Net sales, net income, and total assets for Alexander Construction, Inc., for a four-year period follow E (Cick the icon to view the data.) Read the reguirements .... Requirement 1. Compute trend percentages for each item for 2015 through 2018. Use 2015 as the base year. (Round to the nearest whole percent, X%.) - X Data table Alexander Construction, Inc. - Trend Percentages 2018 2015 2017 % 2016 2018 2017 2016 2015 Net sales. Net sales. S 385,000 S 362,000 $ 323,000 $ 333,000 Net income Total assets. Net income 118.000 92.000 71,000 77.000 Ending total assets 276,000 258.000 234,000 194,000 Requirement 2. Compute the return on assets for 2016, 2017, and 2018. Round your answers to three decimal places. Select the return on assets formula and then enter the amounts to calculate the returm on assets for each year. (Round the return on asset amounts to the nearest tenth of a percent, XX%.) Return on assets Print Done 2016 %3D 2017 2018 Requirement 3. Alexander Construction's main competitor had a return on assets of just under 40 percent for the years 2016, 2017, and 2018. How does Alexander Construction, Inc's return on assets compare with that of its main competitor? Based on the returm on assets, Alexander Construction's, Inc. " its main competitor in 2018 but [ | them in both 2017 and 2016.

Net sales, net income, and total assets for Alexander Construction, Inc., for a four-year period follow E (Cick the icon to view the data.) Read the reguirements .... Requirement 1. Compute trend percentages for each item for 2015 through 2018. Use 2015 as the base year. (Round to the nearest whole percent, X%.) - X Data table Alexander Construction, Inc. - Trend Percentages 2018 2015 2017 % 2016 2018 2017 2016 2015 Net sales. Net sales. S 385,000 S 362,000 $ 323,000 $ 333,000 Net income Total assets. Net income 118.000 92.000 71,000 77.000 Ending total assets 276,000 258.000 234,000 194,000 Requirement 2. Compute the return on assets for 2016, 2017, and 2018. Round your answers to three decimal places. Select the return on assets formula and then enter the amounts to calculate the returm on assets for each year. (Round the return on asset amounts to the nearest tenth of a percent, XX%.) Return on assets Print Done 2016 %3D 2017 2018 Requirement 3. Alexander Construction's main competitor had a return on assets of just under 40 percent for the years 2016, 2017, and 2018. How does Alexander Construction, Inc's return on assets compare with that of its main competitor? Based on the returm on assets, Alexander Construction's, Inc. " its main competitor in 2018 but [ | them in both 2017 and 2016.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 51E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Concept explainers

Question

Please do this!

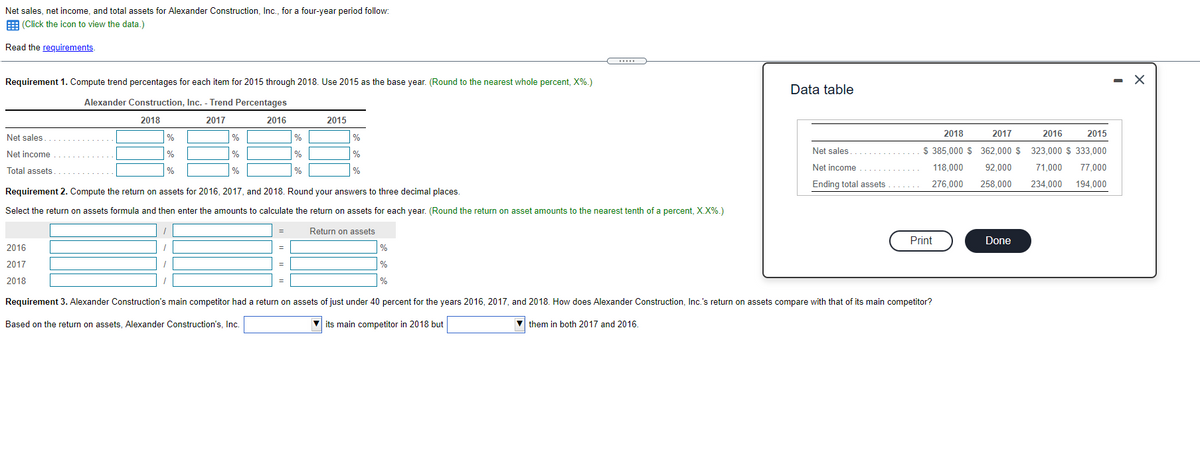

Transcribed Image Text:Net sales, net income, and total assets for Alexander Construction, Inc., for a four-year period follow:

E (Click the icon to view the data.)

Read the requirements.

Requirement 1. Compute trend percentages for each item for 2015 through 2018. Use 2015 as the base year. (Round to the nearest whole percent, X%.)

Data table

Alexander Construction, Inc. - Trend Percentages

2018

2017

2016

2015

%

2018

2017

2016

2015

Net sales.

%

%

Net income

Net sales

$ 385,000 $ 362,000 $ 323,000 $ 333,000

%

%

%

Total assets

%

%

Net income

118,000

92,000

71,000

77,000

Ending total assets.......

276,000

258,000

234,000 194,000

Requirement 2. Compute the return on assets for 2016, 2017, and 2018. Round your answers to three decimal places.

Select the return on assets formula and then enter the amounts to calculate the return on assets for each year. (Round the return on asset amounts to the nearest tenth of a percent, X.X%.)

Return on assets

Print

Done

2016

%

2017

%

2018

Requirement 3. Alexander Construction's main competitor had a return on assets of just under 40 percent for the years 2016, 2017, and 2018. How does Alexander Construction, Inc.'s return on assets compare with that of its main competitor?

Based on the return on assets, Alexander Construction's, Inc.

V its main competitor in 2018 but

them in both 2017 and 2016.

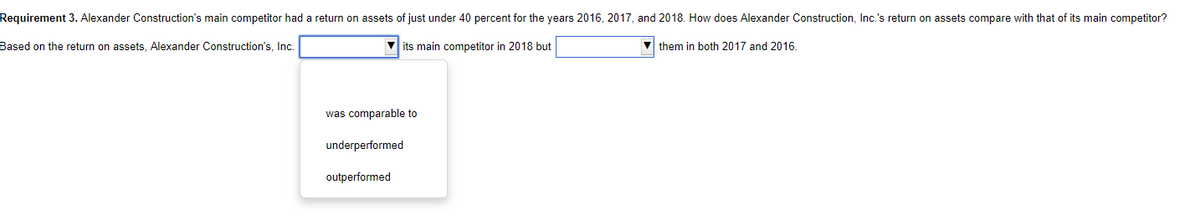

Transcribed Image Text:Requirement 3. Alexander Construction's main competitor had a return on assets of just under 40 percent for the years 2016, 2017, and 2018. How does Alexander Construction, Inc.'s return on assets compare with that of its main competitor?

Based on the return on assets. Alexander Construction's, Inc.

its main competitor in 2018 but

v them in both 2017 and 2016.

was comparable to

underperformed

outperformed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub