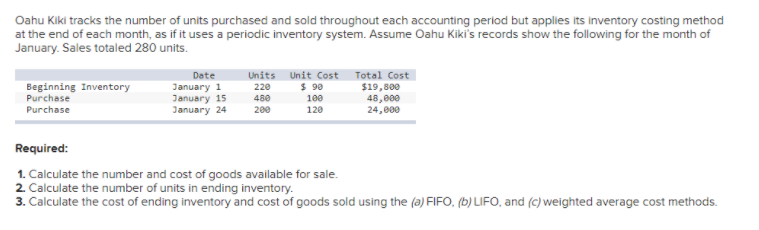

Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki's records show the following for the month of January. Sales totaled 280 units. Beginning Inventory Purchase Purchase Date January 1 January 15 January 24 Units Unit Cost Total Cost $19,800 48,000 24,000 220 $ 90 480 100 200 120 Required: 1. Calculate the number and cost of goods available for sale. 2 Calculate the number of units in ending inventory. 3. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO. (b) LIFO, and (c) weighted average cost methods.

Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki's records show the following for the month of January. Sales totaled 280 units. Beginning Inventory Purchase Purchase Date January 1 January 15 January 24 Units Unit Cost Total Cost $19,800 48,000 24,000 220 $ 90 480 100 200 120 Required: 1. Calculate the number and cost of goods available for sale. 2 Calculate the number of units in ending inventory. 3. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO. (b) LIFO, and (c) weighted average cost methods.

Chapter10: Inventory

Section: Chapter Questions

Problem 6EA: Akira Company had the following transactions for the month. Calculate the gross margin for the...

Related questions

Question

100%

need detailed answers

Transcribed Image Text:Oahu Kiki tracks the number of units purchased and sold throughout each accounting perlod but apples its inventory costing method

at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki's records show the following for the month of

January. Sales totaled 280 units.

Units

Unit Cost

Total Cost

$19,800

48,000

24,000

Date

Beginning Inventory

Purchase

January 1

January 15

January 24

$ 90

220

480

100

Purchase

200

120

Required:

1. Calculate the number and cost of goods available for sale.

2. Calculate the number of units in ending inventory.

3. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO. (b) LIFO, and (c) weighted average cost methods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning