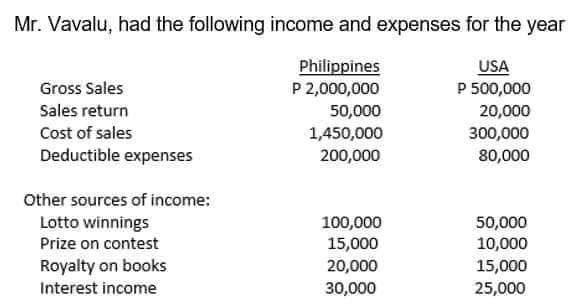

Mr. Vavalu, had the following income and expenses for the year Philippines P 2,000,000 Gross Sales Sales return Cost of sales Deductible expenses Other sources of income: Lotto winnings Prize on contest Royalty on books Interest income 50,000 1,450,000 200,000 100,000 15,000 20,000 30,000 USA P 500,000 20,000 300,000 80,000 50,000 10,000 15,000 25,000

Q: The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the…

A: Balance sheet is one of financial statements which includes assets and liabilities. Total of assets…

Q: Problem 2 Material and Labour Variances The direct materials and direct labour standards for one…

A: The variance is the difference between the actual and standard cost data of production. The…

Q: 2. The listed App AG has issued shares with a nominal value of €1. In t5, a capital increase is…

A: A capital increase by a firm often entails the issuance of new shares to raise additional funds. In…

Q: Harris Company manufactures and sells a single product. A partially completed schedule of the…

A: Variable Cost :— It is the cost that changes with change in activity of cost driver. Variable cost…

Q: Waterway Company uses a job order cost system. On May 1, the company has balances in Raw Materials…

A: Ending work in process = Beginning WIP + Direct materials + Direct Labor + Manufacturing overhead

Q: John is selling his brick-and-frame, 1,500-square-foot ranch-style home in Sunnydale. He has set up…

A: CMA stands for Competitive market analysis is the analysis which helps in learning from the…

Q: The decedent devised to h

A: Gross estate is the valude of all property and assets in the estate before…

Q: Ayayai Construction, Inc. experienced the following construction activity in 2021, the first year of…

A: An income statement is a financial statement that displays how lucrative your company was within a…

Q: Required information Problem 3-8B Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7)…

A: Income Statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: . Product QQ fill in the blank 1 units b. Product ZZ fill in the blank 2 units

A: Break Even point in a whole = Total Fixed Cost/Total Contribution Margin Per unit Total Contribution…

Q: Phil owns a ranch business and uses four-wheelers to do much of his work. Occasionally, though, he…

A: Formula used: Allowable depreciation for year 1=Business travel expense×Depreciation rate according…

Q: Use the above information to prepare a statement of cash flows for the current year using the…

A: The cash flow statement is one of the financial statements which tells about the cash flow from…

Q: Jones plc manufactures one product, and the entire product is sold as soon as it is produced. There…

A: Given for Variable Overheads, Standard Rate per unit= 0.60 Actual Rate per unit= 2,6004,850= 0.54…

Q: Problem 15-3A (Algo) Computing and recording job costs; preparing Income statement and balance sheet…

A: Trial balance is consider all general ledger of accounts in business. This will include all value of…

Q: What is the liability for the outstanding premiums at year-end?* a. 2,000,000 b. 562,500 c.…

A: Warranty is a form of assurance being provided by seller to the buyer that in case product will have…

Q: Novak Design was founded by Thomas Grant in January 2016. Presented below is the adjusted trial…

A: Income Statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Current Attempt in Progress Kingbird's currently manufactures art supplies, including markers. The…

A: The contribution margin is calculated as difference between sales and variable costs. The operating…

Q: Anton Company uses the perpetual inventory method. Anton purchased 760 units of inventory that cost…

A: Lets understand the basics. There are two inventory systems are followed which are periodical basis…

Q: Corrections: - reads "5000 was collected for July's sales." should read "$5000 in services (and cash…

A: Journal entries is the first step in the accounting process where the transactions are recorded as…

Q: correct chart of accounts

A: A chart of accounts is actually a list of all your venture’s accounts in one place. It offers you…

Q: Jones plc manufactures one product, and the entire product is sold as soon as it is produced. There…

A: Introduction: The variances to be calculated are: Materials price variance (MPV)…

Q: Problem 2-2A (Algo) Preparing and posting journal entries; preparing a trial balance LO A1, P1…

A: Journal entries recording is to be termed as initial step in accounting cycle process. Under this,…

Q: Headland Corporation is a regional company which is an SEC registrant. The corporation's securities…

A: The incremental method is a type of method in which the apportionment of the value is done in the…

Q: Problem #8 Treasury Stock Transactions Briones, Inc. has the following stock outstanding on Dec. 31,…

A: Journal Entry A journal is a book in which all of a company's transactions are recorded for…

Q: You work as a freelance accounting professional and have been recently engaged by the auditors of…

A: Net New Equity = Increase in Equity - Dividends = $14,070 - $ 10,800 =$3,270 Change in Net Working…

Q: the first quarter of the year assuming Pharoah follows ASPE. Ignore any cost of goods sold entry.…

A: The journal entry involves calculation of different entry and amount are considered and the…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity. The…

Q: Sandhill Manufacturing Inc. has the following cost and production data for the month of April. Units…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: (3) Brown transfers Blackacre to XYZ Corp., a newly formed corporation, in exchange for 140 shares…

A: Tax consequences for Exchange of Shares A number of variables, such as the type of shares involved,…

Q: The following expenditures and receipts are related to land, land improvements, and buildings…

A: Fixed assets are those assets which are held by the business for longer period of time, say more…

Q: The following balances were taken from the books of Sheffield Fabrication Limited on December 31,…

A: Lets understand the basics. There are various stages through which income statement gets prepared.…

Q: Discount Interest Solve the following. Show solutions. Round off answers up to 2 (two) decimal…

A: Answer:- Discount interest:- When a loan's interest is paid upfront, it is generally referred to as…

Q: Evaluate and detail the significant steps in setting a financial / cost controlling budget in a…

A: Answer:- Budget:- The projection of future income and expenses can be done with the help of a…

Q: Consider the following simplified financial statements for the Wesney Corporation (assuming no…

A: External finances When the company has taken borrowings from third parties or financial agencies in…

Q: ute ROI for Division B. b. Compute residual income for Division A. c. Division B could increase its…

A: Companies invest in the projects to get the sufficient return on investment and create value for…

Q: Helix Company produces several products in its factory, including a karate robe. The company uses a…

A: A budget is a tool to estimate future cost revenue and expenses. After developing a budget, the…

Q: On June 30, 2024, Blue, Incorporated leased a machine from Large Leasing Corporation. The lease…

A: A lease can be defined as a contract between the lessor and the lessee, in which the lessor provides…

Q: Delta Pty Ltd has the following balance sheet figures. The debt to equity ratio is: current assets…

A: INTRODUCTION: The debt-to-equity ratio is used to assess a company's capacity to repay its debts. It…

Q: During its first year of operations, Bonita Corporation had the following transactions pertaining to…

A: PARTICULARS DEBIT CREDIT CASH ACCOUNT 502,200 TO COMMON STOCK 418,500…

Q: Annual Costs of Operating Each Product Line Sales in units Sales in dollars Unit-level costs: Cost…

A: Product-line earnings statement represents a summary of earnings and costs of each product line run…

Q: Q2. Compute the rate of return on the investment characterized by the following cash flow. Year 0 1…

A: Rate of return is annual % return on investment. Investment is an amount of cash outflow in initial…

Q: Sheryl Hansen started a business on May 1, 20--. Analyze the following transactions for the first…

A: T-Accounts The accounts which are prepared on the basis of journal entries recorded in the…

Q: At the beginning of January, the first month of the accounting year, the supplies account had a…

A: Supplies: Supply is an asset for the business and is disclosed in the balance sheet under current…

Q: the context of auditing, what does "tracking" actually

A: In the auditing the audit trails is said to be the process that involved tracking data and verifying…

Q: Kenneth Halabi is a financial executive with Pharoah Enterprises. Although Kenneth has not had any…

A: IFRS 13 refers to the assessment of the fair value which represents the price that will be received…

Q: Use the following data to compute total factory overhead costs for the month: Sales commissions $…

A: Formula used: Total factory overhead costs=Indirect materials+Factory utilities+Indirect…

Q: 5. ZTW Co. purchased shoes from Nike amounting to P17,800 list price with trade discounts of 2% and…

A: INTRODUCTION: Debits and credits show where money is coming in and going out of a firm. To maintain…

Q: Catena's Marketing Company has the following adjusted trial balance at the end of the current year.…

A: In the above income Statement, interest Revenue is not incorporated. Therefore the correct net…

Q: Sheffield Co. sells $425,000 of 12% bonds on June 1, 2025. The bonds pay interest on December 1 and…

A: Bond amortization schedule refers to the schedule that states the amount of the interest expense,…

Q: Valuation Methods Prelim Drill 2 Earning Before Interest Tax and Depreciation 1. Kabebe Inc. earned…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

If Mr. Vavalu is a non-resident citizen, how availed optional standard deduction how much is his income tax due for the year 2023?

Step by step

Solved in 3 steps

- Prepare an income statement if your company’s gross sales isP300,000, with operating expenses of P100,000, and administrativecosts of P30,000. What is its gross income?Based on the following information what was Simmond’s profit for the year? During the year Simmond’s drawings were £6,000 and she introduced a further £2,000 capital 1 January 2021 31 December 2021 Assets £87,500 £106,200 Liabilities £65,300 £76,200 a) £7,800 b) £20,000c) £18,700 d) £11,800The accounts for this income year show the following:Income ($)Sales (excluding GST) 240,000Expenses ($)Cost of goods sold 130,000Interest on capital paid to Richard and Tracy 8,000Salary to Alice 25,000Superannuation to Alice 6,000Lease payments on car (excluding GST) 7,000Other deductible operating expenses (excluding GST) 14,000The leased car was used 80% of the time for business and 20% of the time for private purposes.Required:With reference to the facts above:A.Calculate the net income of the partnership.B.Show the allocation of net income to each of the three partners.C.You must refer to relevant legislation and/or case law in your answer.

- The sole proprietor had the following data for the year 2020. Sales P500,000; Beginning inventory, P50,000; Net purchases P200,000, Freight out P15,000: Ending inventory P25,000; Supplies inventory 10,000; Operating expenses P35,000. What is the gross profit?Adriana Co., with annual net sales of $5 million, maintains a markup of 25% based on cost. Adriana’s expenses average 15% of net sales. What is Adriana’s gross profit and net profit in dollars?Oreo reported the following for the period:Sales P1,000,000Cost of Sales P300,000Operating expenses P100,000Determine the OSD assuming that Oreo is a corporation

- Given the following information, prepare an income statement for Jonas Brothers Cough Drops. Note: Input all your answers as positive values. Selling and administrative expense $ 301,000 Depreciation expense 198,000 Sales 2,050,000 Interest expense 128,000 Cost of goods sold 521,000 Taxes 167,000Read the below information and answer the following questionsINFORMATIONExtract of the Statement of Comprehensive Income for the month ended 31 May 2022Sales 100 000Cost of sales 50 000Rent income 2 500Advertising 5 000Salaries and wages 15 000Rates and taxes 900Other operating expenses 20 000 Additional information1. Sales are expected to increase by 20% each month.2. Thirty percent (30%) of the sales is for cash and the balance is on credit. Collections from credit sales are asfollows:* 30% in the month of the sale, and these customers are entitled to a discount of 5%;* 65% in the month after the sale.The balance is usually written off as bad debts.3. Inventories are kept at a constant level. The business uses a fixed mark-up of 100% on cost. All purchases arefor cash.4. In terms of the lease agreement, the rental…Herbert Wong has extracted the following information from her income statement and balance sheet for 2021 and 2020: 2021 2020 Profit After Tax $656,810 $672,346 Cost of Sales $54,269 $53,251 Sales Revenue $259,368 $212,962 Inventory $35,505 $45,285 Accounts payable $120,483 $129,398 Accounts receivable (Debtors) $59,498 $79,380 Owner's Equity $1,523,999 $1,131,784 Based on the information provided, calculate the Days in Accounts Receivable for 2021, expressed in days to 2 decimal places.

- uarez Department Store has derived the following data from the store’s operations in the year ended December 31, 2019. Net Sales $10,000Net Income ? Current Liabilities 2,000Selling Expenses 1,000Long term liabilities 1,600Total Assets 6,800Stockholders’ equity ?Gross Profit ?Cost of Goods Sold 7,000Current Assets 4,000Income tax expense and other non-operating items 220Operating income ?General and administrative expenses 980Plant and equipment 2,600Other assets ?Using the given data, prepare for Juarez Department store a: Classified balance sheet at December 31, 2019. Classified income statement for the year ended December 31, 2019. Show supporting computations used in determining the missing amounts. How does Income tax expense differs from normal operating expenses such as advertising and salaries? How do you present income tax expense in a classified income statement? An income statement is a summary of revenues and expenses and gains and losses, ending with net income for a…The following are extracts from a statement of profit or loss and other comprehensive income for the year ended 31 December 2009: R’000 Sales revenue 10 000 Cost of sales (8 500) Distribution costs (300) Administrative expenses (200) Net interest paid (150) Taxation (500) Dividends (100) The gross profit is______. Select one: a. R1 500 000 b. R1 200 000 c. R10 000 000 d. R1 000 000evenue for the year amounted to R4 500 000 and represents net sales to third parties of goods purchased for resale. Rainbow Limited maintained a 40% gross profit percentage throughout the year. How much would be the cost of sales for Rainbow Limited? Select one: a. R7 500 000 b. R11 250 000 c. R2 700 000 d. R1 800 000