On 1 January 2016, Atom Ltd leased a new equipment from Success Ltd for three years. Annual payments of $28,000 are payable in arrears, the first installment being due on 31 December 2016. The equipment costs $76,300 and the estimated economic useful life of the asset is four years with nil residual value. The interest rate implicit in the lease is 6%. Required: Complete the following amortisation schedule to determine the interest expenses and lease liability. Round all answers to the nearest dollar. Do not enter $ sign. Year ending Lease Payable Beg. Bal Interest Expense Lease payment Reduction in Lease liability Lease Payable End. Bal $ $ $ $ $ 31 Dec 2016 Blank 1 Blank 2 Blank 3 Blank 4 Blank 5 31 Dec 2017 Blank 6 Blank 7 Blank 8 Blank 9 Blank 10 31 Dec 2018 Blank 11 Blank 12 Blank 13 Blank 14 Blank 15

On 1 January 2016, Atom Ltd leased a new equipment from Success Ltd for three years. Annual payments of $28,000 are payable in arrears, the first installment being due on 31 December 2016.

The equipment costs $76,300 and the estimated economic useful life of the asset is four years with nil residual value. The interest rate implicit in the lease is 6%.

Required:

Complete the following amortisation schedule to determine the interest expenses and lease liability. Round all answers to the nearest dollar. Do not enter $ sign.

| Year ending | Lease Payable Beg. Bal |

Interest Expense | Lease payment | Reduction in Lease liability | Lease Payable End. Bal |

| $ | $ | $ | $ | $ | |

| 31 Dec 2016 | Blank 1 | Blank 2 | Blank 3 | Blank 4 | Blank 5 |

| 31 Dec 2017 | Blank 6 | Blank 7 | Blank 8 | Blank 9 | Blank 10 |

| 31 Dec 2018 | Blank 11 | Blank 12 | Blank 13 | Blank 14 | Blank 15 |

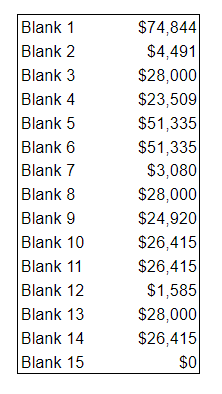

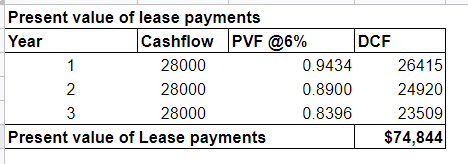

To determine the interest and lease liability first we have to find the present value of lease payment using the interest rate implicit in the lease. Summary of all the blank answers:

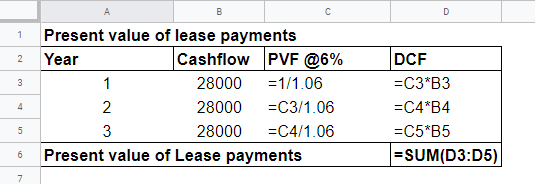

Formulas in excel,

Step by step

Solved in 3 steps with 5 images