ne city of Oakmont is interested in developing some lake front property into a sports park (picnic facilties, boat docks, swimming area, etc.). A consultant has estimated that the city would need to invest $3 million in this project. In retum, the developed property would return $500,000 per year to the city through increased x revenues and recreational benefits to the public. What would the life of this project need to be in order to be cost-beneficial to the city? The interest rate on municipal bonds is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i4% per year. ne life of the project needs to b t least voars in order to be cost.beneficial the nearest whole number)

ne city of Oakmont is interested in developing some lake front property into a sports park (picnic facilties, boat docks, swimming area, etc.). A consultant has estimated that the city would need to invest $3 million in this project. In retum, the developed property would return $500,000 per year to the city through increased x revenues and recreational benefits to the public. What would the life of this project need to be in order to be cost-beneficial to the city? The interest rate on municipal bonds is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i4% per year. ne life of the project needs to b t least voars in order to be cost.beneficial the nearest whole number)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 9E

Related questions

Question

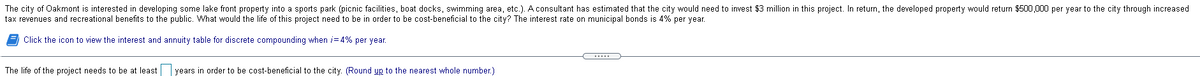

Transcribed Image Text:The city of Oakmont is interested in developing some lake front property into a sports park (picnic facilities, boat docks, swimming area, etc.). A consultant has estimated that the city would need to invest $3 million in this project. In return, the developed property would return $500,000 per year to the city through increased

tax revenues and recreational benefits to the public. What would the life of this project need to be in order to be cost-beneficial to the city? The interest rate on municipal bonds is 4% per year.

E Click the icon to view the interest and annuity table for discrete compounding when i= 4% per year.

The life of the project needs to be at least

years in order to be cost-beneficial to the city. (Round up to the nearest whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning