nd Aguhob are partners in a CPA Review School. They share profü atio of 2:1. On July 1, 2016 they admitted Figueroa's son Doblas as a Figueroa guaranteed that Doblas' profit share would not be less than P25- he six months to Dec. 31, 2016. The profit sharing arrangements after admission is as follows: Figueroa 50%, Aguhob 30% and Doblas 20%. The he year ended Dec.31, 2016 was P240,000 accruing evenly over the year hould Figueroa's total profit share be for the year ended Dec. 31, 2016? . P140,000

nd Aguhob are partners in a CPA Review School. They share profü atio of 2:1. On July 1, 2016 they admitted Figueroa's son Doblas as a Figueroa guaranteed that Doblas' profit share would not be less than P25- he six months to Dec. 31, 2016. The profit sharing arrangements after admission is as follows: Figueroa 50%, Aguhob 30% and Doblas 20%. The he year ended Dec.31, 2016 was P240,000 accruing evenly over the year hould Figueroa's total profit share be for the year ended Dec. 31, 2016? . P140,000

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 39P

Related questions

Question

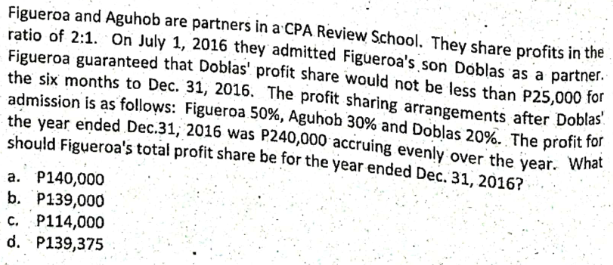

Transcribed Image Text:Figueroa and Aguhob are partners in a CPA Review School. They share profits in the

ratio of 2:1. On July 1, 2016 they admitted Figueroa's son Doblas as a partner.

Figueroa guaranteed that Doblas' profit share would not be less than P25,000 for

the six months to Dec. 31, 2016. The profit sharing arrangements after Doblas

admission is as follows: Figueroa 50%, Aguhob 30% and Doblas 20%. The profit for

the year ended Dec.31, 2016 was P240,000 accruing evenly over the year. What

should Figueroa's total profit share be for the year ended Dec. 31, 2016?

a. P140,000

b. P139,000

c. P114,000

d. P139,375

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT