On January 1, Swifty Corporation had 71000 shares of $10 par value common stock outstanding. On June 17, the company declared a 15% stock dividend to stockholders of record on June 20. Market value of the stock was $14 on June 17. The stock was distributed on June 30. The entry to record the transaction of June 30 would include a debit to Common Stock Dividends Distributable for $149100. O debit to Stock Dividends for $42600. O credit to Paid-in Capital in Excess of Par for $42600. O credit to Common Stock for $106500.

On January 1, Swifty Corporation had 71000 shares of $10 par value common stock outstanding. On June 17, the company declared a 15% stock dividend to stockholders of record on June 20. Market value of the stock was $14 on June 17. The stock was distributed on June 30. The entry to record the transaction of June 30 would include a debit to Common Stock Dividends Distributable for $149100. O debit to Stock Dividends for $42600. O credit to Paid-in Capital in Excess of Par for $42600. O credit to Common Stock for $106500.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 4SEA: STOCK DIVIDENDS Kaufman Company currently has 200,000 shares of 1 par common stock outstanding. On...

Related questions

Question

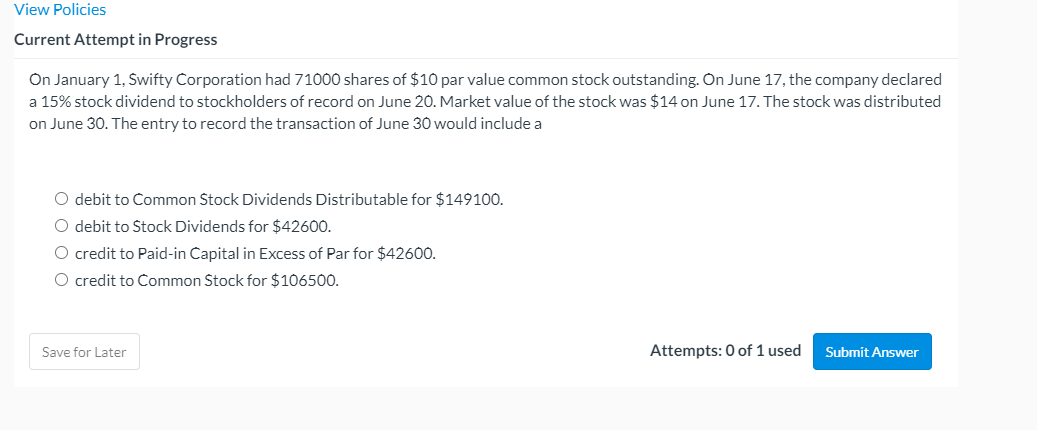

Transcribed Image Text:View Policies

Current Attempt in Progress

On January 1, Swifty Corporation had 71000 shares of $10 par value common stock outstanding. On June 17, the company declared

a 15% stock dividend to stockholders of record on June 20. Market value of the stock was $14 on June 17. The stock was distributed

on June 30. The entry to record the transaction of June 30 would include a

O debit to Common Stock Dividends Distributable for $149100.

O debit to Stock Dividends for $42600.

O credit to Paid-in Capital in Excess of Par for $42600.

O credit to Common Stock for $106500.

Save for Later

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning