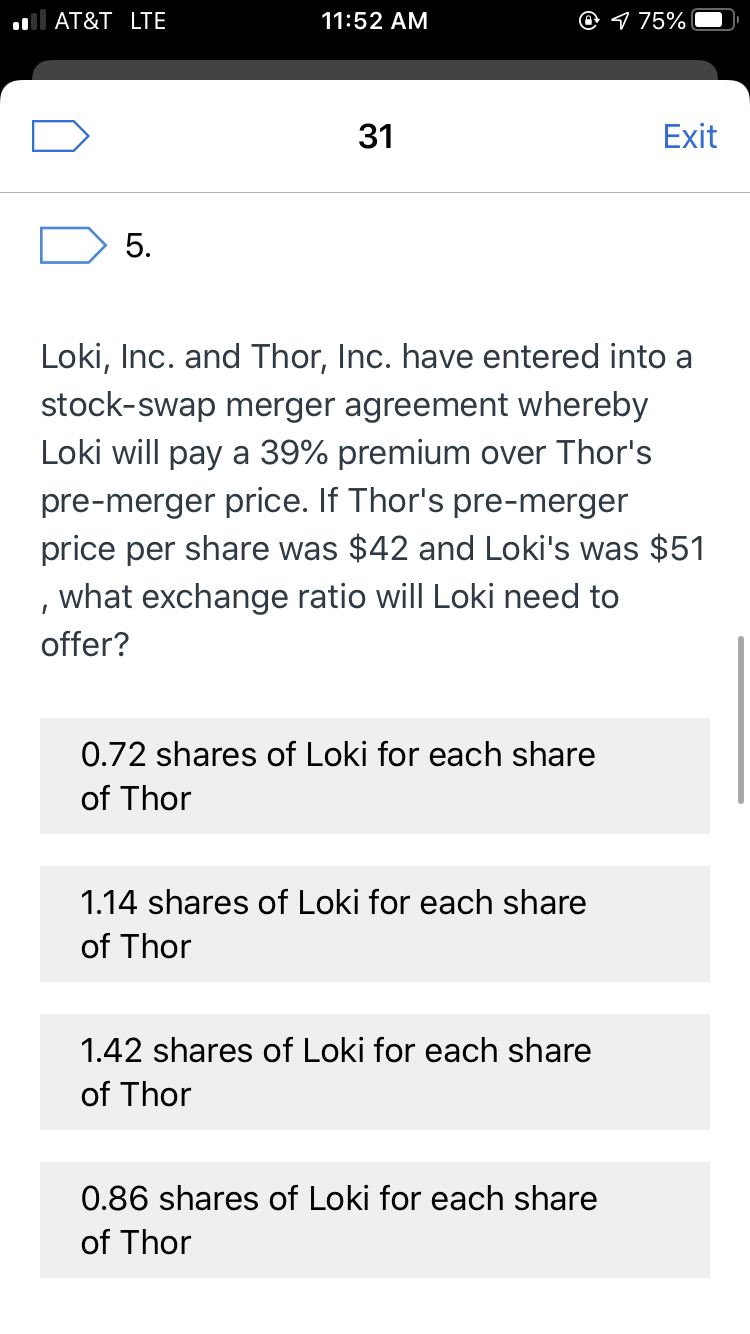

O 1 75% AT&T LTE 11:52 AM Exit 31 5. Loki, Inc. and Thor, Inc. have entered into a stock-swap merger agreement whereby Loki will pay a 39% premium over Thor's pre-merger price. If Thor's pre-merger price per share was $42 and Loki's was $51 , what exchange ratio will Loki need to offer? 0.72 shares of Loki for each share of Thor 1.14 shares of Loki for each share of Thor 1.42 shares of Loki for each share of Thor 0.86 shares of Loki for each share of Thor

Q: E4.18 (LO 5) (Changes in Equity) The equity section of Hasbro Ine, at January 1, 2022, was as…

A: Equity shares are basically of long term purposes for a company and also its a main source of income…

Q: 61. A and B are partners sharing profits in the ratio of 2:3. Their Balance St shows Machinery at…

A: A partnership is a contract between at least two people to run a business and share profits and…

Q: On January 1,2011, Smart Inc. granted 200 share options each to 1,000 employees, conditional upon…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Exercise 6-25 (LO. 1) During the current year, Gnatcatcher, Inc., (E & P of $1,000,000) distributed…

A: The distribution to Brandi is a qualifying stock redemption, thus it will be taxed as a sale or…

Q: Question 3 36.3 A balance sheet for Cuomo Ltd is to be drawn up from the following information as at…

A: Balance sheet is one of the financial statement of the business, which shows all assets and…

Q: E17.16 (LO 2, 3) (Fair Value and Equity Method Compared) Jaycie Phelps me. de the outstanding common…

A: Financial transactions are recorded in the for of journal entry.

Q: Problem #10 Share Dividends and Share Splits On Jan. 1, 2019, the records of Matuguinas Corporation…

A: Share dividends means when instead of paying cash shares of the company will be issued to the…

Q: PB5. LO 14.2 Paydirt Limestone, Incorporated was organized several years ago and was authorized to…

A: Introduction: Journal: Recording of a business transaction in a chronological order. First step in…

Q: EX 12-11 Effect of stock split Willey's Grill & Restaurant Corporation wholesales ovens and ranges…

A: “Hey, since there are multiple questions posted, we will answer first question (EX-12-11). If you…

Q: Barcelona Company owns 20,000 shares of ABC Corporation, representing 10% ownership. Barcelona…

A: The residual profits of the company are distributed to the shareholders as per their holding.

Q: E16.16 (LO 4) (Weighted-Average Ordinary Shares) Portillo SA uses a calendar year for financial…

A:

Q: What is the impact of this sale transaction on Company X's cumulative translation adjustment…

A: The cumulative translation adjustment is reclassified to earning proportionally on part reduction in…

Q: Problem 16-11 (IAA) On July 1, 2021, Queen Company purchased for P2,400,000. 50,000 newly issued 6%…

A: The type of shares that provide fixed income to the holder is defined as preference shares. These…

Q: Problem 18-2 (ACP) Endless Company provided the following shareholders' equity on December 31, 2021:…

A: Preference shares: Preference shares allow an investor to own a stake in the issuing firm in…

Q: OMR 4 par value shares of XYZ Company are actively traded in the stock market at OMR 6.2 per share.…

A: Journal entry for purchase of land: Date Accounts Debit Credit Land OMR 128,000…

Q: CASE 5: CHARLOTTE, INC. On January 1, 20x1, Charlotte, Inc. entity grants 100 share options to each…

A: Answer No. Of employees = 500 Share option per employee = 100 Total share option = 100 ×500 =…

Q: 16.15 (LO 3) (Accounting for Restricted Shares) Lopez SpA issues 10,000 restricted ares to its CFO,…

A: To keep track of the financial transactions, journal entries are used. You enter transaction…

Q: follows: Isaac Esau Share capital, P100 par 5or shres Share premium (APIC) Retained earnings…

A: The capital of firm acquired also becomes the parts of purchasing company.

Q: Problem 3 National Supply's shareholders' equity included the following accounts at December 31,…

A: Retired shares can't be reissued because they wil not have any value after retirement. Please…

Q: 14. A company grants 100 Share appreciation rights (SAR), payable in cash, to an employee on 1/1/Y1.…

A: Stock appreciation right (SAR) - Entitles an employee to receive stock/cash if the entity's stock…

Q: Tusker Corporation is considering a 3- for- 2 share split. It currently has the shareholder’s equity…

A: A company has several sources from where it can raise funds. It can issue equity shares and the…

Q: Exercise 13-7 (Algorithmic) (LO. 7) Derk owns 690 shares of stock in Rose Corporation. The remaining…

A: Shares are equity ownership units in a corporation. Shares exist as a financial asset for some…

Q: On June 1, 2019, Carey, Inc. sold 30,000 shares of its P20 par value ordinary share capital on a…

A: The subscription basis for the issue of share capital states the basis for the payment for the share…

Q: O 1 75% AT&T LTE 11:52 AM Exit 21 Diagonal 3. A rights offering that gives existing target…

A: From the four options we need to select the option corresponding to the statement given.The…

Q: Q.2) EXLO acquired 75% of the shares in BENET five million $1 ordinary shares on 1 2017. On that…

A: Goodwill refers to the intangible asset for the business entity. In simple language it can be said…

Q: Problem 25-19 (IFRS) On January 1, 2020, Jester Company granted 50,000 share appreciation rights to…

A: 1. On 01.01.2020, Jester Company granted rights shares = 50000 shares Predetermined price per right…

Q: O 1 75% AT&T LTE 11:52 AM 17 Exit Conglomerate 2. If Ford Motor Company bought The Goodyear Tire &…

A: Horizontal merger is the merger in which two firms consolidates that belongs to the same…

Q: Exercise 4 – 7 On January 1, 2020, Levesque Co. purchased 500,000 ordinary shares of Rowland Co. at…

A: Investment income is described as the amount which a person or institution gains on the amount of…

Q: 68 Advanced Corporate Accounting 4. Spring Field Ltd. is absorbed by Sports Field Ltd., the…

A: The purchase consideration is the amount paid in the form of cash or securities issued to the…

Q: Question #3. Polecat plc has 18 million $0.50 ordinary shares in issue. The current stock market…

A: In the given question we need to compute the theoretical ex-rights price of the shares.

Q: Punch Manufacturing Corporation owns 80 percent of the common shares of Short Retail Stores. The…

A: SOLUTION- EARNING PER SHARE IS CALCULATED AS A COMPANY'S PROFIT DIVIDED BY OUTSTANDING SHARES OF…

Q: LL %23 SI Angela Corporation (a private company) acquired all of the outstanding voting stock of…

A: Consolidated financial statements are the financial statements of a company that has multiple…

Q: E16.18 (LO 4) (EPS: Simple Capital Structure) Ott Company had 210,000 ordinary shares outstanding on…

A: Earnings per share show the amount that is made by a company for each of its shares. Alternatively,…

Q: Question 3 On 6 July 2021, Falta Limited paid $300 to purchase a put option on Zebra Limited when…

A: The put option is a derivative instrument that expects that the prices will fall below the strike…

Q: 4. The price of Goodyear stock on the merger date announcement was $13.93 and the number of shares…

A: An acquisition is the process of acquiring more than 50% of shares of one company by the other…

Q: On January 1, 2020, Blunt Co. purchased 50,000 ordinary shares of Powter Co. at ₱16 per share. The…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: O 1 75% AT&T LTE 11:52 AM Exit 26 4. Conglomerate Inc. is trading at $80/share, and is about to…

A: Calculation of Maximum Exchange Ratio:The maximum exchange ratio is close to 1.43.Excel Spreadsheet:

Q: Question One The following trial balance relates to Succeed Limited as at 30 June 2020 K K…

A: The following computations are done for Succeed limited.

Q: Problem #10 Share Dividends and Share Splits On Jan. 1, 2019, the records of Matuguinas Corporation…

A: Note: As per the policy we are supposed to solve the first three subparts only at a time. Kindly…

Q: 48 carrying amount of P1,300,000 on January 1, 20x1, under the equity method. On September 1, 20x1,…

A: The question is multiple choice question. Required Choose the Correct Option.

Q: Q.10. Share capital of Tomato Ltd at 31 March 2017 was as follows: 100,000 ordinary shares at an…

A: In the Books of Tomato Ltd. Journal Entry Date Particulars Debit($) Credit($) 31/03/2017 Share…

Q: 18. Qualified Small Business Stock. (Obj. 1) Jenson pays $30,000 for Section 1202 qualified business…

A: Given, Small Business Stock Gains Exclusion (Section 1202),It is the Internal Revenue Code (IRC)…

Step by step

Solved in 5 steps with 2 images

- 111. On June 30, 20X1, ABC Corp exchanged 6,000 shares of XYZ Company P10 par value ordinary shares for patent owned by McKing. The XYZ shares was acquired in 20X1 at a cost of P160,000. At the exchange rate XYZ shares had a fair value of P45 per share, and the patent had a carrying amount of P320,000 in McKing's books. ABC Corp should record the patent at: 320,000 270,000 180,000 160,000A merger between Minnie Corporation and Mickey Corporation is under consideration. The financial information for these firms is as follows: Minnie Corporation Mickey Corporation Total earnings $1,682,000 $2,581,000 Number of shares of stock outstanding 290,000 890,000 EPS $5.80 $2.90 P/E ratio 10X 20X Market price per share $58 $58 a. On a share-for-share exchange basis, what will the postmerger EPS be? (Round the final answer to 2 decimal places.) Postmerger earnings per share $ b. If Mickey Corporation pays a 25 percent premium over the market value of Minnie Corporation, how many shares will be issued? (Do not round intermediate calculations.) Shares issued shares c. With the 25 percent premium, what will the postmerger EPS be? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Postmerger earnings per share $Loki, Inc. and Thor, Inc. have entered into a stock-swap merger agreement whereby Loki will pay a 39% premium over Thor's pre-merger price. If Thor's pre-merger price per share was $42 and Loki's was $51, what exchange ratio will Loki need to offer? a. 1.42 shares of Loki for each share of Thor b. 0.72 shares of Loki for each share of Thor c. 0.86 shares of Loki for each share of Thor d. 1.14 shares of Loki for each share of Thor

- 4. The following table shows pre-merger data for ABC Company and XYZ, Inc. ABC XYZ No of share outstanding 2,000,000 5,000,000 EPS $2.50 $4.00 Price per share $15.00 $60 a) Assume XYZ is taking over ABC by issuing one of its shares for four shares of ABC. If there is no synergy, what would be the post-merger share price of XYZ? What would be the NPV of the merger? b) Assume there is synergy value of $4,200,000 created from the merger. What would be the post-merger price per share of XYZ? What would be the NPV of the merger? 5. Lazos Company is in distress mainly due to its failure to adopt the current technology. Creditors took Lazos to bankruptcy court and Lazos is fighting for a reorganization. The following is its condensed balance sheet. Book Value Market Value Current assets $ 120,000.00 $ 100,000.00 Machinery 200,000.00 150,000.00 Other fixed…Firm E is going to acquire Firm F. The acquisition will be done via a share exchange, whereby Firm E will exchange 2.65 of its shares for every one of Firm F's shares. Synergy is $1,250,000 in total. Firm E has 350,000 shares outstanding trading at $35 each. Firm F has 45,000 shares outstanding trading at $84 each. What would the exchange ratio have to be for the NPV of the deal to be zero? Question 1 options: A) 3.13 shares of E for every 1 of F B) 0.41 shares of E for every 1 of F C) 3.15 shares of E for every 1 of F D) 2.40 shares of E for every 1 of F E) 3.19 shares of E for every 1 of F7. ABC Company and XYZ Company have announced terms of an exchange agreement under which ABC will issue 10,000 shares of its P5 par value ordinary shares to acquire all of XYZ’s assets. ABC’s shares are trading at P28, and XYZ’s P10 par value shares are trading at P15. Historical cost and fair value statement of financial position data on January 1, 2021, are as follows: (see image below) Based on the information provided, what amount will be reported for Ordinary Share in the combined company’s statement of financial position immediately following the business combination?

- ABC Corporation bought a put option on 500 P1000-par value XYZ Corp. preference shares at P1,525 each. ABC paid a premium of P15,000. The market price on the agreement date and on the exercise date are P1,520 and P1530 respectively. * Compute for the net gain or loss ?1.Firm A is planning on merging with the Firm B. Firm A will pay Firm B’s stockholders the current value the of their stock plus one-half on the synergy, which is $120, in shares of firm A. Firm A currently has 4000 shares of stock outstanding at a market price of $21 a share. Firm B has shares outstanding at a price of $10 a share. What is the value of the merged firms? A.$96240 B.$88120 C.$96000 D.$84120 E.$92360 2.Which of the following not true regarding financial statement A.Group financial statement be produced by each subsidiary as well as the parent entity B.Profit must be separated between members of the parent company and that of minority interest C.Minority interest share of equity represents that ‘part of a subsidiary’s equity not allocated to members of the parent company. D.Group financial statements must be produced by the parent entity only. E.None of the options provided.MC 5 P327On April 1, PP, Inc., exchanges P430,000 fair-value consideration for 70% of the outstanding stock of RR Corporation. The remaining 30% of the outstanding shares continued to trade at a collective fair value of P165, 000. RR's identifiable assets and liabilities each had book values that equaled their fair values of April 1 for a net total of P500,000. RR generated annual (12-month) revenues of P600,000 and expenses of P360,000 and paid no dividends. On a December 31 consolidated balance sheet, what should be reported as non-controlling interest?MC 6 P327-28January 1, 20x4, Payne Corp. purchased 70% of Shayne Corp's P10 par common stock for P900,000. On this date, the carrying amount of Shayne's net assets was P1,000,000. The fair values of Shayne's identifiable assets and liabilities were the same as their carrying amounts except for plant assets (net), which were P200, 000 in excess of the carrying amount. For the year ended December 31, 20x4, Shayne had net income of…

- Finance Loki Inc. and Thor Inc. have entered into a stock swap merger agreement whereby Loki will pay a 35% premium over Thor’s pre-merger price. A. If Thor’s pre-merger price per share was $37 and Loki’s was $52, what exchange ratio will Loki need to offer? B. On the day of the merger announcement, the increase in Thor (the target firm’s) stock price will be ______(higher/lower) than 35% (the takeover premium). C. Based on your answer in part B of this question, explain why you think Thor’s stock price increase will be higher or lower than the takeover premium at the time of the merger announcement.Consider the following premerger information about Firm X and Firm Y: Firm X Firm Y Total earnings $ 40,000 $ 15,000 Shares outstanding 20,000 20,000 Per-share values: Market $ 49 $ 18 Book $ 20 $ 7 Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $4 per share. Assuming that neither firm has any debt before or after the merger, what are the total assets of Firm X after the merger?Consider the following premerger information about Firm X and Firm Y: Firm X Firm Y Total earnings $ 95,000 $ 22,000 Shares outstanding 52,000 17,000 Pre-share values: Market $ 52 $ 21 Book $ 15 $ 10 Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $6 per share, and that neither firm has any debt before or after the merger. a. Assuming the pooling of interests method is used, what is the equity of the combined firm? Equity value $ b. List the assets of the combined firm assuming the purchase accounting method is used. Assets from X $ Assets from Y Goodwill Total Assets XY $ Please dont provide solution image based thnx