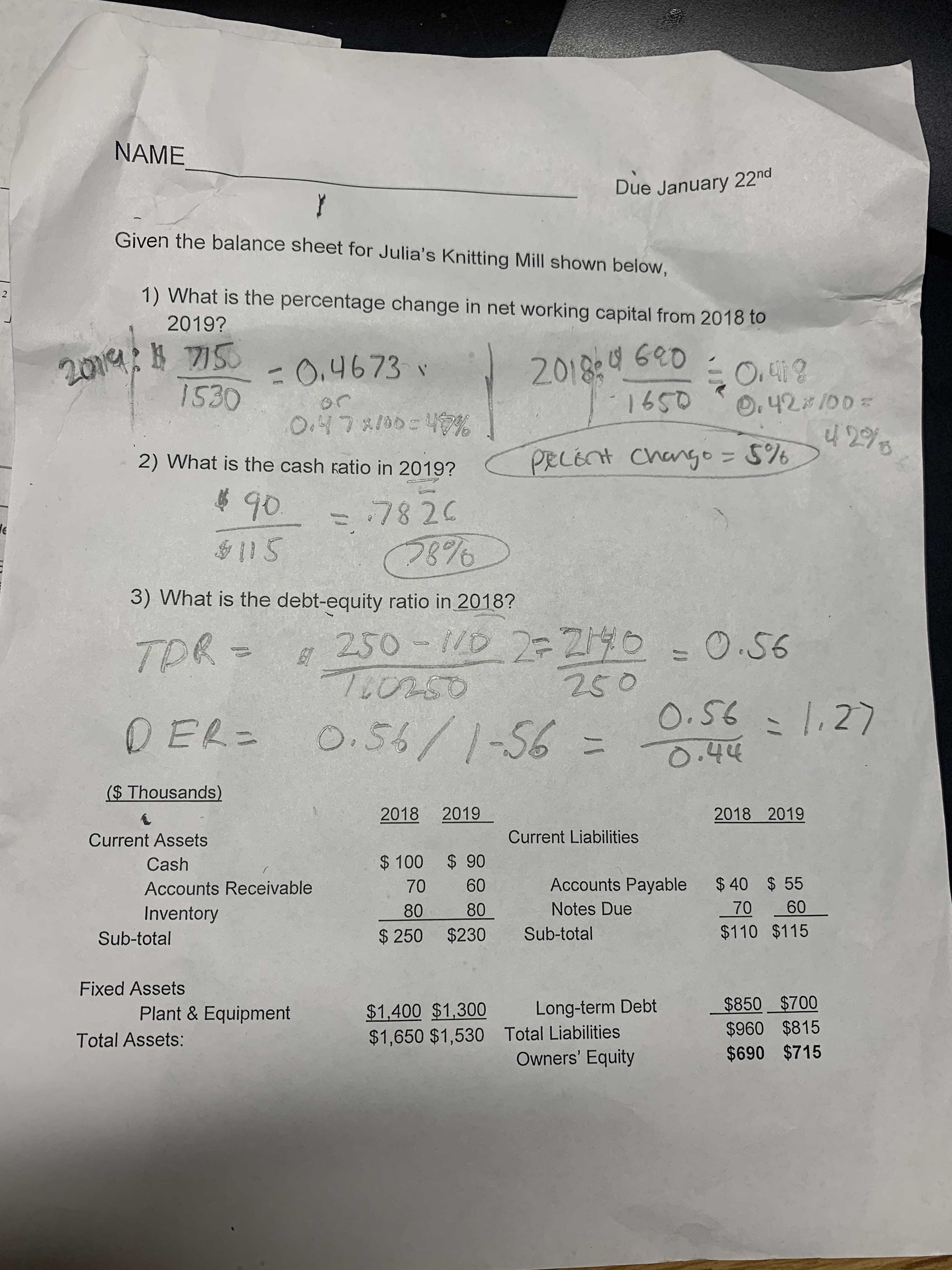

NAME Due January 22nd Given the balance sheet for Julia's Knitting Mill shown below, 1) What is the percentage change in net working capital from 2018 to 2019? 2018.4620 1650 -0.4673 1530 O.42 100= or 0.478/00=49% PRCENT Chango = 5% 2) What is the cash ratio in 2019? $90 7826 8%) 3) What is the debt-equity ratio in 2018? 2=2140 , 250-110 T:0250 DER= O.56/1-56 0.56 TPR= 250 O.56 ০. पप :1.27 ($ Thousands) 2018 2019 2019 2018 Current Liabilities Current Assets $ 90 $ 100 Cash $ 40 $ 55 70 60 $110 $115 Accounts Payable 60 70 Accounts Receivable Notes Due 80 80 Inventory Sub-total 250 $230 Sub-total Fixed Assets $850 $700 Long-term Debt $1,400 $1,300 $1,650 $1,530 Total Liabilities Plant & Equipment $960 $815 Total Assets: $690 $715 Owners' Equity

NAME Due January 22nd Given the balance sheet for Julia's Knitting Mill shown below, 1) What is the percentage change in net working capital from 2018 to 2019? 2018.4620 1650 -0.4673 1530 O.42 100= or 0.478/00=49% PRCENT Chango = 5% 2) What is the cash ratio in 2019? $90 7826 8%) 3) What is the debt-equity ratio in 2018? 2=2140 , 250-110 T:0250 DER= O.56/1-56 0.56 TPR= 250 O.56 ০. पप :1.27 ($ Thousands) 2018 2019 2019 2018 Current Liabilities Current Assets $ 90 $ 100 Cash $ 40 $ 55 70 60 $110 $115 Accounts Payable 60 70 Accounts Receivable Notes Due 80 80 Inventory Sub-total 250 $230 Sub-total Fixed Assets $850 $700 Long-term Debt $1,400 $1,300 $1,650 $1,530 Total Liabilities Plant & Equipment $960 $815 Total Assets: $690 $715 Owners' Equity

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

100%

I did this for hw I just wanted to see if my answers where correct and if not can show me what the right way to get the right answer? Thank you. This will help me study.

Transcribed Image Text:NAME

Due January 22nd

Given the balance sheet for Julia's Knitting Mill shown below,

1) What is the percentage change in net working capital from 2018 to

2019?

2018.4620

1650

-0.4673

1530

O.42 100=

or

0.478/00=49%

PRCENT Chango = 5%

2) What is the cash ratio in 2019?

$90

7826

8%)

3) What is the debt-equity ratio in 2018?

2=2140

,

250-110

T:0250

DER= O.56/1-56

0.56

TPR=

250

O.56

০. पप

:1.27

($ Thousands)

2018 2019

2019

2018

Current Liabilities

Current Assets

$ 90

$ 100

Cash

$ 40 $ 55

70 60

$110 $115

Accounts Payable

60

70

Accounts Receivable

Notes Due

80

80

Inventory

Sub-total

250 $230

Sub-total

Fixed Assets

$850 $700

Long-term Debt

$1,400 $1,300

$1,650 $1,530 Total Liabilities

Plant & Equipment

$960 $815

Total Assets:

$690 $715

Owners' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning