NorSal Trondheim operates a salmon processing facility where fish are purchased from local sources along the North Sea, processed at the facility, and sold to customers for distribution. The plant manager, Inger Hansen, is contemplating a plant modernization to upgrade the technology in the plant. While the plant performs well enough now, modernizing equipment would allow the plant to increase capacity per hour, which is particularly advantageous because the factory has enough demand to cover the additional capacity. Currently, the plant operates seven days a week, three shifts of 20 workers per shift. The workers are paid SiS per hour. The firm is contemplating a plant modermization to upgrade existing equipment, which should increase the plant's output while lowering energy costs. Using the current equipment, around 1.500 pounds of salmon can be processed each hour, while the new plant would be able to processed each hour, while the new plant would be able to process 2.000 pounds per hour. The updated equipment is made by the same manufacturer as the existing equipment, and the new equipment quickly. For this reason, costs to train personnel are assumed to be negligible. The production manager, Bjorn Pedersen, is skeptical about undergoing the plant modernization. The older equipment, he argues, is already paid for, and new equipment would cost $15.000 per week. This cost is comprised of both principal and interest, and includes manufacturer installation of the equipment. The controller, Maret Karlsen, cautions that all decisions related to costs should be included in the analysis and that because the energy consumption would be different, this must also be accounted for in the decision. Energy costs are presently S12 per unit, and the existing plant uses 1.500 units of energy per week. With the modernized plant, the consumption of energy would fail by 50%. 1. What is the productivity of the processing facility, with the equipment currently in use? 2. What would the productivity of the plant become if the new system were purchased and implemented? 3. What would be the amount of additional expense on equipment that would make productivity of the two systems equal? 4. What might happen if energy costs increase in the future?

NorSal Trondheim operates a salmon processing facility where fish are purchased from local sources along the North Sea, processed at the facility, and sold to customers for distribution. The plant manager, Inger Hansen, is contemplating a plant modernization to upgrade the technology in the plant. While the plant performs well enough now, modernizing equipment would allow the plant to increase capacity per hour, which is particularly advantageous because the factory has enough demand to cover the additional capacity. Currently, the plant operates seven days a week, three shifts of 20 workers per shift. The workers are paid SiS per hour. The firm is contemplating a plant modermization to upgrade existing equipment, which should increase the plant's output while lowering energy costs. Using the current equipment, around 1.500 pounds of salmon can be processed each hour, while the new plant would be able to processed each hour, while the new plant would be able to process 2.000 pounds per hour. The updated equipment is made by the same manufacturer as the existing equipment, and the new equipment quickly. For this reason, costs to train personnel are assumed to be negligible. The production manager, Bjorn Pedersen, is skeptical about undergoing the plant modernization. The older equipment, he argues, is already paid for, and new equipment would cost $15.000 per week. This cost is comprised of both principal and interest, and includes manufacturer installation of the equipment. The controller, Maret Karlsen, cautions that all decisions related to costs should be included in the analysis and that because the energy consumption would be different, this must also be accounted for in the decision. Energy costs are presently S12 per unit, and the existing plant uses 1.500 units of energy per week. With the modernized plant, the consumption of energy would fail by 50%. 1. What is the productivity of the processing facility, with the equipment currently in use? 2. What would the productivity of the plant become if the new system were purchased and implemented? 3. What would be the amount of additional expense on equipment that would make productivity of the two systems equal? 4. What might happen if energy costs increase in the future?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Can i get a solution of this question please?

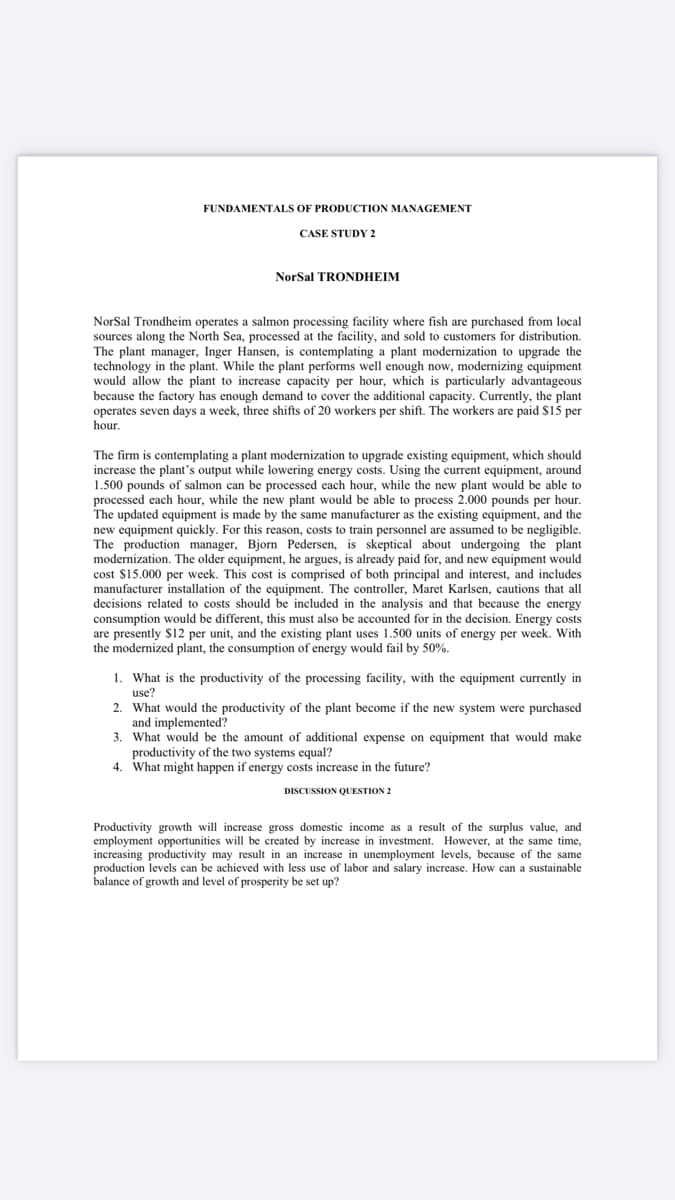

Transcribed Image Text:FUNDAMENTALS OF PRODUCTION MANAGEMENT

CASE STUDY 2

NorSal TRONDHEIM

NorSal Trondheim operates a salmon processing facility where fish are purchased from local

sources along the North Sea, processed at the facility, and sold to customers for distribution.

The plant manager, Inger Hansen, is contemplating a plant modernization to upgrade the

technology in the plant. While the plant performs well enough now, modernizing equipment

would allow the plant to increase capacity per hour, which is particularly advantageous

because the factory has enough demand to cover the additional capacity. Currently, the plant

operates seven days a week, three shifts of 20 workers per shift. The workers are paid $15 per

hour.

The firm is contemplating a plant modernization to upgrade existing equipment, which should

increase the plant's output while lowering energy costs. Using the current equipment, around

1.500 pounds of salmon can be processed each hour, while the new plant would be able to

processed each hour, while the new plant would be able to process 2.000 pounds per hour.

The updated equipment is made by the same manufacturer as the existing equipment, and the

new equipment quickly. For this reason, costs to train personnel are assumed to be negligible.

The production manager, Bjorn Pedersen, is skeptical about undergoing the plant

modernization. The older equipment, he argues, is already paid for, and new equipment would

cost $15.000 per week. This cost is comprised of both principal and interest, and includes

manufacturer installation of the equipment. The controller, Maret Karlsen, cautions that all

decisions related to costs should be included in the analysis and that because the energy

consumption would be different, this must also be accounted for in the decision. Energy costs

are presently $12 per unit, and the existing plant uses 1.500 units of energy per week. With

the modernized plant, the consumption of energy would fail by 50%.

1. What is the productivity of the processing facility, with the equipment currently in

use?

2. What would the productivity of the plant become if the new system were purchased

and implemented?

3. What would be the amount of additional expense on equipment that would make

productivity of the two systems equal?

What might happen if energy costs increase in the future?

DISCUSSION QUESTION 2

Productivity growth will increase gross domestic income as a result of the surplus value, and

employment opportunities will be created by increase in investment. However, at the same time,

increasing productivity may result in an increase in unemployment levels, because of the same

production levels can be achieved with less use of labor and salary increase. How can a sustainable

balance of growth and level of prosperity be set up?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.