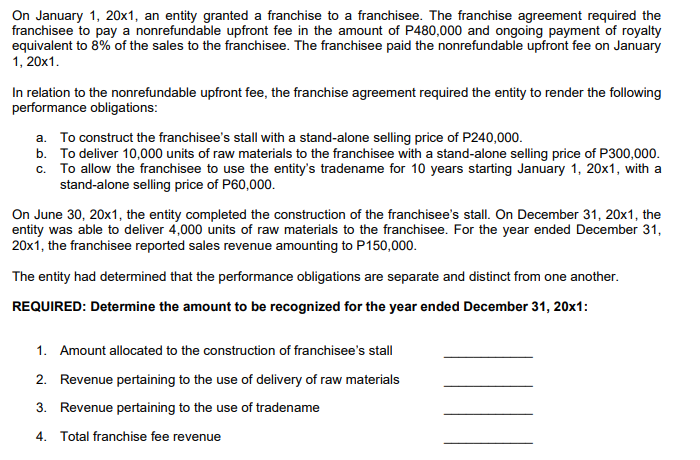

On January 1, 20x1, an entity granted a franchise to a franchisee. The franchise agreement required the franchisee to pay a nonrefundable upfront fee in the amount of P480,000 and ongoing payment of royalty equivalent to 8% of the sales to the franchisee. The franchisee paid the nonrefundable upfront fee on January 1, 20x1. In relation to the nonrefundable upfront fee, the franchise agreement required the entity to render the following performance obligations: a. To construct the franchisee's stall with a stand-alone selling price of P240,000. b. To deliver 10,000 units of raw materials to the franchisee with a stand-alone selling price of P300,000. c. To allow the franchisee to use the entity's tradename for 10 years starting January 1, 20x1, with a stand-alone selling price of P60,000. On June 30, 20x1, the entity completed the construction of the franchisee's stall. On December 31, 20x1, the entity was able to deliver 4,000 units of raw materials to the franchisee. For the year ended December 31, 20x1, the franchisee reported sales revenue amounting to P150,000. The entity had determined that the performance obligations are separate and distinct from one another. REQUIRED: Determine the amount to be recognized for the year ended December 31, 20x1: 1. Amount allocated to the construction of franchisee's stall 2. Revenue pertaining to the use of delivery of raw materials 3. Revenue pertaining to the use of tradename

On January 1, 20x1, an entity granted a franchise to a franchisee. The franchise agreement required the franchisee to pay a nonrefundable upfront fee in the amount of P480,000 and ongoing payment of royalty equivalent to 8% of the sales to the franchisee. The franchisee paid the nonrefundable upfront fee on January 1, 20x1. In relation to the nonrefundable upfront fee, the franchise agreement required the entity to render the following performance obligations: a. To construct the franchisee's stall with a stand-alone selling price of P240,000. b. To deliver 10,000 units of raw materials to the franchisee with a stand-alone selling price of P300,000. c. To allow the franchisee to use the entity's tradename for 10 years starting January 1, 20x1, with a stand-alone selling price of P60,000. On June 30, 20x1, the entity completed the construction of the franchisee's stall. On December 31, 20x1, the entity was able to deliver 4,000 units of raw materials to the franchisee. For the year ended December 31, 20x1, the franchisee reported sales revenue amounting to P150,000. The entity had determined that the performance obligations are separate and distinct from one another. REQUIRED: Determine the amount to be recognized for the year ended December 31, 20x1: 1. Amount allocated to the construction of franchisee's stall 2. Revenue pertaining to the use of delivery of raw materials 3. Revenue pertaining to the use of tradename

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

Transcribed Image Text:On January 1, 20x1, an entity granted a franchise to a franchisee. The franchise agreement required the

franchisee to pay a nonrefundable upfront fee in the amount of P480,000 and ongoing payment of royalty

equivalent to 8% of the sales to the franchisee. The franchisee paid the nonrefundable upfront fee on January

1, 20x1.

In relation to the nonrefundable upfront fee, the franchise agreement required the entity to render the following

performance obligations:

a. To construct the franchisee's stall with a stand-alone selling price of P240,000.

b. To deliver 10,000 units of raw materials to the franchisee with a stand-alone selling price of P300,000.

c. To allow the franchisee to use the entity's tradename for 10 years starting January 1, 20x1, with a

stand-alone selling price of P60,000.

On June 30, 20x1, the entity completed the construction of the franchisee's stall. On December 31, 20x1, the

entity was able to deliver 4,000 units of raw materials to the franchisee. For the year ended December 31,

20x1, the franchisee reported sales revenue amounting to P150,000.

The entity had determined that the performance obligations are separate and distinct from one another.

REQUIRED: Determine the amount to be recognized for the year ended December 31, 20x1:

1. Amount allocated to the construction of franchisee's stall

2. Revenue pertaining to the use of delivery of raw materials

3. Revenue pertaining to the use of tradename

4. Total franchise fee revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning