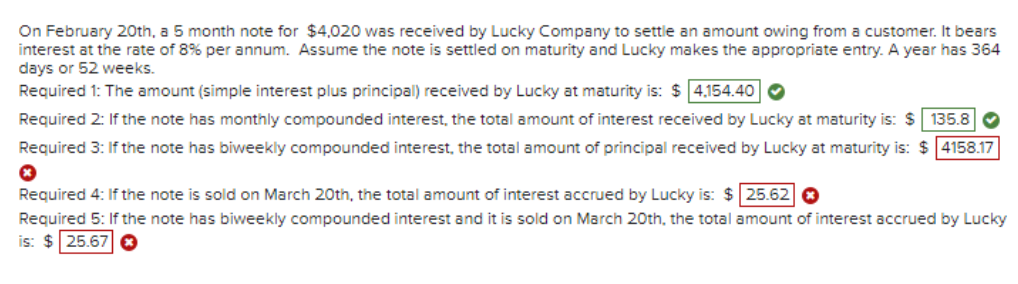

On February 20th, a 5 month note for $4,020 was received by Lucky Company to settle an amount owing from a customer. It bears interest at the rate of 8% per annum. Assume the note is settled on maturity and Lucky makes the appropriate entry. A year has 364 days or 52 weeks. Required 1: The amount (simple interest plus principal) received by Lucky at maturity is: $4.154.40 Required 2: If the note has monthly compounded interest, the total amount of interest received by Lucky at maturity is: $135.8 Required 3: If the note has biweekly compounded interest, the total amount of principal received by Lucky at maturity is: $4158.17 Required 4: If the note is sold on March 20th, the total amount of interest accrued by Lucky is: $25.62 € Required 5: If the note has biweekly compounded interest and it is sold on March 20th, the total amount of interest accrued by Lucky is: $25.67€

On February 20th, a 5 month note for $4,020 was received by Lucky Company to settle an amount owing from a customer. It bears interest at the rate of 8% per annum. Assume the note is settled on maturity and Lucky makes the appropriate entry. A year has 364 days or 52 weeks. Required 1: The amount (simple interest plus principal) received by Lucky at maturity is: $4.154.40 Required 2: If the note has monthly compounded interest, the total amount of interest received by Lucky at maturity is: $135.8 Required 3: If the note has biweekly compounded interest, the total amount of principal received by Lucky at maturity is: $4158.17 Required 4: If the note is sold on March 20th, the total amount of interest accrued by Lucky is: $25.62 € Required 5: If the note has biweekly compounded interest and it is sold on March 20th, the total amount of interest accrued by Lucky is: $25.67€

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

Ef 426.

Transcribed Image Text:On February 20th, a 5 month note for $4,020 was received by Lucky Company to settle an amount owing from a customer. It bears

interest at the rate of 8% per annum. Assume the note is settled on maturity and Lucky makes the appropriate entry. A year has 364

days or 52 weeks.

Required 1: The amount (simple interest plus principal) received by Lucky at maturity is: $4,154.40

Required 2: If the note has monthly compounded interest, the total amount of interest received by Lucky at maturity is: $135.8

Required 3: If the note has biweekly compounded interest, the total amount of principal received by Lucky at maturity is: $4158.17

Ⓡ

Required 4: If the note is sold on March 20th, the total amount of interest accrued by Lucky is: $ 25.62 €

Required 5: If the note has biweekly compounded interest and it is sold on March 20th, the total amount of interest accrued by Lucky

is: $25.67€

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning