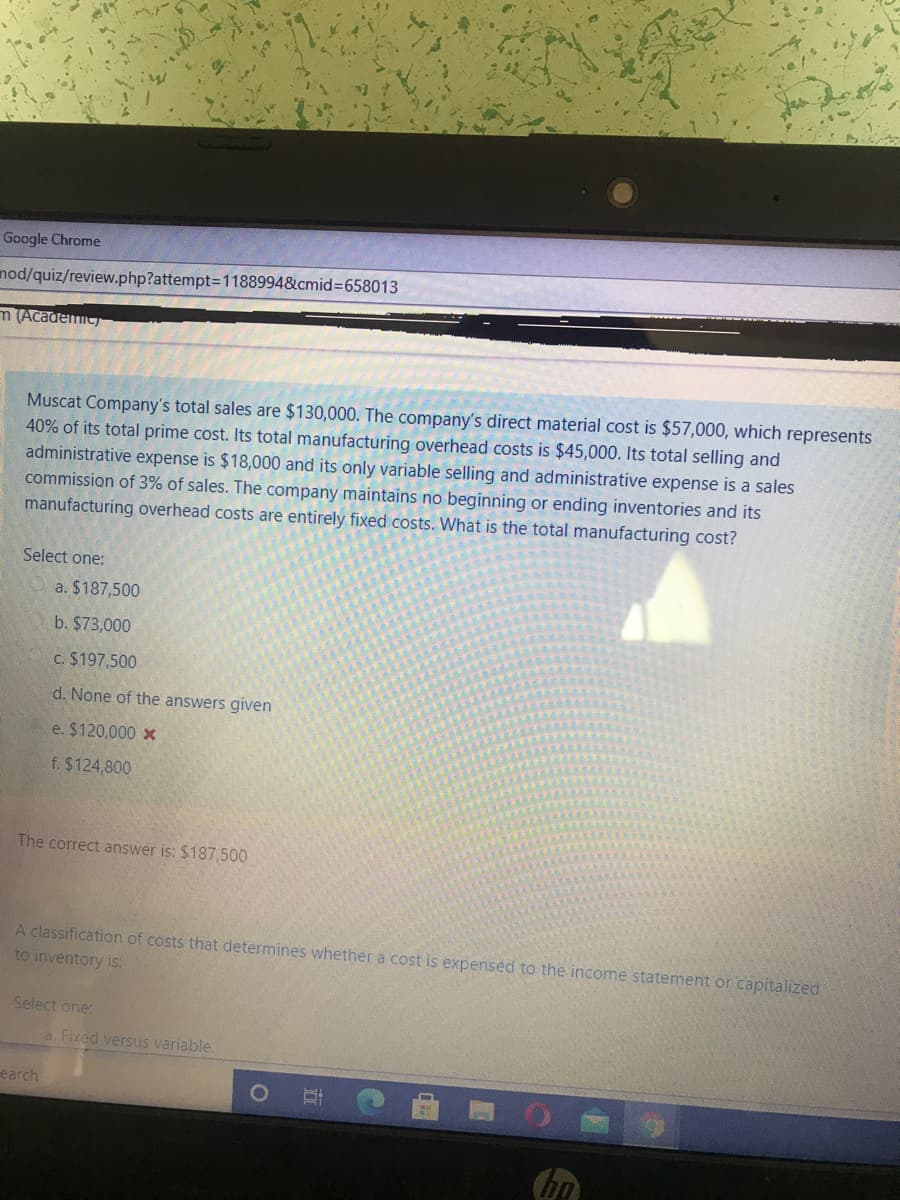

Muscat Company's total sales are $130,000. The company's direct material cost is $57,000, which represents 40% of its total prime cost. Its total manufacturing overhead costs is $45,000. Its total selling and administrative expense is $18,000 and its only variable selling and administrative expense is a sales commission of 3% of sales. The company maintains no beginning or ending inventories and its manufacturing overhead costs are entirely fixed costs. What is the total manufacturing cost? Select one: a. $187,500 b. $73,000 c. $197,500 d. None of the answers given e. $120,000 x f. $124,800

Q: Explain whether both managers are justified in their arguments. How can the Components Division…

A: Transfer price is the price for goods and services, at which these are transferred between different…

Q: Maxim Company incurred $40,000 of fixed cost and $30,000 of variable cost when 2,000 units of…

A: 1.When production = 2000 units Fixed cost = $40,000 Variable cost = $30,000 2. When production =…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 82,000…

A: Break-even point: A breakeven analysis is a calculation of the point at which revenue equals…

Q: Wu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product…

A: Total cost =fixed cost+ variable cost Total cost per unit= Total cost/ number of units

Q: Dake Corporation's relevant range of activity is 3,500 units to 8,500 units. When it produces and…

A: Formula: Total manufacturing overhead = Variable manufacturing overhead + Fixed manufacturing…

Q: If XYZ produced and sold 110,000 units, how much would be its total costs?

A: Variable costs per unit would remain same and total fixed costs would remain same. Calculate…

Q: olaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: Income statement: Under this Statement showing the company’s performance over a period of time by…

Q: army would pick up the Rets with its own trucks, there would be no variable selling expenses…

A: The question is related to a manufacturing company who produces a product Ret.Operating at capacity,…

Q: Mullennex Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces…

A: Fixed costs: Fixed costs are the costs incurred by a company irrespective of its level of…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: Contribution margin per unit=Selling price-Variable cost per unit

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 96,000…

A: we are authorized to do first three sub parts only please re post the other sub part 1) a)…

Q: Fiori Corporation's relevant range of activity is 4,000 units to 7,500 units. When it produces and…

A: Manufacturing costs means all costs that is incurred for the manufacture of products and services.

Q: Miller Company’s total sales are $198,000. The company’s direct labor cost is $23,760, which…

A: Since we are entitled to answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: Cost accounting is one of the important branch of accounting. Under this, various type of costs are…

Q: VXY Corporation has the following standard costs associated with the manufacture and sale of one of…

A: Variable costing is a type and method of costing in which all variable costs incurred in the…

Q: At 50,000 units of production, the Grayson Company expects costs to be as follows: Direct…

A: Total cost per unit is calculated from the costs incurred divided by the number of units produced.…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 84,000…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $190 per unit…

A: Since you have specifically asked for part 6 and 7 so we have answered the same for you.

Q: Boo Company has just completed the first month of producing a new product but has not yet shipped…

A: Break even point means a situation where the is neither profit nor loss. Sales revenue is sufficient…

Q: Bracey Company manufactures and sells one product. The following information pertains to the…

A: Step 1 Super variable cost is the cost which only taken into account totally variable cost which is…

Q: Kubin Company’s relevant range of production is 24,000 to 31,000 units. When it produces and sells…

A: Solution:-1 Calculation of the total amount of period costs incurred to sell 27,500 units as follows…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 84,000…

A: Cost accounting is the method of accounting which helps in calculating the cost of the product or…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: Particulars Amount Incremental Revenue[6000 x (51-16%)] 257040 Less: Direct Material cost(6000x…

Q: Sierra Company incurs the following costs to produce and sell its only product. Variable…

A: Variable costing and Absorption costing are two methods of calculating cost and profits of the…

Q: Ivanhoe Corp. had total variable costs of $180,900, total fixed costs of $77,550, and total revenues…

A: Break even point is usually calculated by the company in order to know how much sales volume is…

Q: Dake Corporation's relevant range of activity is 2,200 units to 5,000 units. When it produces and…

A: SOLUTION- Indirect manufacturing costs are production costs that cannot be directly associated with…

Q: The Riego company had a net operating income of P85,500 using variable costing and a net operating…

A: Total fixed manufacturing overhead P1,50,000 Production in units 100000 Fixed manufacturing…

Q: XYZ has the following cost components for 100,000 units of product for the year: Raw Materials…

A: Particulars P Raw Materials 200,000 Direct Labor 100,000 Prime Cost…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 83,000…

A: Variable costs and fixed costs are two types of cost in the business. Variable costs directly…

Q: Minnesota Company has no beginning and ending inventories, and has the following data about its only…

A: Any special order in the capacity of the business does not affect the fixed cost. So accepting…

Q: Pacific Company sells only one product for $12 per unit, variable production costs are $3 per unit,…

A: Selling price = $ 12 Variable costs = $ 3 Units = 11000 administrative costs = $ 1.70 Fixed cost = $…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A:

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 83,000…

A: Contribution margin per unit=$56-$(7.50+12.00+3.50+3.70 )=$29.30

Q: Perteet Corporation's relevant range of activity is 8,400 units to 16,000 units. When it produces…

A: SOLUTION- Manufacturing overhead is all indirect costs incurred during the production process. This…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 84,000…

A: Since you have posted a question with multiple sub-parts we will do the first three sub-parts for…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: Requirement 1: Compute the amount of total costs.

Q: Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $189 per unit…

A: A break-even point seems to be the moment where a given firm's total cost and total income are…

Q: Miller Company's total sales are $189,000. The company's direct labor cost is $22,680, which…

A: As posted multiple sub parts we are answering only first thee sub parts kindly repost the unanswered…

Q: Miller company's total sales are $120,000. The company's direct labor cost is $15,000, which…

A: Total conversion cost = Direct labor cost / 30% = $15,000 / 0.30 = $50,000

Q: Hixson Company manufactures and sells one product for $34 per unit. The company maintains no…

A:

Q: Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $186 per unit…

A: Operating income is an accounting concept that refers to the amount of profit generated by a…

Q: I have no idea how to answer the two questions involved in this problem: The following total cost…

A:

Q: Romeo manufacturing co has total sales at 120,000. Its direct labor cost is 15,000, which represents…

A: Prime Costs and Conversion Costs: Prime costs are characterized as the expenditure…

Q: Schonhardt Corporation's relevant range of activity is 2,900 units to 7,500 units. When it produces…

A: Fixed manufacturing overhead are those overhead which remain fixed ir-respective the level of…

Q: Dake Corporation's relevant range of activity is 2,600 units to 7,000 units. When it produces and…

A: The product costs are directly or indirectly related to the production process.

Q: Miller Company’s total sales are $120,000. The company’s direct labor cost is $15,000, which…

A: Req 1.Total conversion cost is sum of Direct labouor and manufacturing overheads.The computation is…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 84,000…

A: Selling Price $ 58.00 Less: Variable Expenses Direct Material $ 8.50 Direct Labor…

Q: Dake Corporation's relevant range of activity is 2,600 units to 7,000 units. When it produces and…

A: Fixed expense are the expenses which does not change with change in activity. Since given fixed cost…

Q: VXY Corporation has the following standard costs associated with the manufacture and sale of one of…

A: Volume variance is the change or difference between the actual quantity of goods sold or consumed…

Step by step

Solved in 2 steps

- INFORMATION The following information relates to the only product produced by Clermont Manufactures during August 2022. Openong inventory.....................................................................Nil Number of units manufactured...................................................5 000 Number of units sold...................................................................4 500 Selling price per unit....................................................................R300 Direct materials cost per unit.......................................................R60 Direct labour cost per unit............................................................R40 Fixed manufacturing overheads cost...........................................R90 000 Variable manufacturing overheads per unit..................................R30 Fixed selling cost..........................................................................R50 000 Fixed administrative…Biblio Files CompanyContribution Margin Income StatementFor the Year Ended December 31, 20Y8Sales $379,000 Variable costs: Manufacturing expense$151,600 Selling expense15,160 Administrative expense60,640(227,400) Contribution margin $151,600 Fixed costs: Manufacturing expense$76,750 Selling expense8,000 Administrative expense10,000(94,750)Operating income $56,850Do Not Copy from Bartleby. Solve the questions with the help of the data given below: Type of Data 2015 2016 Units of AIIPad produced and sold 800 900 Selling price $450 $430 Pounds of direct material used 3,200 3,300 Direct material cost per pound $35 $35 Manufacturing capacity in units 12,000 11,000 Total conversion costs $1,800,000 $1,650,000 Conversion cost per unit of capacity $150 $150 Selling and customer service capacity customers 90 customers Total selling and customer service costs $495,000 $495,000 Selling and customer service capacity cost and customer $500 $550 Assuming Titan had 70 customers in 2015 and 80 customers in 2016, 1. Calculate the operating income of Titan for 2015 and 2016; Particulars 2015 2016 Revenue; 800*450;900*430 360,000…

- KPR manufactures deals in various products. Relevant details of the products are as under: AWAXAYAZ Estimated annual demand (units)5000100070008000 Sales price per unit (Rs.)150180154175 Material consumption: Q (Rs)2729.524.529.75 Labor hours (Rs)5056.2543.7562.5 Variable overheads (based on labor cost) 70%80%10%90% Fixed overheads per unit (Rs.)10201416 Machine hours required: Processing machine hours 56810 The capacity utilization is as under:Hours Processing machine 150,000 RequiredCompute the number of units of each product that the company should produce in order tomaximize the profit. (B) KPR manufactures is considering a special order for 20 handcrafted gold bracelets to be given as gifts to members of a wedding party. The normal selling price of a gold bracelet is Rs 184 and its unit product cost is Rs140.00 as shown below: Direct materials . . . . . . . . . . . . . . . . . . . . Rs 81.00Direct labor . . . . . . . . . . . . . . . . . . . . . . . 42.00Manufacturing…Prime cost is 236000 OMR, and cost of production for the year is 355000 OMR Opening stock of work in progress is 4000, and closing stock of Work in progress is 5000 OMR, Opening stock of finished goods is 20000, and closing stock of finished goods is 13750 OMR, Cost of goods manufactured 358500 OMR Calculate cost of Goods Sold. Select one: a. 385500 OMR b. None of these c. 395500 OMR d. 357500 OMRHow do I figure out the pretax net nonoperating expense ? (in thousands) Dec. 29, 2016 Dec. 30, 2015 Revenues Circulation $ 880,543 $ 851,790 Advertising 580,732 638,709 Other 94,067 88,716 Total revenues 1,555,342 1,579,215 Production costs Wages and benefits 363,051 354,516 Raw materials 72,325 77,176 Other 192,728 186,120 Total production costs 628,104 617,812 Selling, general and administrative costs 721,083 713,837 Depreciation and amortization 61,723 61,597 Total operating costs 1,410,910 1,393,246 Restructuring charge 14,804 0 Multiemployer pension plan withdrawal expense 6,730 9,055 Pension settlement charges 21,294 40,329 Early termination charge 0 0 Operating profit 101,604 136,585 Loss from joint ventures (36,273) (783) Interest expense, net 34,805 39,050 Income from continuing operations…

- Do Not Copy from Bartleby. Otherwise I will give you dislike Solve the questions with the help of the data given below: Type of Data 2015 2016 Units of AIIPad produced and sold 800 900 Selling price $450 $430 Pounds of direct material used 3,200 3,300 Direct material cost per pound $35 $35 Manufacturing capacity in units 12,000 11,000 Total conversion costs $1,800,000 $1,650,000 Conversion cost per unit of capacity $150 $150 Selling and customer service capacity customers 90 customers Total selling and customer service costs $495,000 $495,000 Selling and customer service capacity cost and customer $500 $550 Assuming Titan had 70 customers in 2015 and 80 customers in 2016, 1. Calculate the operating income of Titan for 2015 and 2016; Particulars 2015 2016 Revenue; 800*450;900*430…Complete this question by entering your answers in the tabs below. Sims Company, a manufacturer of tablet computers, began operations on January 1, 2019. Its cost and sales information for this year follows. Manufacturing costs Direct materials $ 35 per unit Direct labor $ 55 per unit Overhead costs Variable $ 30 per unit Fixed $ 7,350,000 (per year) Selling and administrative costs for the year Variable $ 775,000 Fixed $ 4,500,000 Production and sales for the year Units produced 105,000 units Units sold 75,000 units Sales price per unit $ 360 per unit Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss)Biblio Files CompanyContribution Margin Income StatementFor the Year Ended December 31, 20Y8 Sales $379,000 Variable costs: Manufacturing expense $151,600 Selling expense 15,160 Administrative expense 60,640 (227,400) Contribution margin $151,600 Fixed costs: Manufacturing expense $76,750 Selling expense 8,000 Administrative expense 10,000 (94,750) Operating income $56,850 Sales Mix Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings. Type ofBookshelf Sales Priceper Unit Variable Costper Unit Basic $5.00 $1.75 Deluxe 9.00 8.10 The company is interested in determining how many of each type of bookshelf would have to be sold in order to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product called…

- Biblio Files CompanyContribution Margin Income StatementFor the Year Ended December 31, 20Y8 Sales $379,000 Variable costs: Manufacturing expense $151,600 Selling expense 15,160 Administrative expense 60,640 (227,400) Contribution margin $151,600 Fixed costs: Manufacturing expense $76,750 Selling expense 8,000 Administrative expense 10,000 (94,750) Operating income $56,850 Sales Mix Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings. Type ofBookshelf Sales Priceper Unit Variable Costper Unit Basic $5.00 $1.75 Deluxe 9.00 8.10 The company is interested in determining how many of each type of bookshelf would have to be sold in order to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product called…USW Ltd a manufacturing entity manufactures specialized robust cell phone cases for resale. The manufacturing cost per ton is R850. Finished products are sold for R935 per ton. Sales expenses amount to R45 per ton, delivery costs amount to R35 per ton and other directly associated costs to inventory to make a sale is R25 per ton. Closing inventories on hand at 31 December 2020 amounts to 3 500 tons. The amount that must be used to write down inventories to its net realisable value is? R70 000 R75 000 R80 000 R85 000Raw Material Consumed is 25000 OMR, Prime cost is 338000 OMR, Cost of Production is 471800 OMR, cost of goods manufactured 485000 OMR Opening stock of work in progress is 27500, and closing stock of Work in progress is 14000 OMR, Opening stock of finished goods is 20000, and closing stock of finished goods is 13750 OMR, Calculate cost of goods available for sale Select one: a. None of These b. 450000 OMR c. 505000 OMR d. 605000 OMR