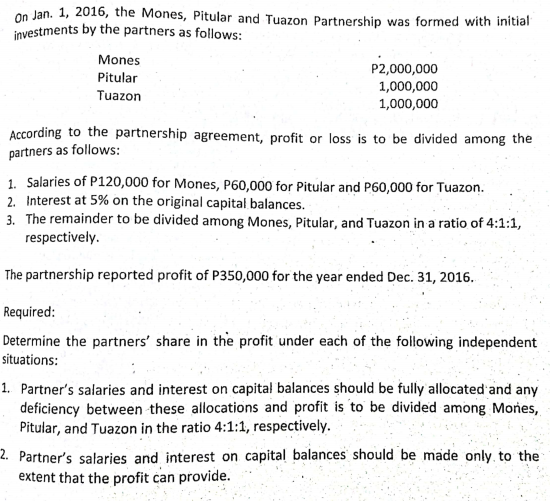

On Jan. 1, 2016, the Mones, Pitular and Tuazon Partnership was formed with initial investments by the partners as follows: Mones P2,000,000 Pitular 1,000,000 1,000,000 Tuazon According to the partnership agreement, profit or loss is to be divided among the partners as follows: 1. Salaries of P120,000 for Mones, P60,000 for Pitular and P60,000 for Tuazon. 2. Interest at 5% on the original capital balances. 3. The remainder to be divided among Mones, Pitular, and Tuazon in a ratio of 4:1:1, respectively. The partnership reported profit of P350,000 for the year ended Dec. 31, 2016.

On Jan. 1, 2016, the Mones, Pitular and Tuazon Partnership was formed with initial investments by the partners as follows: Mones P2,000,000 Pitular 1,000,000 1,000,000 Tuazon According to the partnership agreement, profit or loss is to be divided among the partners as follows: 1. Salaries of P120,000 for Mones, P60,000 for Pitular and P60,000 for Tuazon. 2. Interest at 5% on the original capital balances. 3. The remainder to be divided among Mones, Pitular, and Tuazon in a ratio of 4:1:1, respectively. The partnership reported profit of P350,000 for the year ended Dec. 31, 2016.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

100%

Determine the partner's share in the profit under each of the following independent situations

Transcribed Image Text:00 Jan. 1, 2016, the Mones, Pitular and Tuazon Partnership was formed with initial

investments by the partners as follows:

Mones

P2,000,000

Pitular

1,000,000

Tuazon

1,000,000

According to the partnership agreement, profit or loss is to be divided among the

partners as follows:

1. Salaries of P120,000 for Mones, P60,000 for Pitular and P60,000 for Tuazon.

2. Interest at 5% on the original capital balances.

3. The remainder to be divided among Mones, Pitular, and Tuazon in a ratio of 4:1:1,

respectively.

The partnership reported profit of P350,000 for the year ended Dec. 31, 2016.

Required:

Determine the partners' share in the profit under each of the following independent

situations:

1. Partner's salaries and interest on capital balances should be fully allocated and any

deficiency between these allocations and profit is to be divided among Mones,

Pitular, and Tuazon in the ratio 4:1:1, respectively.

2. Partner's salaries and interest on capital balances should be made only, to the

extent that the profit can provide.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning