On August 1, 2018, Trico Technologies, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Interest is payable at maturity. FirstBanc Corp's year-end is December 31. Required: 1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below for FirstBanc Corp. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet 2 3 Record the acceptance of note. Note: Enter debits before credits. Date General Journal Debit Credit August 01, 2018 Record entry Clear entry View general journal View transaction list View transaction list Journal entry worksheet Journal entry worksheet 3 3 Record the adjustment for interest. Record the receipt of cash at maturity. Note: Enter debits before credits. Note: Enter debits before credits. Date General Journal Debit Credit Date General Journal Debit Credit December 31, 2018 January 31, 2019 Record entry Clear entry View general journal Record entry Clear entry View general journal

On August 1, 2018, Trico Technologies, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Interest is payable at maturity. FirstBanc Corp's year-end is December 31. Required: 1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below for FirstBanc Corp. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet 2 3 Record the acceptance of note. Note: Enter debits before credits. Date General Journal Debit Credit August 01, 2018 Record entry Clear entry View general journal View transaction list View transaction list Journal entry worksheet Journal entry worksheet 3 3 Record the adjustment for interest. Record the receipt of cash at maturity. Note: Enter debits before credits. Note: Enter debits before credits. Date General Journal Debit Credit Date General Journal Debit Credit December 31, 2018 January 31, 2019 Record entry Clear entry View general journal Record entry Clear entry View general journal

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.9AMCP

Related questions

Question

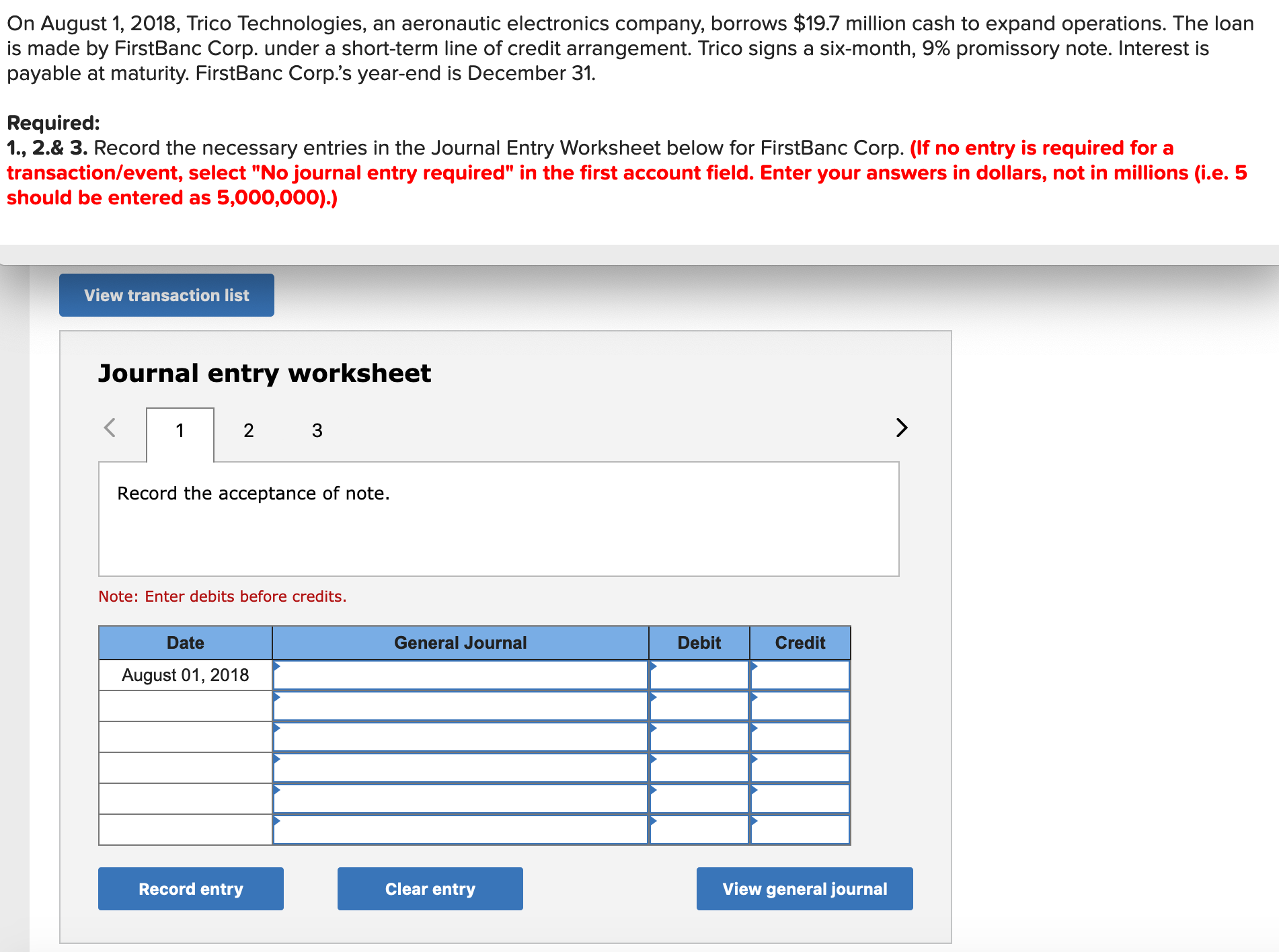

Transcribed Image Text:On August 1, 2018, Trico Technologies, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan

is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Interest is

payable at maturity. FirstBanc Corp's year-end is December 31.

Required:

1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below for FirstBanc Corp. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5

should be entered as 5,000,000).)

View transaction list

Journal entry worksheet

2 3

Record the acceptance of note.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

August 01, 2018

Record entry

Clear entry

View general journal

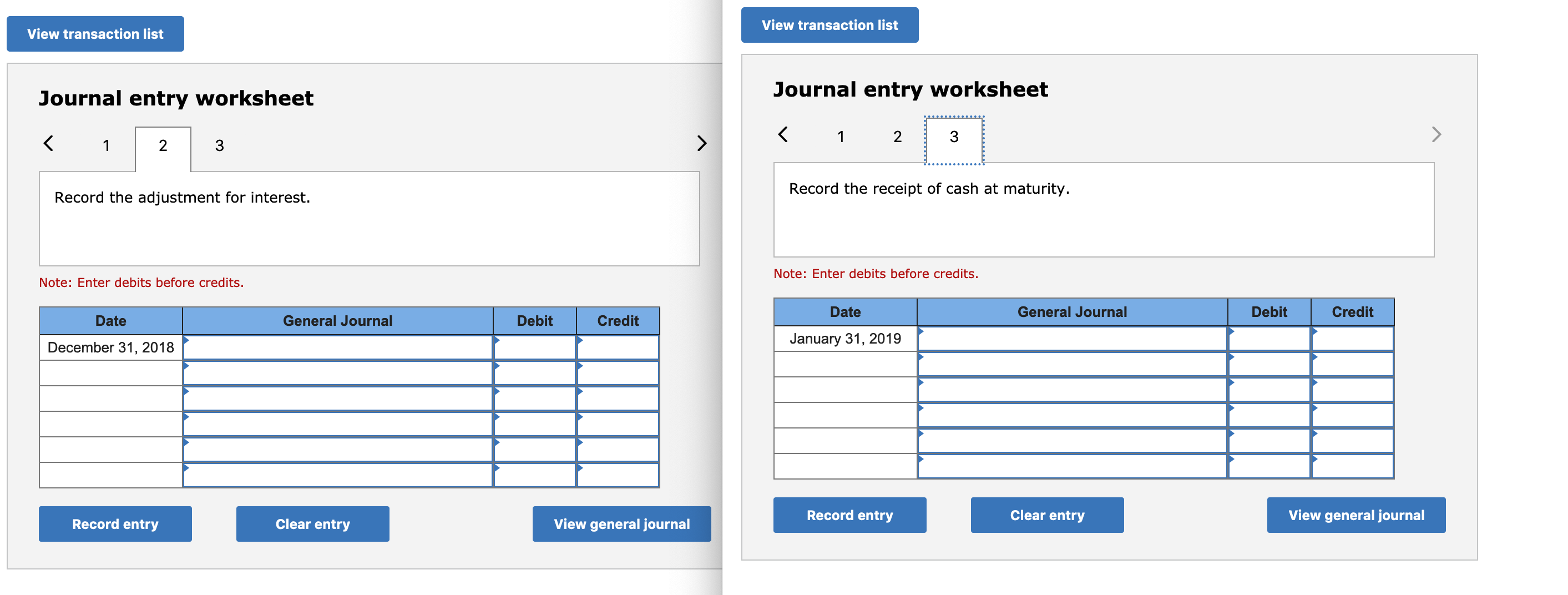

Transcribed Image Text:View transaction list

View transaction list

Journal entry worksheet

Journal entry worksheet

3

3

Record the adjustment for interest.

Record the receipt of cash at maturity.

Note: Enter debits before credits.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Date

General Journal

Debit

Credit

December 31, 2018

January 31, 2019

Record entry

Clear entry

View general journal

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning