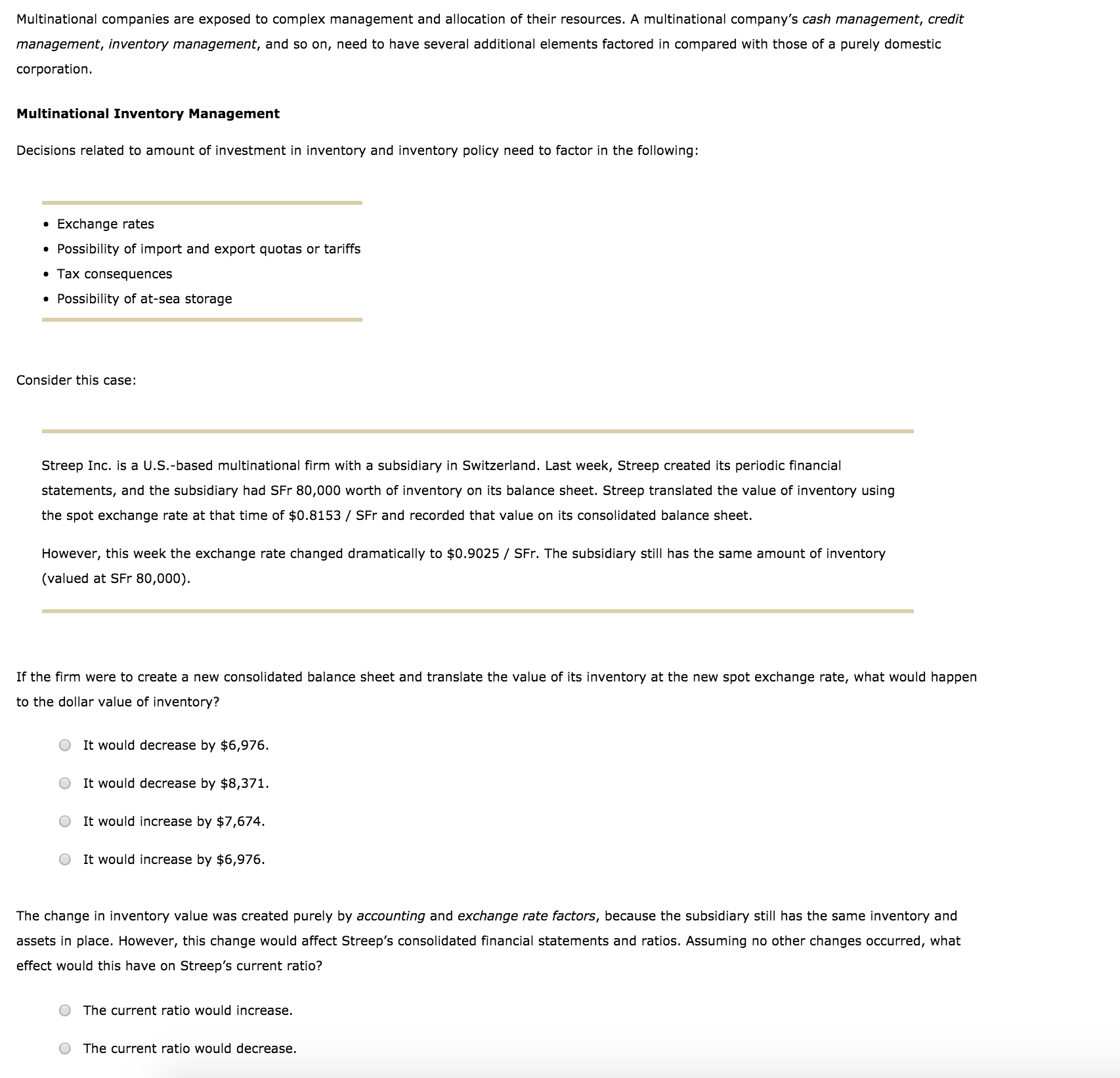

Multinational companies are exposed to complex management and allocation of their resources. A multinational company's cash management, credit management, inventory management, and so on, need to have several additional elements factored in compared with those of a purely domestic corporation. Multinational Inventory Management Decisions related to amount of investment in inventory and inventory policy need to factor in the following: * Exchange rates . Possibility of import and export quotas or tariffs Tax consequences Possibility of at-sea storage Consider this case: Streep Inc. is a U.S.-based multinational firm with a subsidiary in Switzerland. Last week, Streep created its periodic financial statements, and the subsidiary had SFr 80,000 worth of inventory on its balance sheet. Streep translated the value of inventory using the spot exchange rate at that time of $0.8153 / SFr and recorded that value on its consolidated balance sheet. However, this week the exchange rate changed dramatically to $0.9025 / SFr. The subsidiary still has the same amount of inventory (valued at SFr 80,000) If the firm were to create a new consolidated balance sheet and translate the value of its inventory at the new spot exchange rate, what would happen to the dollar value of inventory? O It would decrease by $6,976. O It would decrease by $8,371. It would increase by $7,674. It would increase by $6,976. The change in inventory value was created purely by accounting and exchange rate factors, because the subsidiary still has the same inventory and assets in place. However, this change would affect Streep's consolidated financial statements and ratios. Assuming no other changes occurred, what effect would this have on Streep's current ratio? O The current ratio would increase. O The current ratio would decrease.

Multinational companies are exposed to complex management and allocation of their resources. A multinational company's cash management, credit management, inventory management, and so on, need to have several additional elements factored in compared with those of a purely domestic corporation. Multinational Inventory Management Decisions related to amount of investment in inventory and inventory policy need to factor in the following: * Exchange rates . Possibility of import and export quotas or tariffs Tax consequences Possibility of at-sea storage Consider this case: Streep Inc. is a U.S.-based multinational firm with a subsidiary in Switzerland. Last week, Streep created its periodic financial statements, and the subsidiary had SFr 80,000 worth of inventory on its balance sheet. Streep translated the value of inventory using the spot exchange rate at that time of $0.8153 / SFr and recorded that value on its consolidated balance sheet. However, this week the exchange rate changed dramatically to $0.9025 / SFr. The subsidiary still has the same amount of inventory (valued at SFr 80,000) If the firm were to create a new consolidated balance sheet and translate the value of its inventory at the new spot exchange rate, what would happen to the dollar value of inventory? O It would decrease by $6,976. O It would decrease by $8,371. It would increase by $7,674. It would increase by $6,976. The change in inventory value was created purely by accounting and exchange rate factors, because the subsidiary still has the same inventory and assets in place. However, this change would affect Streep's consolidated financial statements and ratios. Assuming no other changes occurred, what effect would this have on Streep's current ratio? O The current ratio would increase. O The current ratio would decrease.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:Multinational companies are exposed to complex management and allocation of their resources. A multinational company's cash management, credit

management, inventory management, and so on, need to have several additional elements factored in compared with those of a purely domestic

corporation.

Multinational Inventory Management

Decisions related to amount of investment in inventory and inventory policy need to factor in the following:

* Exchange rates

. Possibility of import and export quotas or tariffs

Tax consequences

Possibility of at-sea storage

Consider this case:

Streep Inc. is a U.S.-based multinational firm with a subsidiary in Switzerland. Last week, Streep created its periodic financial

statements, and the subsidiary had SFr 80,000 worth of inventory on its balance sheet. Streep translated the value of inventory using

the spot exchange rate at that time of $0.8153 / SFr and recorded that value on its consolidated balance sheet.

However, this week the exchange rate changed dramatically to $0.9025 / SFr. The subsidiary still has the same amount of inventory

(valued at SFr 80,000)

If the firm were to create a new consolidated balance sheet and translate the value of its inventory at the new spot exchange rate, what would happen

to the dollar value of inventory?

O It would decrease by $6,976.

O It would decrease by $8,371.

It would increase by $7,674.

It would increase by $6,976.

The change in inventory value was created purely by accounting and exchange rate factors, because the subsidiary still has the same inventory and

assets in place. However, this change would affect Streep's consolidated financial statements and ratios. Assuming no other changes occurred, what

effect would this have on Streep's current ratio?

O The current ratio would increase.

O The current ratio would decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education