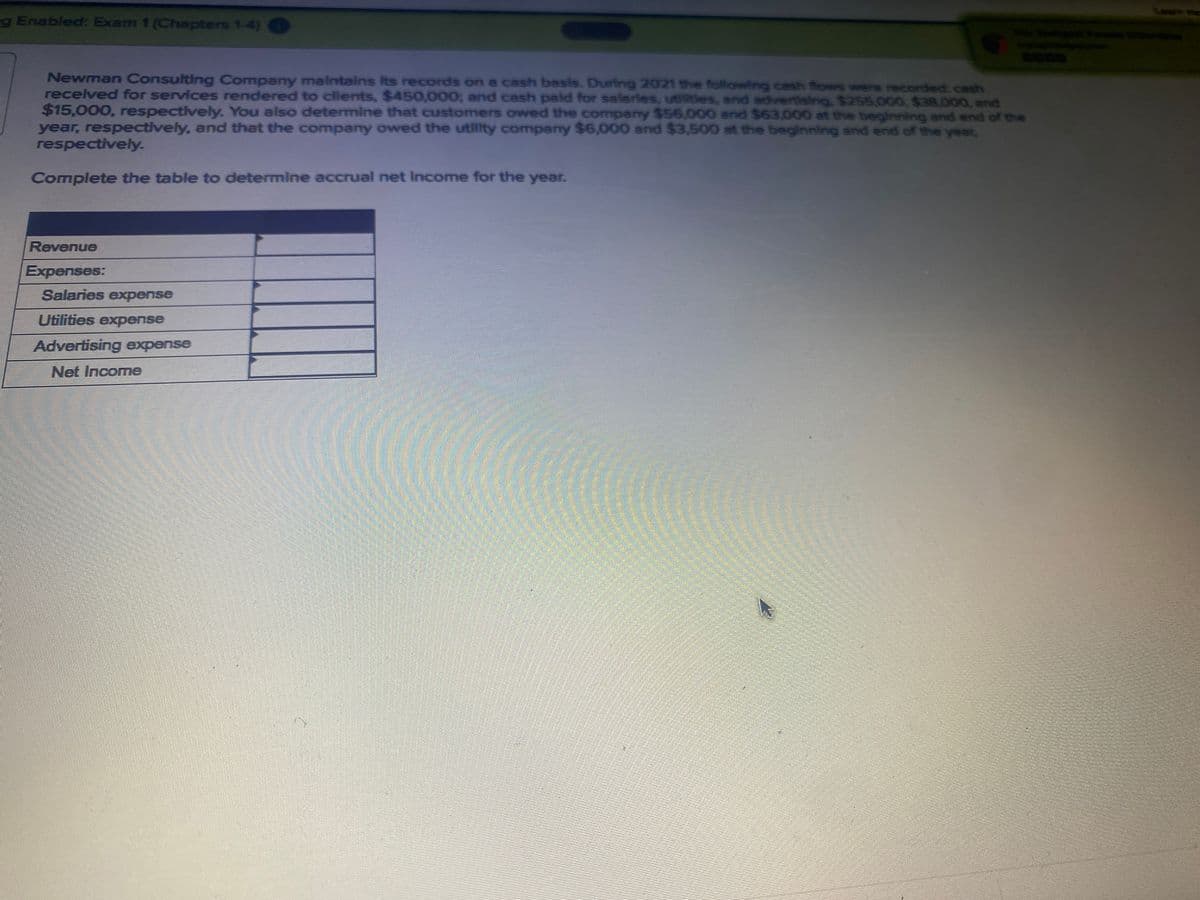

Newman Consulting Company maintains Its records on a cash besis. During 2021 the following cash fows were recorded cash recelved for services rendered to clients, $450,000; and cash pald for salerles, utes, and advertising. $255,000, $38.000, and $15,000, respectively. You also determine that customers owed the company $56,000 and $63,000 et the beginning and end of the year, respectively, and that the company owed the utility compeny $6,000 and $3,500 at the beginning and end of the year, respectively. Complete the table to determine accrual net Income for the year. Revenue Expenses: Salaries expense Utilities expense Advertising expense Net Income

Newman Consulting Company maintains Its records on a cash besis. During 2021 the following cash fows were recorded cash recelved for services rendered to clients, $450,000; and cash pald for salerles, utes, and advertising. $255,000, $38.000, and $15,000, respectively. You also determine that customers owed the company $56,000 and $63,000 et the beginning and end of the year, respectively, and that the company owed the utility compeny $6,000 and $3,500 at the beginning and end of the year, respectively. Complete the table to determine accrual net Income for the year. Revenue Expenses: Salaries expense Utilities expense Advertising expense Net Income

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 2SEQ: On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services...

Related questions

Topic Video

Question

Transcribed Image Text:g Enabled: Exam 1 (Chapters 1-4)

Newman Consulting Company malntalns Its records on a cash besls. During 2021 the following cash flowes were recorded: cash

recelved for services rendered to clients, $450,000; and cash pald for salarles, utilities, and advertising $255,000, $38,000, and

$15,000, respectively. You also determine that customers owed the company $56,000 and $63,000 at the beginning and end of the

year, respectively, and that the company owed the utillty company $6,000 and $3,500 at the beglinning and end of the year,

respectively.

Complete the table to determine accrual net Income for the year.

Revenue

Expenses:

Salaries expense

Utilities expense

Advertising expense

Net Income

Expert Solution

Working:

Revenue Earned = Cash received + Ending Accounts receivable - Beginning Accounts receivable

= $450,000 + $63,000 - $56,000

= $457,000

Utilities expenses = Cash paid for utilities + Ending amount payable for utilities - Beginning amount payable for utilities

= $38,000 + $3,500 - $6,000

= $35,500

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning