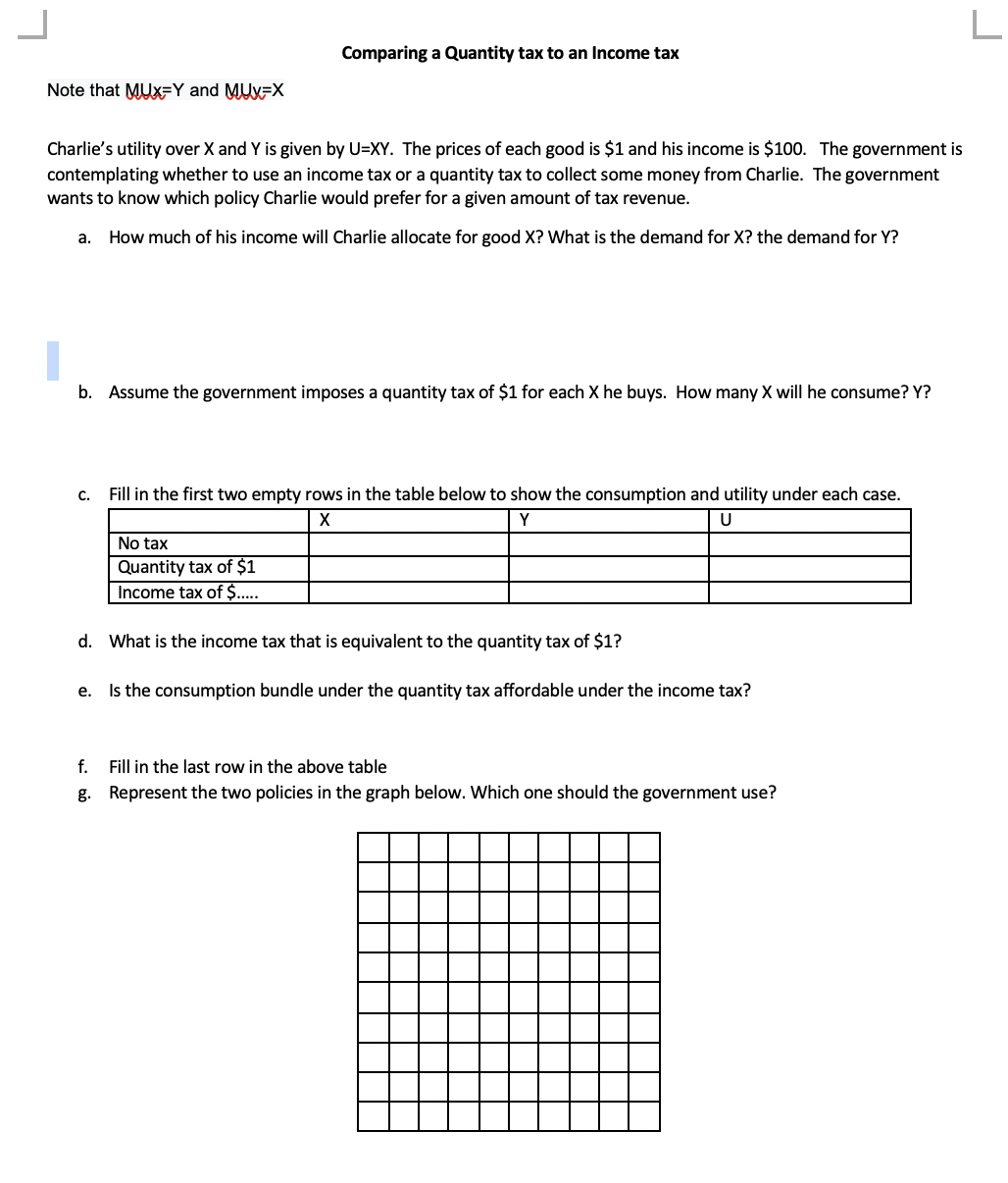

Note that MUX-Y and MUX-X Comparing a Quantity tax to an Income tax Charlie's utility over X and Y is given by U=XY. The prices of each good is $1 and his income is $100. The government is contemplating whether to use an income tax or a quantity tax to collect some money from Charlie. The government wants to know which policy Charlie would prefer for a given amount of tax revenue. a. How much of his income will Charlie allocate for good X? What is the demand for X? the demand for Y?

Note that MUX-Y and MUX-X Comparing a Quantity tax to an Income tax Charlie's utility over X and Y is given by U=XY. The prices of each good is $1 and his income is $100. The government is contemplating whether to use an income tax or a quantity tax to collect some money from Charlie. The government wants to know which policy Charlie would prefer for a given amount of tax revenue. a. How much of his income will Charlie allocate for good X? What is the demand for X? the demand for Y?

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter17: Taxation And Resource Allocation

Section: Chapter Questions

Problem 2DQ

Related questions

Question

a,b,c,d

Transcribed Image Text:Note that MUX-Y and MUX-X

Charlie's utility over X and Y is given by U=XY. The prices of each good is $1 and his income is $100. The government is

contemplating whether to use an income tax or a quantity tax to collect some money from Charlie. The government

wants to know which policy Charlie would prefer for a given amount of tax revenue.

a. How much of his income will Charlie allocate for good X? What is the demand for X? the demand for Y?

Comparing a Quantity tax to an Income tax

b. Assume the government imposes a quantity tax of $1 for each X he buys. How many X will he consume? Y?

C.

Fill in the first two empty rows in the table below to show the consumption and utility under each case.

X

Y

U

No tax

Quantity tax of $1

Income tax of $.....

d. What is the income tax that is equivalent to the quantity tax of $1?

e.

Is the consumption bundle under the quantity tax affordable under the income tax?

f. Fill in the last row in the above table

g. Represent the two policies in the graph below. Which one should the government use?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning