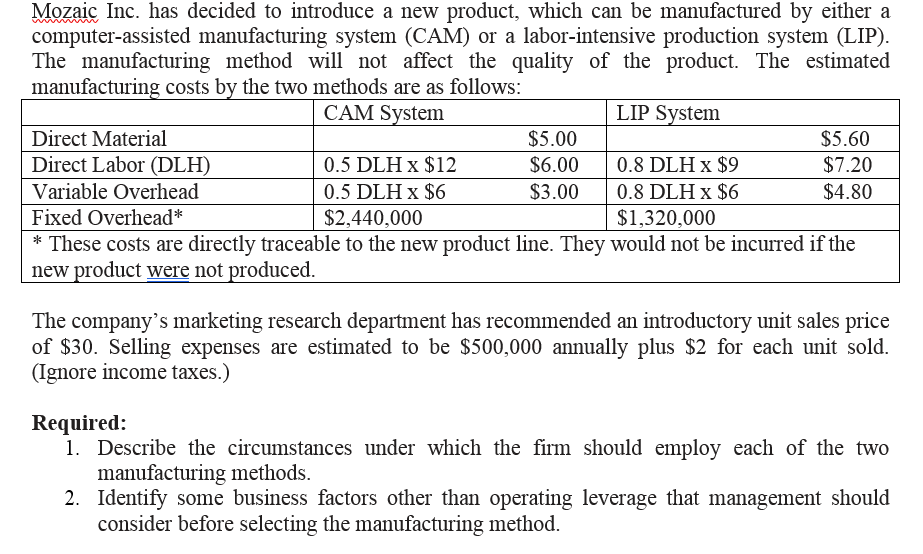

Mozaic Inc. has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP). The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: CAM System LIP System Direct Material Direct Labor (DLH) $5.00 $5.60 0.5 DLH x $12 $6.00 0.8 DLH x $9 $7.20 Variable Overhead $3.00 0.8 DLH x $6 $1,320,000 0.5 DLH x $6 $4.80 Fixed Overhead* $2,440,000 * These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: 1. Describe the circumstances under which the firm should employ each of the two manufacturing methods. 2. Identify some business factors other than operating leverage that management should consider before selecting the manufacturing method.

Mozaic Inc. has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP). The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: CAM System LIP System Direct Material Direct Labor (DLH) $5.00 $5.60 0.5 DLH x $12 $6.00 0.8 DLH x $9 $7.20 Variable Overhead $3.00 0.8 DLH x $6 $1,320,000 0.5 DLH x $6 $4.80 Fixed Overhead* $2,440,000 * These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: 1. Describe the circumstances under which the firm should employ each of the two manufacturing methods. 2. Identify some business factors other than operating leverage that management should consider before selecting the manufacturing method.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter6: Statistical Inference

Section: Chapter Questions

Problem 26P: Because of high production-changeover time and costs, a director of manufacturing must convince...

Related questions

Question

Transcribed Image Text:Mozaic Inc. has decided to introduce a new product, which can be manufactured by either a

computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP).

The manufacturing method will not affect the quality of the product. The estimated

manufacturing costs by the two methods are as follows:

www

CAM System

LIP System

Direct Material

$5.00

$5.60

Direct Labor (DLH)

0.5 DLH x $12

$6.00

0.8 DLH x $9

$7.20

Variable Overhead

0.5 DLH x $6

$3.00

0.8 DLH x $6

$4.80

Fixed Overhead*

$2,440,000

$1,320,000

* These costs are directly traceable to the new product line. They would not be incurred if the

new product were not produced.

The company's marketing research department has recommended an introductory unit sales price

of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold.

(Ignore income taxes.)

Required:

1. Describe the circumstances under which the firm should employ each of the two

manufacturing methods.

2. Identify some business factors other than operating leverage that management should

consider before selecting the manufacturing method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College