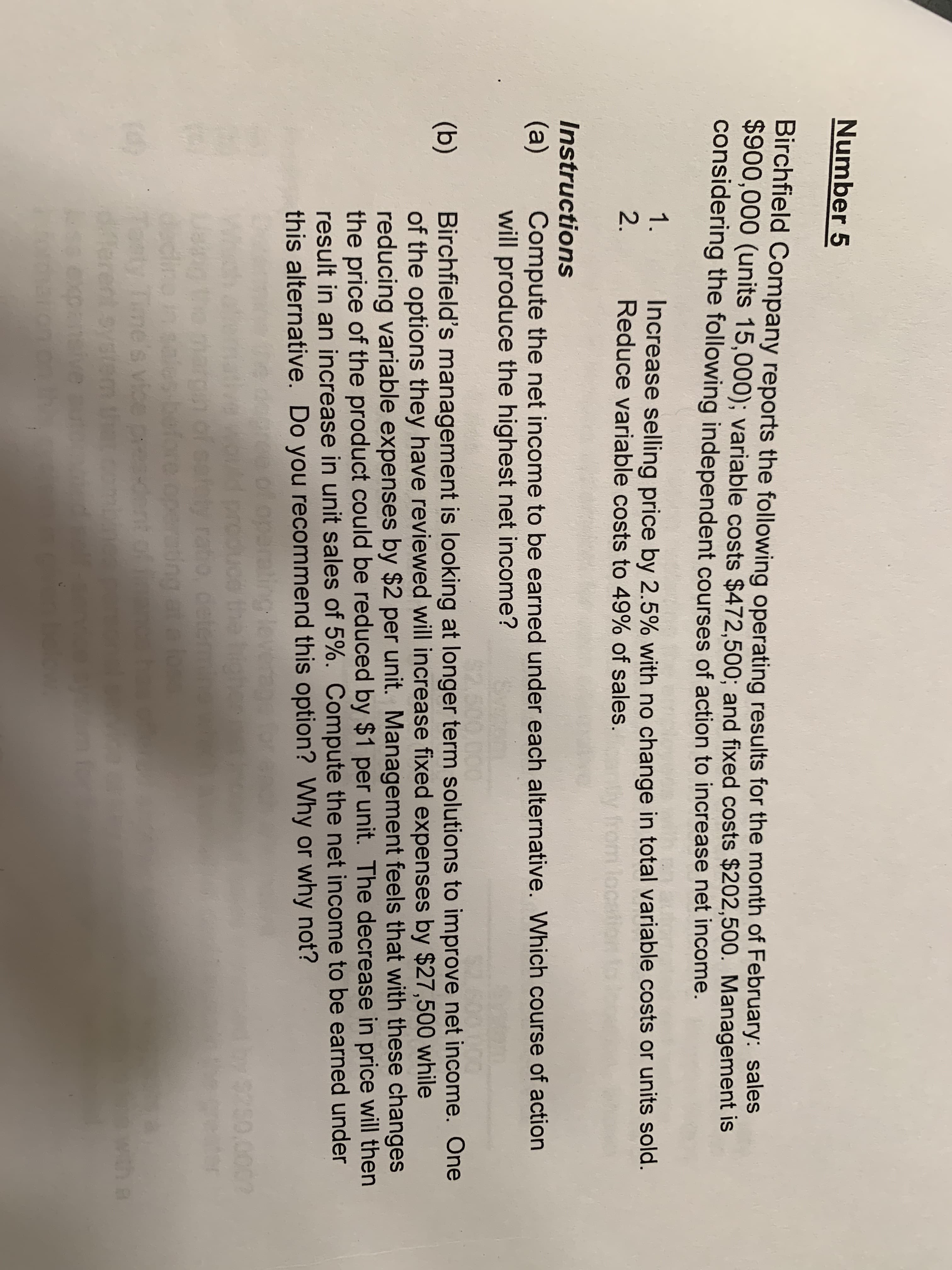

Number 5 Birchfield Company reports the following operating results for the month of February: Sales $900,000 (units 15,000); variable costs $472,500; and fixed costs $202,500. Management is considering the following independent courses of action to increase net income. 1. Increase selling price by 2.5% with no change in total variable costs or units sold. Reduce variable costs to 49% of sales 2. ty fhom locat Instructions (a) Compute the net income to be earned under each alternative. Which course of action will produce the highest net income? Birchfield's management is looking at longer term solutions to improve net income. One of the options they have reviewed will increase fixed expenses by $27,500 while reducing variable expenses by $2 per unit. Management feels that with these changes the price of the product could be reduced by $1 per unit. The decrease in price will then result in an increase in unit sales of 5%. Compute the net income to be earned under this alternative. Do you recommend this option? Why or why not? (b) leverage for e 1525 000? fsatoty ra f tne's vice pres-ent 9

Number 5 Birchfield Company reports the following operating results for the month of February: Sales $900,000 (units 15,000); variable costs $472,500; and fixed costs $202,500. Management is considering the following independent courses of action to increase net income. 1. Increase selling price by 2.5% with no change in total variable costs or units sold. Reduce variable costs to 49% of sales 2. ty fhom locat Instructions (a) Compute the net income to be earned under each alternative. Which course of action will produce the highest net income? Birchfield's management is looking at longer term solutions to improve net income. One of the options they have reviewed will increase fixed expenses by $27,500 while reducing variable expenses by $2 per unit. Management feels that with these changes the price of the product could be reduced by $1 per unit. The decrease in price will then result in an increase in unit sales of 5%. Compute the net income to be earned under this alternative. Do you recommend this option? Why or why not? (b) leverage for e 1525 000? fsatoty ra f tne's vice pres-ent 9

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 46E: Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is...

Related questions

Question

Just part B

Transcribed Image Text:Number 5

Birchfield Company reports the following operating results for the month of February: Sales

$900,000 (units 15,000); variable costs $472,500; and fixed costs $202,500. Management is

considering the following independent courses of action to increase net income.

1.

Increase selling price by 2.5% with no change in total variable costs or units sold.

Reduce variable costs to 49% of sales

2.

ty fhom locat

Instructions

(a)

Compute the net income to be earned under each alternative. Which course of action

will produce the highest net income?

Birchfield's management is looking at longer term solutions to improve net income. One

of the options they have reviewed will increase fixed expenses by $27,500 while

reducing variable expenses by $2 per unit. Management feels that with these changes

the price of the product could be reduced by $1 per unit. The decrease in price will then

result in an increase in unit sales of 5%. Compute the net income to be earned under

this alternative. Do you recommend this option? Why or why not?

(b)

leverage for e

1525

000?

fsatoty ra

f

tne's vice pres-ent

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning