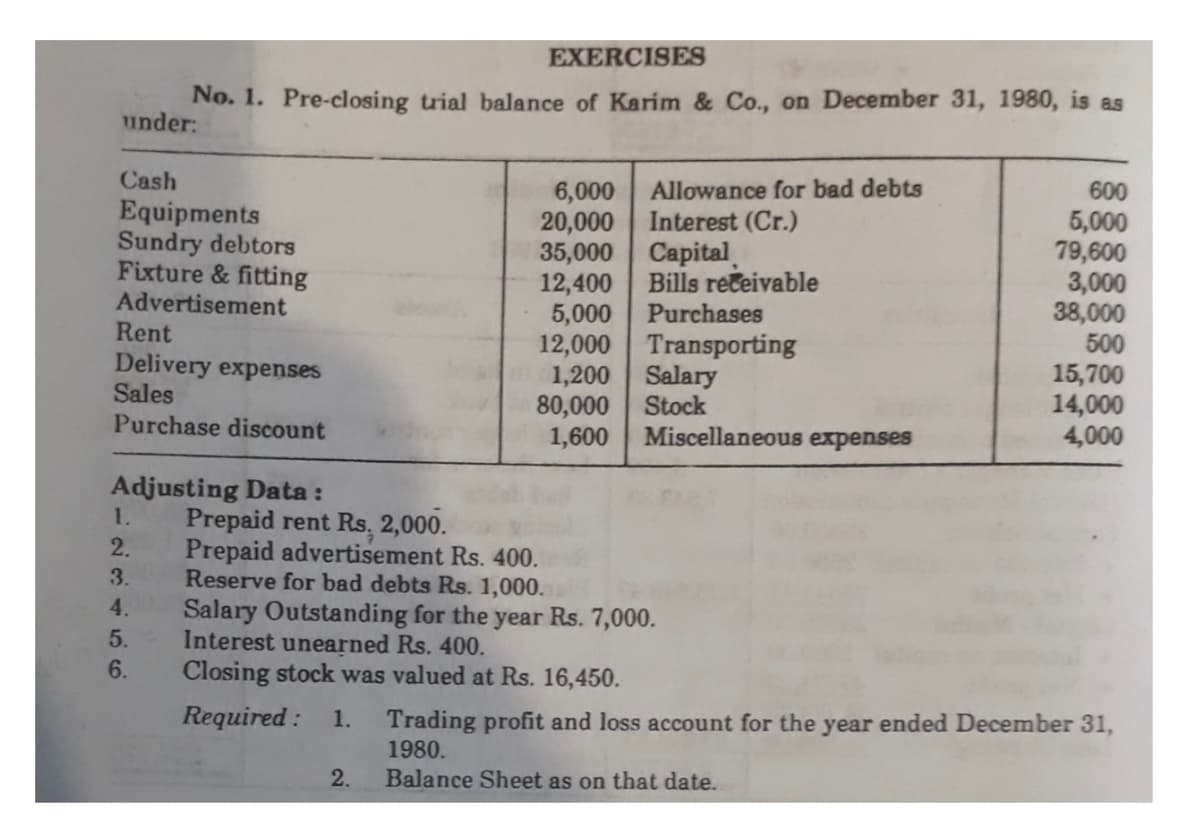

No. 1. Pre-closing trial balance of Karim & Co., on December 31, 1980, is as under: Cash Allowance for bad debts Interest (Cr.) 600 6,000 20,000 35,000 Capital 12,400 5,000 12,000 1,200 80,000 1,600 Equipments Sundry debtors Fixture & fitting Advertisement 5,000 79,600 3,000 38,000 Bills reteivable Purchases Rent Transporting Salary Stock Miscellaneous expenses 500 Delivery expenses Sales Purchase discount 15,700 14,000 4,000 Adjusting Data: Prepaid rent Rs, 2,000. Prepaid advertisement Rs. 400. Reserve for bad debts Rs. 1,000. 1. 2. 3. 4. Salary Outstanding for the year Rs. 7,000. Interest unearned Rs. 400. Closing stock was valued at Rs. 16,450. Required : 1. Trading profit and loss account for the year ended December 31, 1980. 2. Balance Sheet as on that date. 56

No. 1. Pre-closing trial balance of Karim & Co., on December 31, 1980, is as under: Cash Allowance for bad debts Interest (Cr.) 600 6,000 20,000 35,000 Capital 12,400 5,000 12,000 1,200 80,000 1,600 Equipments Sundry debtors Fixture & fitting Advertisement 5,000 79,600 3,000 38,000 Bills reteivable Purchases Rent Transporting Salary Stock Miscellaneous expenses 500 Delivery expenses Sales Purchase discount 15,700 14,000 4,000 Adjusting Data: Prepaid rent Rs, 2,000. Prepaid advertisement Rs. 400. Reserve for bad debts Rs. 1,000. 1. 2. 3. 4. Salary Outstanding for the year Rs. 7,000. Interest unearned Rs. 400. Closing stock was valued at Rs. 16,450. Required : 1. Trading profit and loss account for the year ended December 31, 1980. 2. Balance Sheet as on that date. 56

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 4MC: Marmol Corporation uses the allowance method for bad debts. During 2019, Marmol charged 50,000 to...

Related questions

Question

Transcribed Image Text:EXERCISES

No. 1. Pre-closing trial balance of Karim & Co., on December 31, 1980, is as

under:

Cash

Allowance for bad debts

Interest (Cr.)

600

6,000

20,000

35,000 Capital.

12,400

5,000 Purchases

12,000 Transporting

1,200 Salary

Stock

Equipments

Sundry debtors

Fixture & fitting

5,000

79,600

3,000

38,000

500

Bills receivable

Advertisement

Rent

Delivery expenses

Sales

Purchase discount

80,000

1,600

15,700

14,000

4,000

Miscellaneous expenses

Adjusting Data :

Prepaid rent Rs, 2,000.

1.

2.

Prepaid advertisement Rs. 400.

3.

Reserve for bad debts Rs. 1,000.

4.

Salary Outstanding for the year Rs. 7,000.

Interest unearned Rs. 400.

Closing stock was valued at Rs. 16,450.

5.

6.

Required :

1.

Trading profit and loss account for the year ended December 31,

1980.

Balance Sheet as on that date.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning