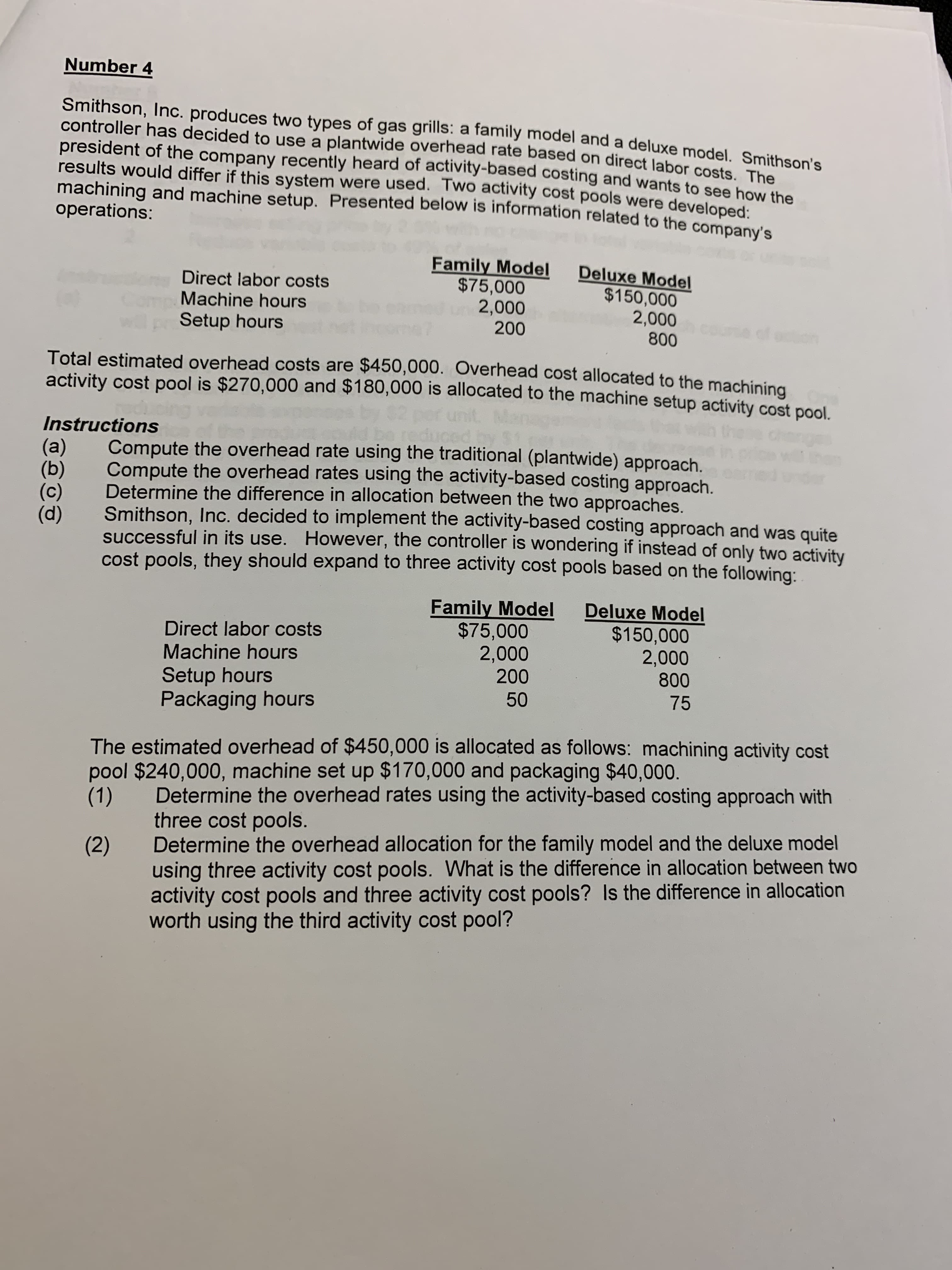

Number 4 Smithson, Inc. produces two types of gas grills: a family model and a deluxe model. Smithson's controller has decided to use a plantwide overhead rate based on direct labor costs The president of the company recently heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations: Family Model $75,000 2,000 200 Deluxe Model $150,000 2,000 800 Direct labor costs Machine hours Setup hours cton Total estimated overhead costs are $450,000. Overhead cost allocated to the machining activity cost pool is $270,000 and $180,000 is allocated to the machine setup activity cost pool Instructions Compute the overhead rate using the traditional (plantwide) approach. Compute the overhead rates using the activity-based costing approach. Determine the difference in allocation between the two approaches. Smithson, Inc. decided to implement the activity-based costing approach and was quite successful in its use. However, the controller is wondering if instead of only two activity cost pools, they should expand to three activity cost pools based on the following: (a) (b) (c) Deluxe Model $150,000 2,000 800 Family Model $75,000 2,000 200 Direct labor costs Machine hours Setup hours Packaging hours 75 50 The estimated overhead of $450,000 is allocated as follows: machining activity cost pool $240,000, machine set up $170,000 and packaging $40,000. (1) Determine the overhead rates using the activity-based costing approach with three cost pools. Determine the overhead allocation for the family model and the deluxe model using three activity cost pools. What is the difference in allocation between two activity cost pools and three activity cost pools? Is the difference in allocation worth using the third activity cost pool? (2)

Number 4 Smithson, Inc. produces two types of gas grills: a family model and a deluxe model. Smithson's controller has decided to use a plantwide overhead rate based on direct labor costs The president of the company recently heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations: Family Model $75,000 2,000 200 Deluxe Model $150,000 2,000 800 Direct labor costs Machine hours Setup hours cton Total estimated overhead costs are $450,000. Overhead cost allocated to the machining activity cost pool is $270,000 and $180,000 is allocated to the machine setup activity cost pool Instructions Compute the overhead rate using the traditional (plantwide) approach. Compute the overhead rates using the activity-based costing approach. Determine the difference in allocation between the two approaches. Smithson, Inc. decided to implement the activity-based costing approach and was quite successful in its use. However, the controller is wondering if instead of only two activity cost pools, they should expand to three activity cost pools based on the following: (a) (b) (c) Deluxe Model $150,000 2,000 800 Family Model $75,000 2,000 200 Direct labor costs Machine hours Setup hours Packaging hours 75 50 The estimated overhead of $450,000 is allocated as follows: machining activity cost pool $240,000, machine set up $170,000 and packaging $40,000. (1) Determine the overhead rates using the activity-based costing approach with three cost pools. Determine the overhead allocation for the family model and the deluxe model using three activity cost pools. What is the difference in allocation between two activity cost pools and three activity cost pools? Is the difference in allocation worth using the third activity cost pool? (2)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 7E: The management of Nova Industries Inc. manufactures gasoline and diesel engines through two...

Related questions

Question

Transcribed Image Text:Number 4

Smithson, Inc. produces two types of gas grills: a family model and a deluxe model. Smithson's

controller has decided to use a plantwide overhead rate based on direct labor costs The

president of the company recently heard of activity-based costing and wants to see how the

results would differ if this system were used. Two activity cost pools were developed:

machining and machine setup. Presented below is information related to the company's

operations:

Family Model

$75,000

2,000

200

Deluxe Model

$150,000

2,000

800

Direct labor costs

Machine hours

Setup hours

cton

Total estimated overhead costs are $450,000. Overhead cost allocated to the machining

activity cost pool is $270,000 and $180,000 is allocated to the machine setup activity cost pool

Instructions

Compute the overhead rate using the traditional (plantwide) approach.

Compute the overhead rates using the activity-based costing approach.

Determine the difference in allocation between the two approaches.

Smithson, Inc. decided to implement the activity-based costing approach and was quite

successful in its use. However, the controller is wondering if instead of only two activity

cost pools, they should expand to three activity cost pools based on the following:

(a)

(b)

(c)

Deluxe Model

$150,000

2,000

800

Family Model

$75,000

2,000

200

Direct labor costs

Machine hours

Setup hours

Packaging hours

75

50

The estimated overhead of $450,000 is allocated as follows: machining activity cost

pool $240,000, machine set up $170,000 and packaging $40,000.

(1)

Determine the overhead rates using the activity-based costing approach with

three cost pools.

Determine the overhead allocation for the family model and the deluxe model

using three activity cost pools. What is the difference in allocation between two

activity cost pools and three activity cost pools? Is the difference in allocation

worth using the third activity cost pool?

(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning