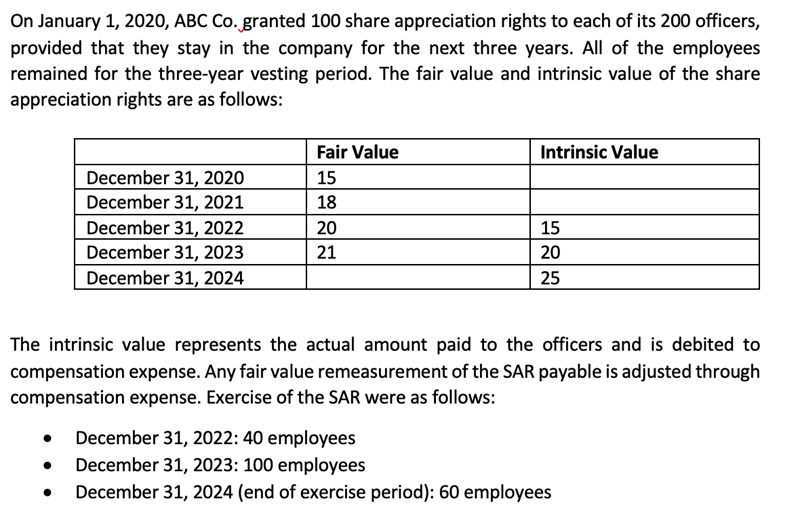

On January 1, 2020, ABC Co. granted 100 share appreciation rights to each of its 200 officers, provided that they stay in the company for the next three years. All of the employees remained for the three-year vesting period. The fair value and intrinsic value of the share appreciation rights are as follows: Fair Value Intrinsic Value December 31, 2020 December 31, 2021 15 18 December 31, 2022 December 31, 2023 20 15 21 20 December 31, 2024 25 The intrinsic value represents the actual amount paid to the officers and is debited to compensation expense. Any fair value remeasurement of the SAR payable is adjusted through compensation expense. Exercise of the SAR were as follows: December 31, 2022: 40 employees December 31, 2023: 100 employees December 31, 2024 (end of exercise period): 60 employees

On January 1, 2020, ABC Co. granted 100 share appreciation rights to each of its 200 officers, provided that they stay in the company for the next three years. All of the employees remained for the three-year vesting period. The fair value and intrinsic value of the share appreciation rights are as follows: Fair Value Intrinsic Value December 31, 2020 December 31, 2021 15 18 December 31, 2022 December 31, 2023 20 15 21 20 December 31, 2024 25 The intrinsic value represents the actual amount paid to the officers and is debited to compensation expense. Any fair value remeasurement of the SAR payable is adjusted through compensation expense. Exercise of the SAR were as follows: December 31, 2022: 40 employees December 31, 2023: 100 employees December 31, 2024 (end of exercise period): 60 employees

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 60P

Related questions

Question

How much is the compensation expense for 2022?

P 140,000

P 400,000

P 320,000

P 160,000

Transcribed Image Text:On January 1, 2020, ABC Co. granted 100 share appreciation rights to each of its 200 officers,

provided that they stay in the company for the next three years. All of the employees

remained for the three-year vesting period. The fair value and intrinsic value of the share

appreciation rights are as follows:

Fair Value

Intrinsic Value

December 31, 2020

December 31, 2021

December 31, 2022

December 31, 2023

December 31, 2024

15

18

20

15

21

20

25

The intrinsic value represents the actual amount paid to the officers and is debited to

compensation expense. Any fair value remeasurement of the SAR payable is adjusted through

compensation expense. Exercise of the SAR were as follows:

December 31, 2022: 40 employees

December 31, 2023: 100 employees

December 31, 2024 (end of exercise period): 60 employees

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT