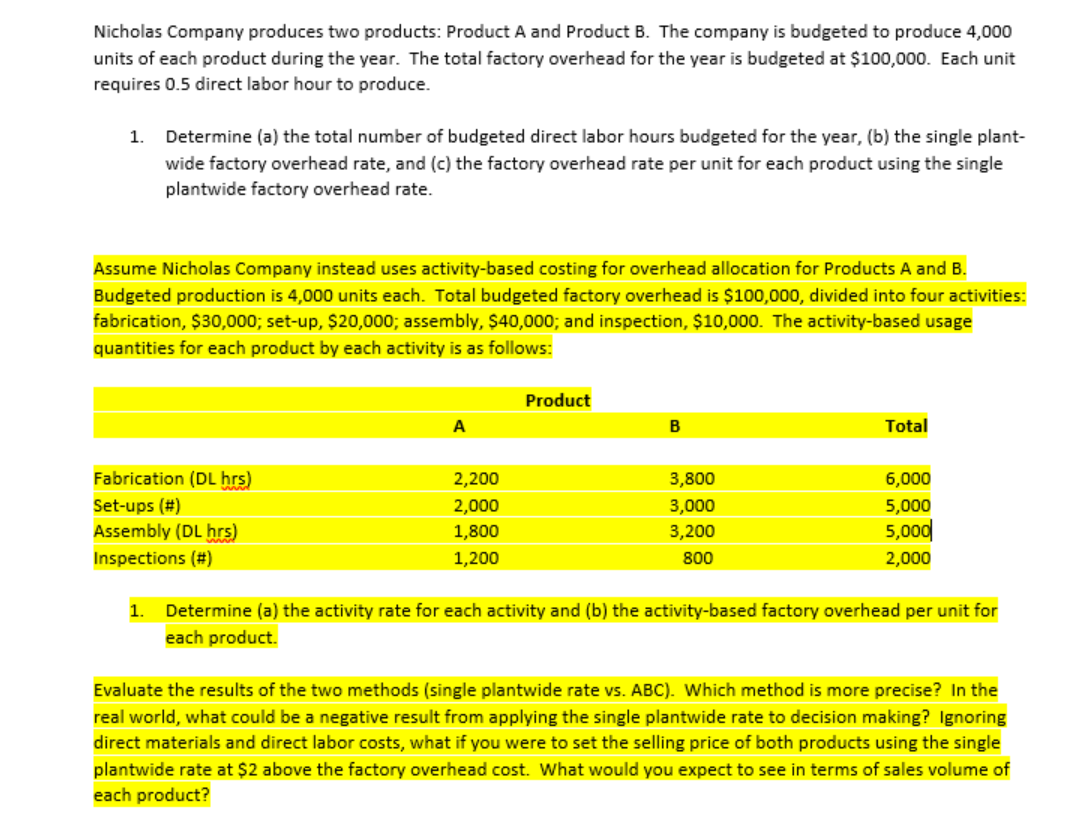

Nicholas Company produces two products: Product A and Product B. The company is budgeted to produce 4,000 units of each product during the year. The total factory overhead for the year is budgeted at $100,000. Each unit requires 0.5 direct labor hour to produce. 1. Determine (a) the total number of budgeted direct labor hours budgeted for the year, (b) the single plant- wide factory overhead rate, and (c) the factory overhead rate per unit for each product using the single plantwide factory overhead rate. Assume Nicholas Company instead uses activity-based costing for overhead allocation for Products A and B. Budgeted production is 4,000 units each. Total budgeted factory overhead is $100,000, divided into four activities: fabrication, $30,000; set-up, $20,000; assembly, $40,000; and inspection, $10,000. The activity-based usage quantities for each product by each activity is as follows: Product Total Fabrication (DL hrs) 2,200 3,800 6,000 Set-ups (#) 2,000 3,000 5,000 Assembly (DL hrs) 1,800 3,200 5,000 Inspections (#) 1,200 800 2,000 1. Determine (a) the activity rate for each activity and (b) the activity-based factory overhead per unit for each product. Evaluate the results of the two methods (single plantwide rate vs. ABC). Which method is more precise? In the real world, what could be a negative result from applying the single plantwide rate to decision making? Ignoring direct materials and direct labor costs, what if you were to set the selling price of both products using the single plantwide rate at $2 above the factory overhead cost. What would you expect to see in terms of sales volume of each product?

Nicholas Company produces two products: Product A and Product B. The company is budgeted to produce 4,000 units of each product during the year. The total factory overhead for the year is budgeted at $100,000. Each unit requires 0.5 direct labor hour to produce. 1. Determine (a) the total number of budgeted direct labor hours budgeted for the year, (b) the single plant- wide factory overhead rate, and (c) the factory overhead rate per unit for each product using the single plantwide factory overhead rate. Assume Nicholas Company instead uses activity-based costing for overhead allocation for Products A and B. Budgeted production is 4,000 units each. Total budgeted factory overhead is $100,000, divided into four activities: fabrication, $30,000; set-up, $20,000; assembly, $40,000; and inspection, $10,000. The activity-based usage quantities for each product by each activity is as follows: Product Total Fabrication (DL hrs) 2,200 3,800 6,000 Set-ups (#) 2,000 3,000 5,000 Assembly (DL hrs) 1,800 3,200 5,000 Inspections (#) 1,200 800 2,000 1. Determine (a) the activity rate for each activity and (b) the activity-based factory overhead per unit for each product. Evaluate the results of the two methods (single plantwide rate vs. ABC). Which method is more precise? In the real world, what could be a negative result from applying the single plantwide rate to decision making? Ignoring direct materials and direct labor costs, what if you were to set the selling price of both products using the single plantwide rate at $2 above the factory overhead cost. What would you expect to see in terms of sales volume of each product?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 16E: Thomas Textiles Corporation began November with a budget for 60,000 hours of production in the...

Related questions

Question

Please answer highlighted portion. Thank you.

Transcribed Image Text:Nicholas Company produces two products: Product A and Product B. The company is budgeted to produce 4,000

units of each product during the year. The total factory overhead for the year is budgeted at $100,000. Each unit

requires 0.5 direct labor hour to produce.

1. Determine (a) the total number of budgeted direct labor hours budgeted for the year, (b) the single plant-

wide factory overhead rate, and (c) the factory overhead rate per unit for each product using the single

plantwide factory overhead rate.

Assume Nicholas Company instead uses activity-based costing for overhead allocation for Products A and B.

Budgeted production is 4,000 units each. Total budgeted factory overhead is $100,000, divided into four activities:

fabrication, $30,000; set-up, $20,000; assembly, $40,000; and inspection, $10,000. The activity-based usage

quantities for each product by each activity is as follows:

Product

Total

Fabrication (DL hrs)

2,200

3,800

6,000

Set-ups (#)

2,000

3,000

5,000

Assembly (DL hrs)

1,800

3,200

5,000

Inspections (#)

1,200

800

2,000

1. Determine (a) the activity rate for each activity and (b) the activity-based factory overhead per unit for

each product.

Evaluate the results of the two methods (single plantwide rate vs. ABC). Which method is more precise? In the

real world, what could be a negative result from applying the single plantwide rate to decision making? Ignoring

direct materials and direct labor costs, what if you were to set the selling price of both products using the single

plantwide rate at $2 above the factory overhead cost. What would you expect to see in terms of sales volume of

each product?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College