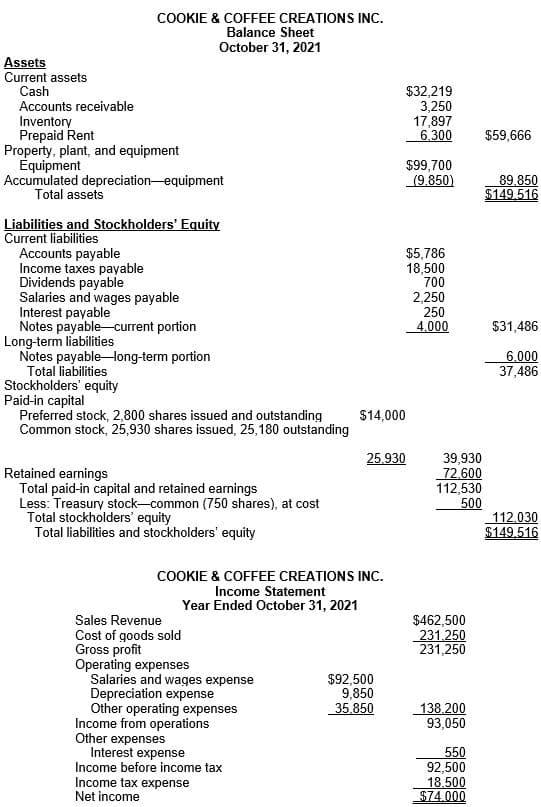

Natalie and Curtis have comparative balance sheets and income statements for Cookie & Coffee Creations, Inc. They have been told that they can use these financial statements to prepare horizontal and vertical analyses, to calculate financial ratios, to analyze how their business is doing, and to make some decisions they have been considering. Below, you are provided with the balance sheet and income statement of Cookie & Coffee Creations Inc. for its first year of operations; the year ended October 31, 2021. Review the calculations below, and then review the additional case information to calculate the ratios. (REFER TO ATTACHED IMAGE) Review the additional case information below. Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more equipment. The loan would be repaid over a 4-year period. The terms of the loan provide for equal semi-annual installment payments of $2,500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance. Dividends on preferred stock were $1,400. Since this is the first year of operations and the beginning balances are zero, use the ending balance as the average balance where appropriate. Complete the tasks listed below. Calculate the following ratios: current ratio, accounts receivable turnover, inventory turnover,

Natalie and Curtis have comparative balance sheets and income statements for Cookie & Coffee Creations, Inc. They have been told that they can use these financial statements to prepare horizontal and vertical analyses, to calculate financial ratios, to analyze how their business is doing, and to make some decisions they have been considering. Below, you are provided with the balance sheet and income statement of Cookie & Coffee Creations Inc. for its first year of operations; the year ended October 31, 2021. Review the calculations below, and then review the additional case information to calculate the ratios. (REFER TO ATTACHED IMAGE) Review the additional case information below. Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more equipment. The loan would be repaid over a 4-year period. The terms of the loan provide for equal semi-annual installment payments of $2,500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance. Dividends on preferred stock were $1,400. Since this is the first year of operations and the beginning balances are zero, use the ending balance as the average balance where appropriate. Complete the tasks listed below. Calculate the following ratios: current ratio, accounts receivable turnover, inventory turnover,

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

100%

Natalie and Curtis have comparative balance sheets and income statements for Cookie & Coffee Creations, Inc. They have been told that they can use these financial statements to prepare horizontal and vertical analyses, to calculate financial ratios, to analyze how their business is doing, and to make some decisions they have been considering. Below, you are provided with the balance sheet and income statement of Cookie & Coffee Creations Inc. for its first year of operations; the year ended October 31, 2021. Review the calculations below, and then review the additional case information to calculate the ratios.

(REFER TO ATTACHED IMAGE)

Review the additional case information below.

Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more equipment. The loan would be repaid over a 4-year period. The terms of the loan provide for equal semi-annual installment payments of $2,500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance. Dividends on preferred stock were $1,400. Since this is the first year of operations and the beginning balances are zero, use the ending balance as the average balance where appropriate.

Complete the tasks listed below.

- Calculate the following ratios:

current ratio ,- accounts receivable turnover,

- inventory turnover,

Transcribed Image Text:COOKIE & COFFEE CREATIONS INC.

Balance Sheet

October 31, 2021

Assets

Current assets

Cash

Accounts receivable

$32,219

3,250

17,897

6.300

Inventory

Prepaid Rent

Property, plant, and equipment

Équipment

Accumulated depreciation-equipment

Total assets

$59,666

$99,700

(9,850)

89,850

$149.516

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable

Income taxes payable

Dividends payable

Salaries and wages payable

Interest payable

Notes payable current portion

Long-term liabilities

Notes payable-long-term portion

Total liabilities

Stockholders' equity

Paid-in capital

Preferred stock, 2,800 shares issued and outstanding

Common stock, 25,930 shares issued, 25,180 outstanding

$5,786

18,500

700

2,250

250

4.000

$31,486

6.000

37,486

$14,000

25.930

Retained earnings

Total paid-in capital and retained earnings

Less: Treasury stock-common (750 shares), at cost

Total stockholders' equity

Total liabilities and stockholders' equity

39,930

72,600

112,530

500

112.030

$149.516

COOKIE & COFFEE CREATIONS INC.

Income Statement

Year Ended October 31, 2021

Sales Revenue

$462,500

231,250

231,250

Cost of goods sold

Gross profit

Operating expenses

Salaries and wages expense

Depreciation expense

Other operating expenses

Income from operations

Other expenses

Interest expense

Income before income tax

$92,500

9,850

35.850

138.200

93,050

550

Income tax expense

Net income

92,500

18.500

$74,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning