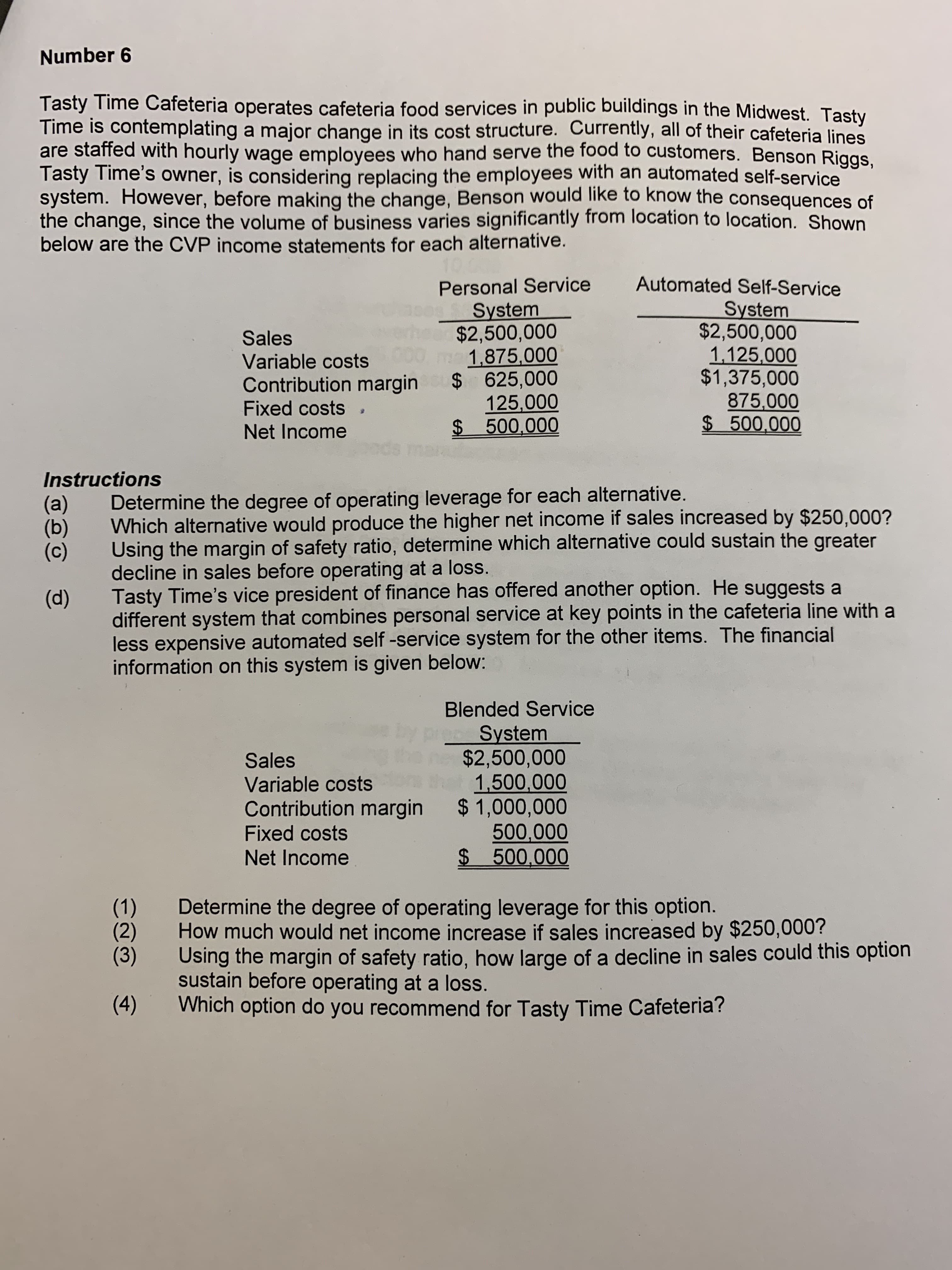

Number 6 Tasty Time Cafeteria operates cafeteria food services in public buildings in the Midwest. Tasty Time is contemplating a major change in its cost structure. Currently, all of their cafeteria lines are staffed with hourly wage employees who hand serve the food to customers. Benson Riggs, Tasty Time's owner, is considering replacing the employees with an automated self-service system. However, before making the change, Benson would like to know the consequences of the change, since the volume of business varies significantly from location to location. Shown below are the CVP income statements for each alternative. Automated Self-Service Personal Service System $2,500,000 1.125,000 $1,375,000 875,000 S 500,000 System $2,500,000 1.875,000 625,000 125,000 S 500,000 Sales Variable costs Contribution margin Fixed costs Net Income Instructions Determine the degree of operating leverage for each alternative. Which alternative would produce the higher net income if sales increased by $250,000? ng the margin of safety ratio, determine which alternative could sustain the greater decline in sales before operating at a loss. Tasty Time's vice president of finance has offered another option. He suggests different system that combines personal service at key points in the cafeteria line with less expensive automated self -service system for the other items. The financial information on this system is given below: (a) (b) (c) (d) Blended Service System $2,500,000 1.500,000 $1,000,000 500,000 $ 500,000 Sales Variable costs Contribution margin Fixed costs Net Income Determine the degree of operating leverage for this option. How much would net income increase if sales increased by $250,000? Using the margin of safety ratio, how large of a decline in sales could this option sustain before operating at a loss. Which option do you recommend for Tasty Time Cafeteria? (1) (2) (3) (4)

Number 6 Tasty Time Cafeteria operates cafeteria food services in public buildings in the Midwest. Tasty Time is contemplating a major change in its cost structure. Currently, all of their cafeteria lines are staffed with hourly wage employees who hand serve the food to customers. Benson Riggs, Tasty Time's owner, is considering replacing the employees with an automated self-service system. However, before making the change, Benson would like to know the consequences of the change, since the volume of business varies significantly from location to location. Shown below are the CVP income statements for each alternative. Automated Self-Service Personal Service System $2,500,000 1.125,000 $1,375,000 875,000 S 500,000 System $2,500,000 1.875,000 625,000 125,000 S 500,000 Sales Variable costs Contribution margin Fixed costs Net Income Instructions Determine the degree of operating leverage for each alternative. Which alternative would produce the higher net income if sales increased by $250,000? ng the margin of safety ratio, determine which alternative could sustain the greater decline in sales before operating at a loss. Tasty Time's vice president of finance has offered another option. He suggests different system that combines personal service at key points in the cafeteria line with less expensive automated self -service system for the other items. The financial information on this system is given below: (a) (b) (c) (d) Blended Service System $2,500,000 1.500,000 $1,000,000 500,000 $ 500,000 Sales Variable costs Contribution margin Fixed costs Net Income Determine the degree of operating leverage for this option. How much would net income increase if sales increased by $250,000? Using the margin of safety ratio, how large of a decline in sales could this option sustain before operating at a loss. Which option do you recommend for Tasty Time Cafeteria? (1) (2) (3) (4)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter12: Activity-based Management

Section: Chapter Questions

Problem 15E: Refer to Exercise 12.14. Suppose that for 20x2, Sanford, Inc., has chosen suppliers that provide...

Related questions

Question

100%

Transcribed Image Text:Number 6

Tasty Time Cafeteria operates cafeteria food services in public buildings in the Midwest. Tasty

Time is contemplating a major change in its cost structure. Currently, all of their cafeteria lines

are staffed with hourly wage employees who hand serve the food to customers. Benson Riggs,

Tasty Time's owner, is considering replacing the employees with an automated self-service

system. However, before making the change, Benson would like to know the consequences of

the change, since the volume of business varies significantly from location to location. Shown

below are the CVP income statements for each alternative.

Automated Self-Service

Personal Service

System

$2,500,000

1.125,000

$1,375,000

875,000

S 500,000

System

$2,500,000

1.875,000

625,000

125,000

S 500,000

Sales

Variable costs

Contribution margin

Fixed costs

Net Income

Instructions

Determine the degree of operating leverage for each alternative.

Which alternative would produce the higher net income if sales increased by $250,000?

ng the margin of safety ratio, determine which alternative could sustain the greater

decline in sales before operating at a loss.

Tasty Time's vice president of finance has offered another option. He suggests

different system that combines personal service at key points in the cafeteria line with

less expensive automated self -service system for the other items. The financial

information on this system is given below:

(a)

(b)

(c)

(d)

Blended Service

System

$2,500,000

1.500,000

$1,000,000

500,000

$ 500,000

Sales

Variable costs

Contribution margin

Fixed costs

Net Income

Determine the degree of operating leverage for this option.

How much would net income increase if sales increased by $250,000?

Using the margin of safety ratio, how large of a decline in sales could this option

sustain before operating at a loss.

Which option do you recommend for Tasty Time Cafeteria?

(1)

(2)

(3)

(4)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 7 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning