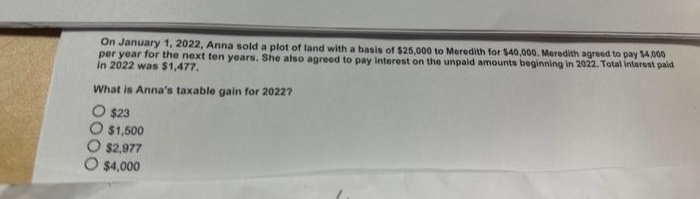

On January 1, 2022, Anna sold a plot of land with a basis of $25,000 to Meredith for $40,000, Meredith agreed to pay $4.000 per year for the next ten years. She also agreed to pay interest on the unpaid amounts beginning in 2022. Total interest paid in 2022 was $1,477. What is Anna's taxable gain for 20227 O $23 $1,500 O $2,977 O $4,000

On January 1, 2022, Anna sold a plot of land with a basis of $25,000 to Meredith for $40,000, Meredith agreed to pay $4.000 per year for the next ten years. She also agreed to pay interest on the unpaid amounts beginning in 2022. Total interest paid in 2022 was $1,477. What is Anna's taxable gain for 20227 O $23 $1,500 O $2,977 O $4,000

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 18MCQ: Pat sells land for $25,000 cash and a $75,000 5-year note. If her basis in the property is $30,000...

Related questions

Question

Transcribed Image Text:On January 1, 2022, Anna sold a plot of land with a basis of $25,000 to Meredith for $40,000. Meredith agreed to pay $4,000

per year for the next ten years. She also agreed to pay interest on the unpaid amounts beginning in 2022. Total interest paid

in 2022 was $1,477.

What is Anna's taxable gain for 20227

O $23

$1,500

O $2,977

$4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you