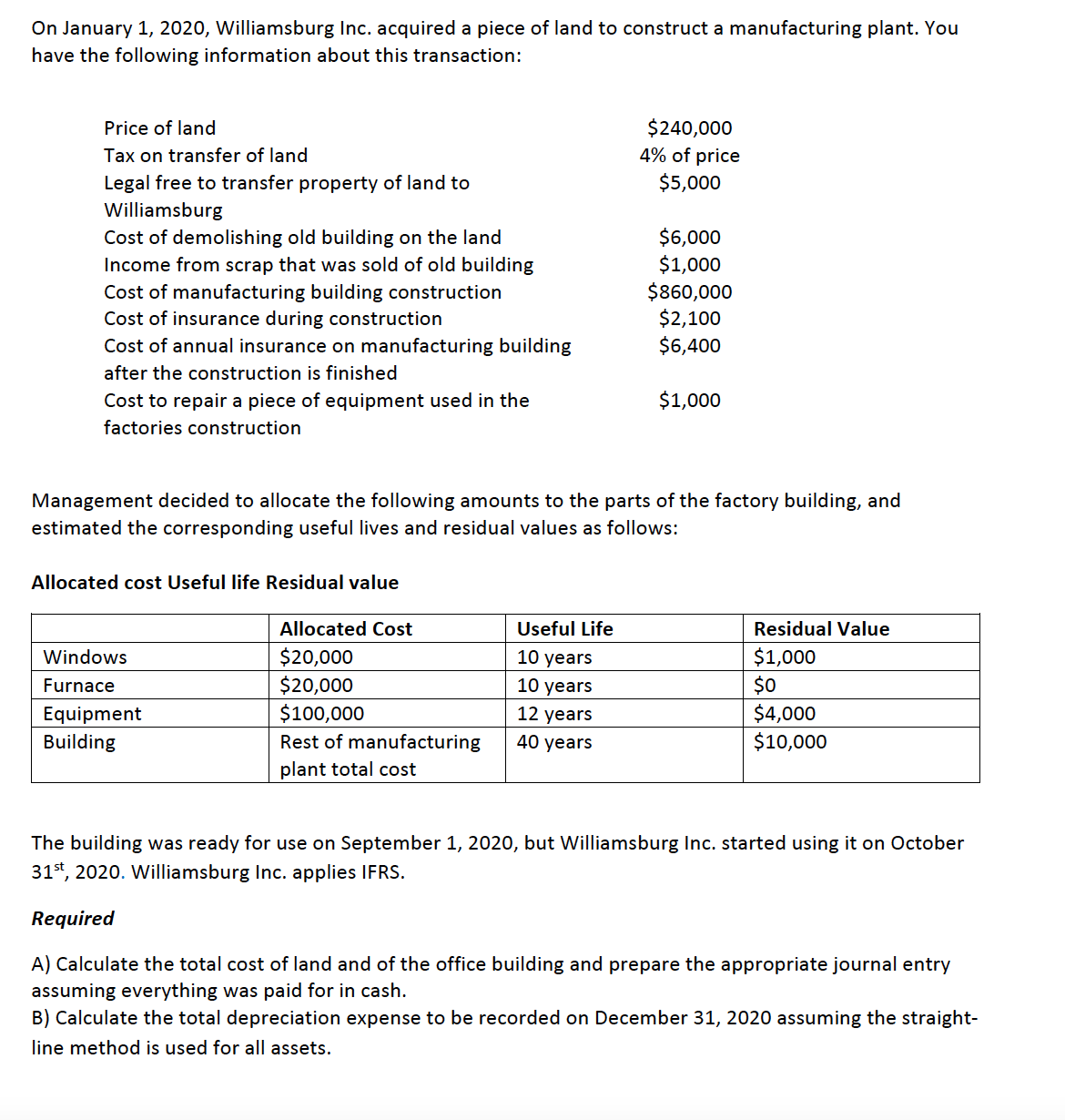

On January 1, 2020, Williamsburg Inc. acquired a piece of land to construct a manufacturing plant. You have the following information about this transaction:

On January 1, 2020, Williamsburg Inc. acquired a piece of land to construct a manufacturing plant. You have the following information about this transaction:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:On January 1, 2020, Williamsburg Inc. acquired a piece of land to construct a manufacturing plant. You

have the following information about this transaction:

$240,000

4% of price

$5,000

Price of land

Tax on transfer of land

Legal free to transfer property of land to

Williamsburg

$6,000

$1,000

$860,000

$2,100

$6,400

Cost of demolishing old building on the land

Income from scrap that was sold of old building

Cost of manufacturing building construction

Cost of insurance during construction

Cost of annual insurance on manufacturing building

after the construction is finished

Cost to repair a piece of equipment used in the

$1,000

factories construction

Management decided to allocate the following amounts to the parts of the factory building, and

estimated the corresponding useful lives and residual values as follows:

Allocated cost Useful life Residual value

Allocated Cost

Useful Life

Residual Value

$20,000

$1,000

$0

$4,000

$10,000

Windows

10 years

$20,000

$100,000

Furnace

10 years

Equipment

12 years

Building

Rest of manufacturing

40 years

plant total cost

The building was ready for use on September 1, 2020, but Williamsburg Inc. started using it on October

31st, 2020. Williamsburg Inc. applies IFRS.

Required

A) Calculate the total cost of land and of the office building and prepare the appropriate journal entry

assuming everything was paid for in cash.

B) Calculate the total depreciation expense to be recorded on December 31, 2020 assuming the straight-

line method is used for all assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College