Olivia Company completed the following transactions in December 2021. All purchased goods are received by Olivia Company and sold goods are delivered before the end of the month. Olivia uses perpetual inventory system. It records purchase and sales at gross amount. Purchased goods from Switch Co. for $88,000 with the terms of 1/10, n/30. Sold goods on account $32,000, terms 1/15, n/30, to Fun Limited. The cost of goods sold was $18,100. Returned the defective goods costing $21,000 purchased on 2 December to Switch 4 7 Co. Paid $5,400 for transportation cost of 4 December sale. Fun Limited returned $5,000 of unsatisfactory goods from the 4 December sale to Olivia Company. Olivia Company's cost for these goods was $1,300. Purchased goods from Switch Co. for $38,000 with the terms of 2/10, n/30. Received collections in full, from the Fun Limited for the sales in December. 13 15 18 25 Paid the outstanding amounts owed to Switch Co. in full. 31 Found inventory shortfall of $1,000 in the month-end physical count. Required Prepare the journal entries to record the above transactions of Olivia Company. b) Assume Olivia Company has a financial year ended at 31 December and some purchased goods are not received by Olivia Company before the end of December. Explain FOB destination point and discuss how this may affect the correctness of recording all purchase transactions of goods ordered in December.

Olivia Company completed the following transactions in December 2021. All purchased goods are received by Olivia Company and sold goods are delivered before the end of the month. Olivia uses perpetual inventory system. It records purchase and sales at gross amount. Purchased goods from Switch Co. for $88,000 with the terms of 1/10, n/30. Sold goods on account $32,000, terms 1/15, n/30, to Fun Limited. The cost of goods sold was $18,100. Returned the defective goods costing $21,000 purchased on 2 December to Switch 4 7 Co. Paid $5,400 for transportation cost of 4 December sale. Fun Limited returned $5,000 of unsatisfactory goods from the 4 December sale to Olivia Company. Olivia Company's cost for these goods was $1,300. Purchased goods from Switch Co. for $38,000 with the terms of 2/10, n/30. Received collections in full, from the Fun Limited for the sales in December. 13 15 18 25 Paid the outstanding amounts owed to Switch Co. in full. 31 Found inventory shortfall of $1,000 in the month-end physical count. Required Prepare the journal entries to record the above transactions of Olivia Company. b) Assume Olivia Company has a financial year ended at 31 December and some purchased goods are not received by Olivia Company before the end of December. Explain FOB destination point and discuss how this may affect the correctness of recording all purchase transactions of goods ordered in December.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PA: On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as...

Related questions

Topic Video

Question

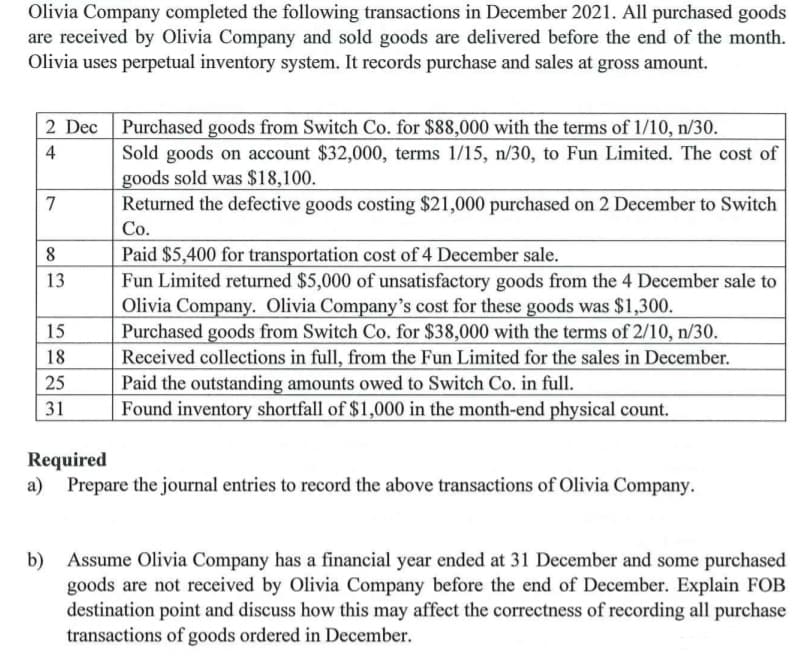

Transcribed Image Text:Olivia Company completed the following transactions in December 2021. All purchased goods

are received by Olivia Company and sold goods are delivered before the end of the month.

Olivia uses perpetual inventory system. It records purchase and sales at gross amount.

Purchased goods from Switch Co. for $88,000 with the terms of 1/10, n/30.

Sold goods on account $32,000, terms 1/15, n/30, to Fun Limited. The cost of

goods sold was $18,100.

Returned the defective goods costing $21,000 purchased on 2 December to Switch

4

7

Co.

Paid $5,400 for transportation cost of 4 December sale.

Fun Limited returned $5,000 of unsatisfactory goods from the 4 December sale to

Olivia Company. Olivia Company's cost for these goods was $1,300.

Purchased goods from Switch Co. for $38,000 with the terms of 2/10, n/30.

Received collections in full, from the Fun Limited for the sales in December.

Paid the outstanding amounts owed to Switch Co. in full.

Found inventory shortfall of $1,000 in the month-end physical count.

13

15

18

25

31

Required

a)

Prepare the journal entries to record the above transactions of Olivia Company.

b)

Assume Olivia Company has a financial year ended at 31 December and some purchased

goods are not received by Olivia Company before the end of December. Explain FOB

destination point and discuss how this may affect the correctness of recording all purchase

transactions of goods ordered in December.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,