NAPOLEAN CORPORATION Statement of Stockholders' Equity For Year Ended December 31, 2016 Common Stock Retained arnings Total Balance, January 1, 2016 Add: Net Income for 2016 2,400 2,400 Add: Issuance of Common Stock 6,000 6,000 (900) 7,500 6,000 Less: Dividends paid (enter as a negative) (900) (900) Balance, December 31, 2016 5,100 $ 7,500

Q: Peakhurst Limited had the following trial balance at 1 January 2016:…

A: 1)

Q: The following is selected information related to Tamarisk, Inc. at December 31, 2022. Tamarisk, Inc.…

A: Stockholder's equity is one of section which is reported under liabilities & equity side of…

Q: The following data were taken from the balance sheet of Mossberg Co. Dec. 31,2014 Dec. 31,…

A: Solution:- Calculation of the following ratios of Mossberg Co as follows:-

Q: The accountant for Morris, Inc prepared the following list of account balances from the company's…

A: An individual can see the company's income and expenses on an income statement, which is a financial…

Q: The following trial balance has been extracted from the books of Paul Co. as at 31 December 2018 $ $…

A: IAS I- Presentation of Financial Statements This standard is based on International Financial…

Q: Mazaya Company began operations on December 1, 2011. Presented below is selected information related…

A:

Q: Coleman Motors, Inc., was formed on January 1,2018. The following transactions occurred during…

A: 1. Income statement:

Q: Insu Company had the following accounts and balances on June 30, 2018. Account Amount Cash S50,000…

A: The current ratio is used to measure how well a company is capable to pay off its short-term…

Q: Baker Company had the following balances in its accounting records as of December 31,2016: Assets…

A: Financial statements are prepared to assess the business activities during the reporting period and…

Q: Sage Hill Inc. had the following transactions involving current assets and current liabilities…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Below are the December 31, 2016, year-end accounts balances for Abled Appliance Repair Ltd This is…

A: Closing entry means where all nominal account i.e. revenue and expenses account will be transfer to…

Q: In alphabetical order below are balance sheet items for Vaughn Manufacturing at December 31, 2017.…

A: Balance sheet: This financial statement reports a company’s resources (assets) and claims of…

Q: The following items are taken from the financial statements of Starr Corporation for 2016:…

A: Financial Statements are prepared by the management for reporting purposes. These are the essential…

Q: The following selected accounts are taken from the Crandle Corporation's December 31, 2017 adjusted…

A: Income Statement: It is statement which shows income and expenditures and also shows the profit or…

Q: Presented below is selected information related to Nizwa Company at December 31, 2010.…

A: Retained Earnings - Retained earnings (RE) is the amount of net income left over for the business…

Q: At the end of 2013, Crandall Company reported the following amounts on its balance sheet:…

A: Question 1 Stock holder Equity in beginning= 132000 Equity= 95000…

Q: Use the following accounts and information to prepare, an Income Statement, a Retained Earnings…

A: Financial statements are the records that provides information about the company's performance…

Q: E2-8 These financial statement items are for Barfield Corporation at year-end, July 31, 2014.…

A: Income statement: income statement is one of the statement of the company which shows the revenues…

Q: The following items were taken from the accounting records of Talecom, Incorporated. The income…

A: firm. Net profit or loss is calculated by deducting the total expenses of the firm from the total…

Q: Mazaya Company began operations on December 1,2011. Presented below İS selected information telated…

A: Total of liabilities = Notes payable + Accounts payable = RO 12,000 + RO…

Q: The accounts and balances shown below were gathered from A Corporation's trial balance on December…

A: CURRENT ASSETS ARE THOSE ASSETS WHICH ARE EXPECTED TO BE CONVERTED INTO CASH WITHIN THE PERIOD OF…

Q: The following items were taken from the accounting records of Talecom, Incorporated. The income…

A: The most common liquidity ratios are Current ratio Quick Ratio The most common Solvency Ratios…

Q: The balances of Paradise Travel Service's accounting equation items for the year ended May 31, 20Y6,…

A: Introduction: The balance sheet records every transaction since the beginning of the business and…

Q: Prepare a classified balance sheet. Assume that $12,784 of the note payable will be paid in 2018.…

A: This numerical cover the concept Of Balance Sheet in Accounting Cycle

Q: The following information is available for Larkspur, Inc. for the year 2017. Administrative…

A: Income statement is the statement in which the revenues and outlays of a business entity are…

Q: Peakhurst Limited had the following trial balance at 1 January 2016: Debit $ Credit $ Cash 200 000…

A: Journal: It is the first step of recording financial transactions. It is used to prepare the…

Q: Peakhurst Limited had the following trial balance at 1 January 2016: Debit $ Credit $ Cash 200…

A: Journal entry is a record of financial transaction in the books of accounts maintained by an…

Q: Prepare the financial statements Entertainment Centre Ltd. reported the following data at March 31,…

A: Financial statement is prepared from the trial balance which include :- Profit and loss and…

Q: On December 31, 2016, Cantor Company reported Total Assets of $20,000 and Total equity of $15,000.…

A:

Q: Pizza, Inc. balance sheet statement for December 31. 2015 with the following information: Lound to…

A: Balance sheet is the statement which represents the current and non-current assets, current and…

Q: White Corporation began operations on January 1, 2018. The following information is available for…

A: White Corporation Income Statement (For the Year Ended December 31, 2018) Particulars…

Q: Flounder Company has been operating for several years, and on December 31, 2017, presented the…

A:

Q: Swifty Corporation compiled the following financial information as of December 31, 2017: Service…

A: Stockholders' equity: Stockholders' equity means the remaining net assets available to shareholders.…

Q: Please see below. All info is included. During 2017, Ivanhoe Company entered into the following…

A: The accounting equation states that assets equal to sum of liabilities and equity. It can be written…

Q: White Corporation began operations on January 1, 2018. The following information is available for…

A: Retained earnings is company's accumulated balance of net income or loss. To find out retained…

Q: Below are the December 31, 2015, year-end accounts balances for Mitch's Architects Ltd. This is the…

A: From the given accounts in the problem we will prepare income statement in below step.

Q: Hofnim, Inc. had the following account balances on September 30, 2016. What is Hofnim's net income…

A: The income statement shows the net income or net loss calculated by deducting the expenses from the…

Q: The following amounts were taken from the accounting records of Russell Services, Inc. as of Dec 31,…

A: Income statement reports profit or loss from operations for a particular period. revenue less…

Q: The following is a partial trial balance for the Green Star Corporation as of December 31, 2016:…

A: Requirement 1: Prepare a single step income statement of Green Star Corporation for the year ended…

Q: Jadara Company compiled the following financial information as of December 31, 2014: Revenues…

A: Liabilities includes all such amounts which has been taken by an individual or a company to purchase…

Q: The table below shows transactions from Mr. Situmbeko's busin for the year ended 31st December,…

A: Trading and Profit and Loss account will give us the Net profit Earned by the Business for a…

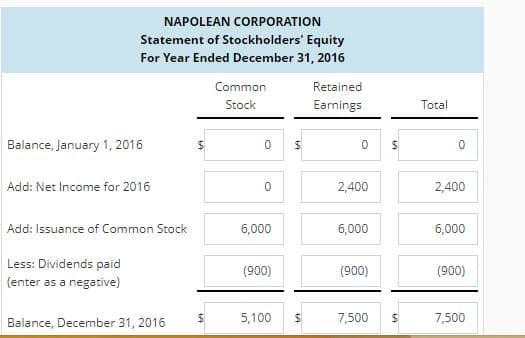

Napolean Corporation started business on January 1, 2016. The following information was compiled by Napolean’s accountant on December 31, 2016:

Sales Revenue $6,000 Equipment, net $4,500

Expenses 3,600 Building, net 12,000

Dividends 900 Accounts Payable 1,200

Cash 450 Notes Payable 9,900

Accounts Receivable 750 Common Stock 6,000

Inventory 900

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Earnings per share Financial statement data for the years ended December 31 for Black Bull Inc. follows: 2016 2015 Net income 2,485,700 1,538,000 Preferred dividends 50,000 50,000 Average number of common shares outstanding 115,000 shares 80,000 shares a. Determine the earnings per share for 2016 and 2015. b. Does the change in the earnings per share from 2015 to 2016 indicate a favorable or an unfavorable trend?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.