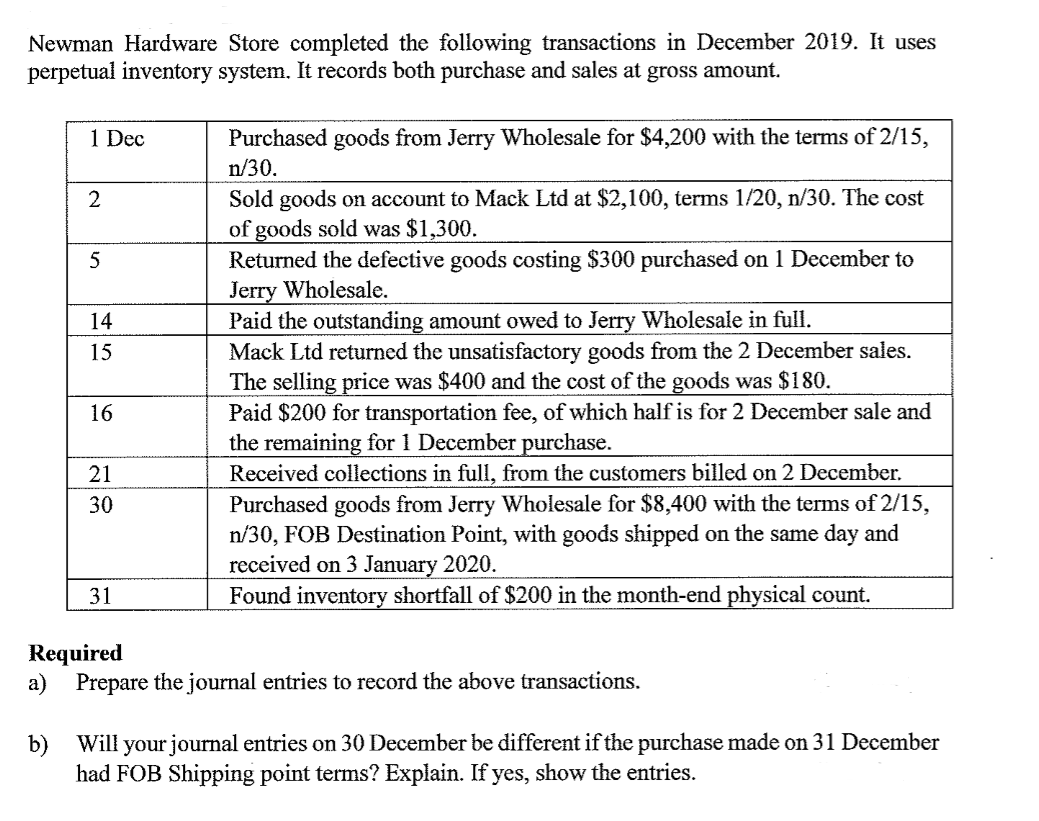

Newman Hardware Store completed the following transactions in December 2019. It uses perpetual inventory system. It records both purchase and sales at gross amount. Purchased goods from Jerry Wholesale for $4,200 with the terms of 2/15, 1 Dec n/30. Sold goods on account to Mack Ltd at $2,100, terms 1/20, n/30. The cost of goods sold was $1,300. Returned the defective goods costing $300 purchased on 1 December to Jerry Wholesale. Paid the outstanding amount owed to Jerry Wholesale in full. Mack Ltd returned the unsatisfactory goods from the 2 December sales. The selling price was $400 and the cost of the goods was $180. Paid $200 for transportation fee, of which half is for 2 December sale and the remaining for 1 December purchase. Received collections in full, from the customers billed on 2 December. 14 15 16 21 Purchased goods from Jerry Wholesale for $8,400 with the terms of 2/15, n/30, FOB Destination Point, with goods shipped on the same day and received on 3 January 2020. Found inventory shortfall of $200 in the month-end physical count. 30 31 Required a) Prepare the journal entries to record the above transactions. Will your journal entries on 30 December be different if the purchase made on 31 December b) had FOB Shipping point terms? Explain. If yes, show the entries.

Newman Hardware Store completed the following transactions in December 2019. It uses perpetual inventory system. It records both purchase and sales at gross amount. Purchased goods from Jerry Wholesale for $4,200 with the terms of 2/15, 1 Dec n/30. Sold goods on account to Mack Ltd at $2,100, terms 1/20, n/30. The cost of goods sold was $1,300. Returned the defective goods costing $300 purchased on 1 December to Jerry Wholesale. Paid the outstanding amount owed to Jerry Wholesale in full. Mack Ltd returned the unsatisfactory goods from the 2 December sales. The selling price was $400 and the cost of the goods was $180. Paid $200 for transportation fee, of which half is for 2 December sale and the remaining for 1 December purchase. Received collections in full, from the customers billed on 2 December. 14 15 16 21 Purchased goods from Jerry Wholesale for $8,400 with the terms of 2/15, n/30, FOB Destination Point, with goods shipped on the same day and received on 3 January 2020. Found inventory shortfall of $200 in the month-end physical count. 30 31 Required a) Prepare the journal entries to record the above transactions. Will your journal entries on 30 December be different if the purchase made on 31 December b) had FOB Shipping point terms? Explain. If yes, show the entries.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PA: On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as...

Related questions

Question

Transcribed Image Text:Newman Hardware Store completed the following transactions in December 2019. It uses

perpetual inventory system. It records both purchase and sales at gross amount.

Purchased goods from Jerry Wholesale for $4,200 with the terms of 2/15,

1 Dec

n/30.

Sold goods on account to Mack Ltd at $2,100, terms 1/20, n/30. The cost

of goods sold was $1,300.

Returned the defective goods costing $300 purchased on 1 December to

Jerry Wholesale.

Paid the outstanding amount owed to Jerry Wholesale in full.

Mack Ltd returned the unsatisfactory goods from the 2 December sales.

The selling price was $400 and the cost of the goods was $180.

Paid $200 for transportation fee, of which half is for 2 December sale and

the remaining for 1 December purchase.

Received collections in full, from the customers billed on 2 December.

14

15

16

21

Purchased goods from Jerry Wholesale for $8,400 with the terms of 2/15,

n/30, FOB Destination Point, with goods shipped on the same day and

received on 3 January 2020.

Found inventory shortfall of $200 in the month-end physical count.

30

31

Required

a) Prepare the journal entries to record the above transactions.

Will your journal entries on 30 December be different if the purchase made on 31 December

b)

had FOB Shipping point terms? Explain. If yes, show the entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,