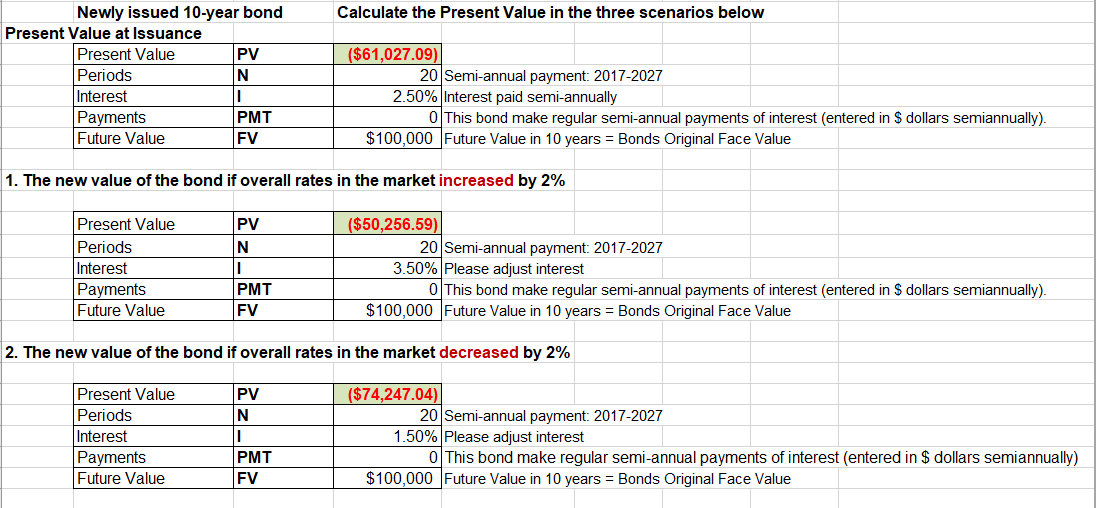

Newly issued 10-year bond Calculate the Present Value in the three scenarios below Present Value at Issuance Present Value ($61,027.09) PV 20 Semi-annual payment: 2017-2027 2.50% Interest paid semi-annually 0 This bond make regular semi-annual payments of interest (entered in $ dollars semiannually) Periods N Interest Payments Future Value PMT FV $100,000 Future Value in 10 years Bonds Original Face Value 1. The new value of the bond if overall rates in the market increased by 2% Present Value Periods PV ($50,256.59) 20 Semi-annual payment: 2017-2027 3.50% Please adjust interest 0 This bond make regular semi-annual payments of interest (entered in $ dollars semiannually). I Interest Payments Future Value PMT $100,000 Future Value in 10 years Bonds Original Face Value FV 2. The new value of the bond if overall rates in the market decreased by 2% Present Value Periods Interest Payments Future Value PV ($74,247.04) 20 Semi-annual payment: 2017-2027 1.50% Please adjust interest 0 This bond make regular semi-annual payments of interest (entered in $ dollars semiannually) PMT FV $100,000 Future Value in 10 years Bonds Original Face Value

Cost of Capital

Shareholders and investors who invest into the capital of the firm desire to have a suitable return on their investment funding. The cost of capital reflects what shareholders expect. It is a discount rate for converting expected cash flow into present cash flow.

Capital Structure

Capital structure is the combination of debt and equity employed by an organization in order to take care of its operations. It is an important concept in corporate finance and is expressed in the form of a debt-equity ratio.

Weighted Average Cost of Capital

The Weighted Average Cost of Capital is a tool used for calculating the cost of capital for a firm wherein proportional weightage is assigned to each category of capital. It can also be defined as the average amount that a firm needs to pay its stakeholders and for its security to finance the assets. The most commonly used sources of capital include common stocks, bonds, long-term debts, etc. The increase in weighted average cost of capital is an indicator of a decrease in the valuation of a firm and an increase in its risk.

To what extent does the company’s bond issuance policies support or hinder their strategies? For example, if the company is attempting to fund operating expenses, refinance old debt, or change its capital structure, are they issuing sufficient bonds to achieve these goals? Be sure to substantiate claims.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps