 2022.

Mo Salah is employed by Liverpool Limited. The normal working week is 45 hours. Mo Salah worked for 48 hours during the last week of March 2022. He is remunerated at R90 per hour during normal working hours. Overtime is calculated at 1.5 times the normal rate. The following are her deductions for the week: Medical aid fund R400 Pension fund 8% of the normal wages Income tax R850 Liverpool Limited contributes the same amount as the employees towards the medical aid fund and pension fund. equired: alculate the net wage of Mo Salah for the last week of March 2022.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 5PA

Related questions

Question

Transcribed Image Text:Mo Salah is employed by Liverpool Limited. The normal working week is 45 hours. Mo Salah worked

for 48 hours during the last week of March 2022. He is remunerated at R90 per hour during normal

working hours. Overtime is calculated at 1.5 times the normal rate. The following are her deductions for

the week:

Medical aid fund R400

Pension fund 8% of the normal wages

Income tax R850

Liverpool Limited contributes the same amount as the employees towards the medical aid fund and

pension fund.

Required:

Calculate the net wage of Mo Salah for the last week of March 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT